Zoopla: £82bn of UK house sales on hold as transactions set to halve in 2020

Hundreds of thousands of property transactions have been put on hold as the UK housing market freezes up during the coronavirus lockdown, with house sales set to fall 50 per cent this year.

Roughly 373,000 property transactions with a total value of £82bn are on hold after the government put in place strict coronavirus restrictions, property website Zoopla said today.

The figures show the extent of the effect of coronavirus on the UK property market, which was just finding its feet after the Brexit uncertainty of 2019.

Zoopla said demand for houses is 60 per cent below the levels recorded at the start of March as the economy crashes and social distancing rules make viewings impossible. It had fallen as much as 70 per cent in March.

The huge slump in demand means sales are likely to be 50 per cent lower in 2020 than in 2019. Zoopla said new sales were running at just a tenth of their early March levels by mid-April.

It is also likely to cause house prices to drop significantly, spelling good news for potential buyers but bad news for sellers. Experts have predicted that UK house prices could fall by as much as 10 per cent this year.

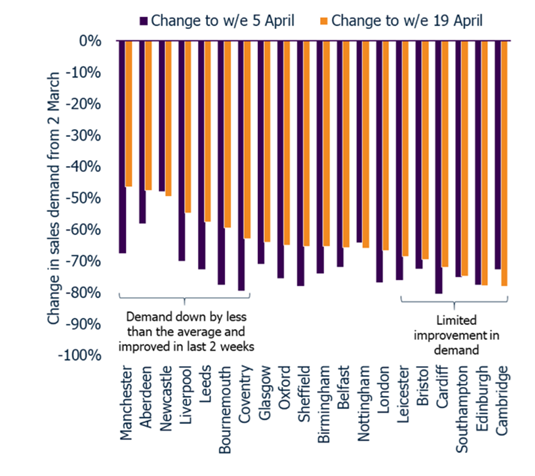

The slump in demand was not evenly spread across the country. The prosperous cities of Cambridge and Edinburgh, which have expensive housing, were the hardest-hit as of 19 April, with demand down close to 80 per cent.

Demand has tumbled across Britain, but recovered slightly in some places

Manchester and Aberdeen had seen a less sizeable, although still pronounced, fall in demand of around 50 per cent. Along with other regions, demand was even lower two weeks earlier.

Richard Donnell, director of research and insight at Zoopla, said: “Parts of the market are at a virtual standstill as a result of the physical restrictions that have stopped new supply coming to the market and the viewing of homes for sale.”

Donnell was bullish about the market’s chances of recovery, however. “Without doubt, once the coronavirus restrictions are relaxed, we should expect the release of demand that has been building since Brexit and political uncertainty destabilised market sentiment,” he said.

Part of the reason for this, he said, is that “many households have spent more time at home in the last few weeks and some may feel the urge to move and find more space or consider the potential for remote working”.

Yet he added that the future of the housing market “all depends upon how much the economy is impacted over the rest of the year and the impact on levels of unemployment”.