The year crypto went crazy: what’s next for bitcoin in 2019?

This was the year the world woke up to cryptocurrencies. When the Bitcoin price bubble burst in December last year, having hit almost $20,000 (£15,886) per coin in value, governments, banks and tech giants alike began to sit up and take notice.

The City was faced with a decision: is Bitcoin a vehicle for fraud and money laundering, or is it a legitimate asset class? For some crypto had become a means of speculating on the market, while others viewed it as a cash cow. Companies changed their name to include the word blockchain – the technology that cryptocurrency exists upon – and saw their share prices skyrocket. Celebrities joined in on the fun, too, with figures such as boxer Manny Pacquiao and music mogul DJ Khaled promising to launch their own eponymous digital coins.

In a unique testimony to the currency’s power, rapper 50 Cent famously returned from the brink of bankruptcy in January by having accepted payment in Bitcoin for his last album in 2014.The crypto craze even permeated the UK’s own House of Lords when Baroness Michelle Mone announced in October she would be returning to the world of digital coins through a new venture that backs startups with tokenised funding. Somehow, she also convinced Apple co-founder Steve Wozniak to join her.

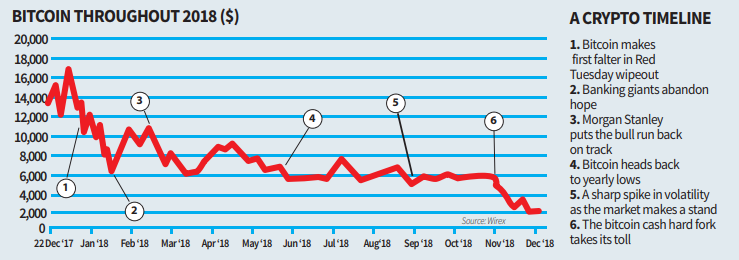

The sudden interest from regulators and famous faces hit the market in shockwaves, causing the price of crypto coins to swing wildly throughout the year. Now Bitcoin, which remains the world’s largest cryptocurrency by market capitalisation, has returned almost to pre-bubble value to a low of $3,130 this month.

But what happened to the market in between those two points? Here’s a breakdown of the six major peaks and pitfalls in crypto prices as they happened.

2018 in cryptocurrencies

On 16 January, the day now referred to as Red Tuesday struck the market. Bitcoin tumbled briefly below the $10,000 mark, a whole 50 per cent below its 2017 peak. Its next largest bedfellows, Ethereum and Ripple, also dropped more than 30 per cent and 46 per cent respectively in a single day.

The decline followed comments from South Korean government figures that indicated a tougher stance to crypto trading than anticipated, including a potential ban on exchanges while they figured out the best approach.

Running scared in the face of no regulation, a series of banks such as JP Morgan, Citi, Lloyds and Virgin Money decided to ban their customers from using their cards to buy crypto a little over a fortnight later. Bitcoin’s value crashed even further, hitting a low of $5,920 on 6 February.

But in true crypto fashion, the bearish attitude towards Bitcoin didn’t last long. Turning against the tide, Morgan Stanley announced it would open a trading desk for derivative coins, while South Korea eased its stance towards crypto. By 19 February, the bull run was back in full force as Bitcoin rose back above $11,000, a staggering 80 per cent up from its yearly low just two weeks before.

Source: Wirex

The decline soon resumed in what is now known as cryptocurrency’s closest thing to a stable period, falling steadily as the summer and autumn months provided some much-needed respite for investors.

Major news markers for the decline appeared to dissipate, and Bitcoin’s value neared its February low once again by the end of June. In a brief market spasm, 12 days of gains were wiped out in less than 16 hours on 5 September, but this volatility later quietened again to its lowest levels in 15 months.

By mid-November, Bitcoin and other cryptocurrencies looked set to end 2018 in a reasonably predictable state, providing authorities with a small sense of confidence that they might be able to regulate the market effectively.

Unfortunately, crypto’s own notoriously-mutinous community upended that notion swiftly. On 14 November, bitcoin’s own derivative coin, bitcoin cash, split again in a so-called hard fork to create two new currencies, bitcoin cash ABC and bitcoin SV. Its price has been slowly falling ever since.

The future of digital assets

Etoro analyst Mati Greenspan told City A.M. at the time of the fork that part of the problem was that the rise of crypto coins in 2017 had “sent the markets higher than can be logically supported by real-world adoption, and so now we’re seeing a retracement of that”.

Starting out this week around the $3,200 mark, has the volatility of bitcoin and other cryptocurrencies finally bottomed out? What will the coming year look like for the fledgling asset class?

“Regulators are warming to cryptocurrencies,” said Dmitry Lazarichev, co-founder and chief executive of London-based crypto payments startup Wirex. “Once regulation is fully implemented, the parties who seek to defraud individuals with bogus [fundraises] will be weeded out and only a handful of quality coins will remain.”

Both Lazarichev and Greenspan have predicted a significant push towards the use of so-called stablecoins, which are digital assets tied to a widely-used currency such as sterling or the US dollar to reduce volatility.

Lazarichev added that he expects a number of merchants to start accepting stablecoins in 2019 as a form of payment for goods and services, benefitting from its low cost in terms of payment infrastructure and protection against chargebacks.

“2018 was a watershed year for crypto,” he continued. “You can’t ignore the impact of interest shown by the likes of Goldman Sachs, Fidelity and Blackrock. We expect to see that commitment continue into next year.”