The Woodford effect: How to get active value

But investing in a cheaper passive vehicle may make more sense in more efficient markets

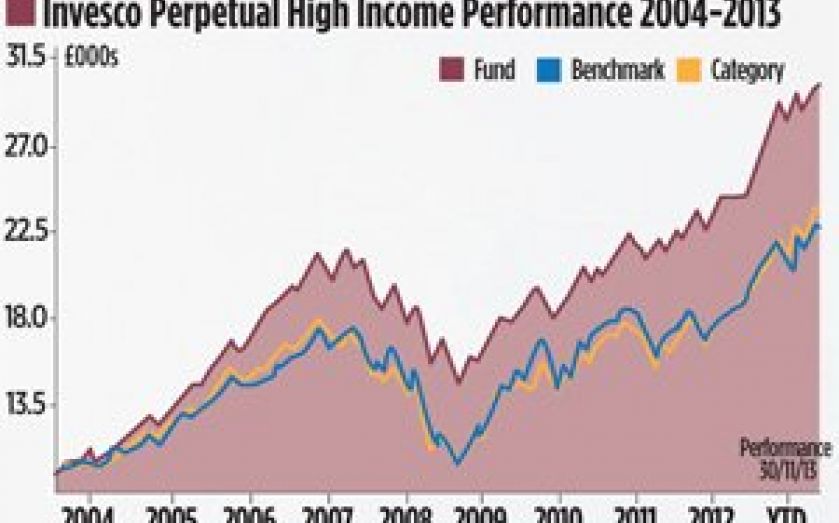

CLOSE to £2bn has been withdrawn from Neil Woodford’s flagship funds, Invesco Perpetual High Income and Invesco Perpetual Income, in the two months since the fund manager announced that he will step down in April 2014. Despite experts advising against a “knee-jerk” reaction (his successor Mark Barnett has a credible track record of his own), Woodford’s lead equity funds have seen their combined assets under management drop from £24.3bn to £22.9bn since October. Invesco said it was “pleased” with the reaction.

Woodford’s departure has turned the spotlight on the importance of investors keeping on top of who is managing their money. As Jason Hollands of BestInvest says, “a chunk of the most successful actively-managed investment funds still rely on the skills and judgment of a key trigger-puller”. Not everyone has Woodford’s stardust.

SHOPPING AROUND

Unsurprisingly, rival fund groups have leapt at the opportunity to capitalise on the news, and investors have plenty of options. A scan of Woodford’s top holdings reveals a number of prominent names, including AstraZeneca and Imperial Tobacco. And recent data from Lipper has shown that, on average, these companies appear in 60 per cent of UK equity-income funds.

Tom Stevenson of Fidelity lists the Artemis Income and Fidelity MoneyBuilder Dividend funds as possible alternatives. Their recent performance (they have returned 72 per cent and 73 per cent respectively in the last five years) almost matches Invesco.

But Woodford’s departure also raises the wider question of whether actively-managed funds are a more sensible investing option than their passive equivalents. Recent Vanguard research found that, on average, UK-based active managers in UK, European, Eurozone, US, global and emerging market equities have failed to beat their benchmarks over the long term. And of those funds that do perform well, leadership is quick to change. “A top-ranked fund over the five years to December 2007 was more likely to be near the bottom of the performance rankings or be closed or merged, than remain top ranked over the next five years,” the Vanguard report claims.

A major reason why the average fund manager under-performs is fees. While the average cost of active equity management comes in at 1.55 per cent per year, tracker funds and exchange-traded funds (ETFs) are generally cheaper. For instance, you can buy a S&P 500 ETF from HSBC for 0.09 per cent plus adviser and platform fees.

But Peter Sleep of Seven Investment Management points to a second cause: a fund manager’s characteristics. Typically, a successful manager will hold a small number of shares in their portfolio. “Research suggests that nearly all fund managers are very good at picking five or 10 stock winners, and at avoiding disasters. But what lets them down is all the shares they hold to control the riskiness of a portfolio.” Of course, investors should bear in mind that a fund manager with only a few contrarian bets in his portfolio may see volatile performance.

THE ACTIVE-PASSIVE DEBATE

One thing is clear: investors are increasingly turning to passive vehicles. Tracker funds’ share of total funds under management was 9.6 per cent in October 2013, compared with 7.8 per cent a year earlier, according to the IMA. While they won’t outperform the market (the small fee means you will under-perform relatively), they offer investors lower fees and simplicity. With a tracker vehicle, for example, an investor can quickly create a portfolio that covers the equity and fixed-income markets with a handful of ETFs.

KNOWING YOUR MARKETS

And there are a variety of conditions under which passive vehicles will make more sense. The US is deemed to have the most efficient stock market, “so continuously beating the S&P can be hard,” says Darius McDermott of Chelsea Financial Services. And Sleep advises a passive approach in more narrow markets, like the UK gilt market or the US treasury market, where there is “a very limited number of securities to choose from.” Hollands, meanwhile recommends passive investing in strongly rising and very efficient parts of the market, like FTSE 100 stocks.

Hollands adds that an index fund is only as good as the index it replicates. They can be useful components of a portfolio at different points in the cycle, he thinks, but they are not a panacea that will work well all the time. “The only sensible approach to constructing a fund portfolio is to be agnostic and use both active and passive funds,” he says.