The yield curve explained: is it predicting recession?

The yield curve has been a reliable predictor of US recessions over the last four decades. Each time the yield curve has inverted, the US economy has entered a downturn within 18 months. At the start of 2019, the curve is precipitously close to inverting again.

The yield curve is the difference between the interest rate on a longer-dated bond (debt issued by a corporation or country) and a shorter-dated bond.

For instance, typically it should cost less to borrow money for two years than for 10 years. This is because the economy is expected to grow over time and experience inflation. Inflation erodes the fixed return of a bond and investors tend to want compensation for taking on that risk. They therefore demand a higher yield for longer-dated bonds.

However, when it costs more to borrow money in the short term than it does in the long term, the yield curve inverts. At best, an inversion suggests that investors expect the economy to slow, at worst it signals a recession could be on the way.

What is the US yield curve telling us?

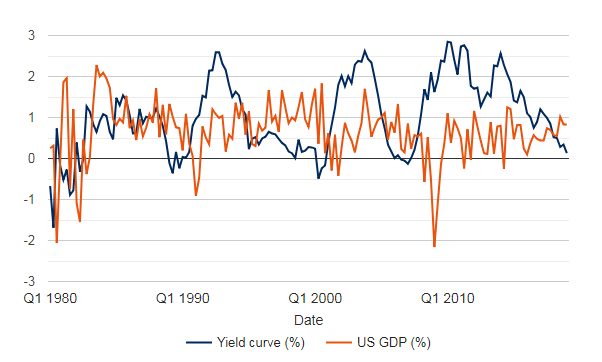

In the chart below, the blue coloured line represents the difference between the interest rate on a 10-year Treasury, which is a US government bond, and a two-year Treasury on a quarterly basis since 1980. The orange coloured line shows quarterly US GDP over the same period.

The yield curve has inverted, dropping below zero, five times in the last four decades and each time a recession has followed.

The last two times the yield curve inverted, in 1998 and in 2008, the debate among economists was whether this time would be different. In both cases, it wasn't. In 2019, the curve is the closest it has been to inverting since 2008.

The US yield curve: Is it predicting recession?

Please remember that past performance is not a guide to future performance and may not be repeated.

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

Source: Schroders. Refinitiv data for US benchmark two and 10 year treasuries correct as at 09 January 2019. US GDP data from OECD correct as at 11 January 2019.

Is the US heading for recession?

In raising its benchmark interest rate, the Federal Reserve (Fed) has put pressure on other short-term rates, resulting in the US Treasury yield curve being close to inverting as we start 2019. The yield curve is just one leading indicator of a potential recession, however, and just because it has been a precursor to sustained downturns in the past, this does not mean that it will necessarily be the case this time.

What really matters is how the Fed responds to the yield curve development and other key macroeconomic data over the next few months.

Schroders’ economists expect a gradual slowdown in US growth in 2019 and 2020. The emphasis is on the word gradual: they do not see a recession as likely in 2019 (although not inconceivable in 2020) as many of the forces that led to strong growth in 2018 are still in play. The slowdown, however, means that an end to the cycle of rising interest rates is in sight. We think interest rates could peak at 2.75 per cent, which is modest compared to past economic cycles.

We recently published a 10-year outlook for markets, “Inescapable investment truths for the decade ahead”. This highlighted the modest return prospects from public investment markets, given lower rates of economic growth than in the past and the reduced level of bond yields. 2019 looks set to fit that pattern.

Read more:

- The fed is still the market's flexible friend

- 29 reasons not to invest in the stock market

- Infograpic: A view of the world economy in January 2019

View more insights from Schroders on their content hub or follow them on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.