Wood Group sustains outlook after new deals with Harbour Energy and Shell

Wood Group has sustained its robust full-year outlook, having renewed its order book with some “excellent contract wins” over its third quarter of trading.

The engineering giant revealed that group revenue had grown eight per cent year-on-year, rising from £1.12bn to £1.2bn with growth across all its business units.

Revenues for the first nine months of trading had risen to £3.7bn, reflecting growth of 13 per cent and in line with expectations of around £4.9bn for the full year.

The FTSE 250-listed firm revealed operations revenues grew four per cent to £500m, while consulting revenues were up 22 per cent in the quarter to £155m, and investment services revenues surged 31 per cent to £58m.

Wood’s pre-tax margin is expected to be flat in the nearer term at around seven per cent, however it did not disclose any profit figures.

Instead, it clarified adjusted gross earnings for the full year were expected to be within its medium-term target of mid to high single digit growth.

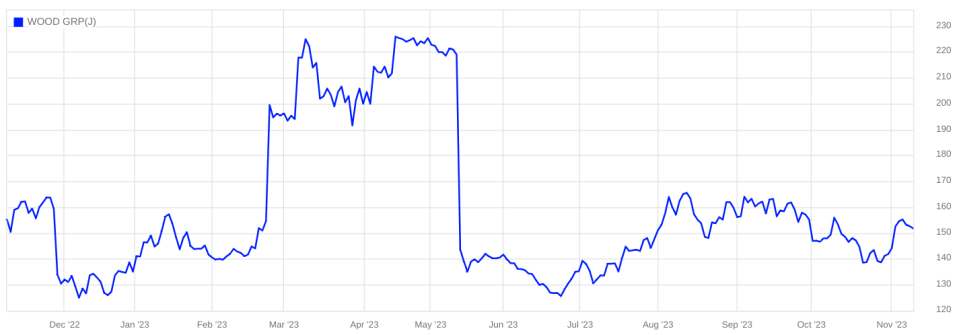

Wood has been slowly recovering from a steep fall in its valuation after Apollo’s takeover bid failed

The company has brushed off Apollo’s failed multiple takeover attempts this year with a raft of new deals across its business, including new contracts with Harbour Energy and Shell.

The group’s order book was around £4.8bn at the end of September, flat year-on-year and slightly lower than at the same time at the end of June.

However, it has expended its sustainable solutions pipeline – a key sector during the transition to green and low carbon energy – which has risen from 33 per cent to 35 per cent of its order book quarter-by-quarter.

Wood is now on course to post over $1bn of sustainable revenue over the full year – having reached $900m over the first nine months of trading.

Ken Gilmartin, chief executive, said: “We have delivered another quarter of strong growth in revenue and EBITDA as we continue to execute against the growth strategy we set out a year ago.

“Reflecting the momentum that we are building in the business, we remain confident that our actions, business model and strategy are delivering.”

Wood trades on the London Stock Exchange and was down 0.6 per cent in early trading this morning.

Analyst group Jefferies has kept its buy stance towards the company, with a target price of 152.7p per share.