YouGov shares jump after revenue and profit growth revealed

YouGov shares jumped 13 per cent on Tuesday as the data firm reported revenue and operating profit narrowly ahead of full-year expectations.

In unaudited results for the year to 31 July, 2024, Yougov posted a three per cent organic revenue increase, with reported revenue up 30 per cent to £335.3m, driven by its recent CPS acquisition.

This outpaced guidance offered in August, owing to higher-than-expected research activity in July.

Adjusted operating profit inched up from £49.1m in 2023 to £49.6m, with trading this year tracking last year’s levels and reflecting slower sales bookings in the second half.

However, statutory operating profit fell 75 per cent to £10.9m, due to £38.7m in acquisition and restructuring costs.

In January, YouGov acquired CPS, the European leader in household purchase data across 18 countries, for €315m (£262.4m).

The London-listed company said the CPS business is continuing to perform well, in line with expectations and the integration is progressing well.

Meanwhile, YouGov has accelerated a cost optimisation plan, expecting 70 per cent of annualised savings, weighted towards the second half of 2025.

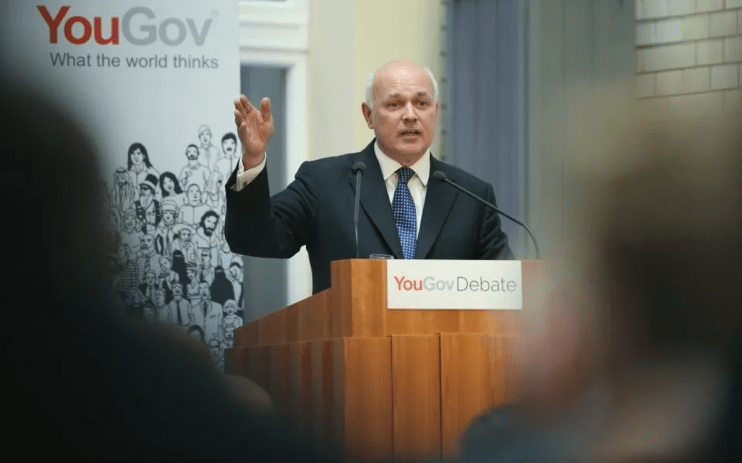

YouGov boss ‘confident’ for the future

YouGov boss Steve Hatch said: “The macroeconomic environment remained challenging across the wider market research industry and for YouGov, while internal execution also contributed to the challenges we faced.

“We acted quickly over the summer and I am confident that we have put the right initiatives in place as we focus on the execution of our long-term strategic plan,” he added.

Looking ahead, YouGov expects revenue growth in FY25, driven by further development of AI capabilities, improvements to its core data products and new commercial leadership.

Peel Hunt analysts rated YouGov a buy, saying: “Most of the FY25 cost-saving measures are in place, but the corporate spending backdrop remains tough.

“However, we believe that confirming market expectations for FY25 should be supportive of the shares today, given their recent weakness.”