Wood Group bids to win back investors with boosted revenues after failed Apollo deal

Wood Group has posted robust revenues and gross profits, as it bids to bolster its share price and win back the approval of investors following the failed takeover attempt from private equity firm Apollo.

The Scottish engineering giant generated £2.2bn ($2.9bn) in revenue over its first six months of trading in 2023 – up around 15 per cent year-on-year – and profits before tax of of £149m ($195m), which is a six per cent boost over the same trading period 12 months ago.

Its bumper figures were powered by a fattening order book which has stretched to £4.6bn ($6bn), up three per cent excluding the sale of its Gulf of Mexico business earlier this year.

This was supported by multiple contract wins, including a hefty £191m ($250m) deal to extend an engineering contract in South East Asia for brownfield services, a new £38m ($50m) agreement with Glaxosmithkline in the US, and an engineering services contract with Euro Manganese for sustainable mineral processing.

In a sign of the emerging shift to green projects as firms scramble to align themselves with net zero targets, over a third of Wood’s bidding pipeline was from sustainable solutions, up from 30 per cent at year end.

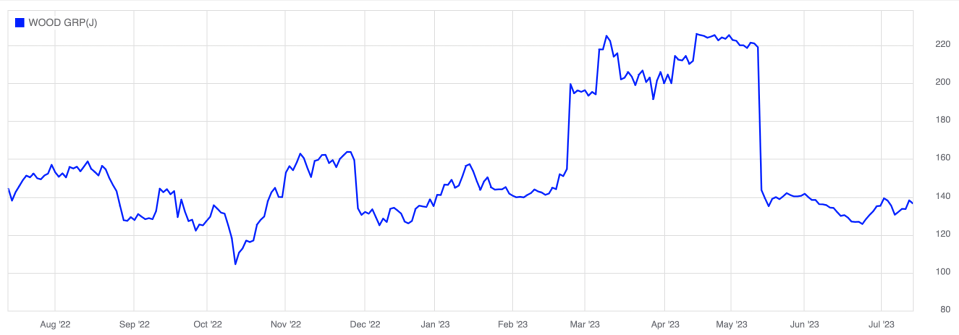

Wood’s latest results follow Apollo’s failed attempt to take over the company, which knocked back five bids from the private equity firm.

In May, Apollo ruled out making a sixth bid for Wood, after several months of pursuing a takeover of the business – including a final offer of 240p per share on April 4 – a 20 per cent premium on its trading price that day.

Since then, Wood’s shares have plummeted on the FTSE 250 – dropping to 135p per share in the two weeks following the aborted sale.

Debt persists after Apollo-Wood deal crumbles

Wood also warned of outflows totalling £103m ($135m) on its expenses, which it attributes to the seasonality of its business, and the remaining tax paid on the sale of the its environment consulting division – costing £46m ($60m).

This contributed to a spike in its net debt position, which worsened from £301m ($393m) at the end of 2022 to £498m ($650m) – roughly 2.2 times its pre-tax earnings.

Nevertheless, the company is bullish about its future prospects, and now expects to generate positive free cash flow in the second half of 2023.

It has also made no change to its optimistic full-year expectations of extra liquidity through the entirety of 2024.

Ken Gilmartin, chief executive, said: “Trading shows continued good growth and margins in line with our expectations. We have won a number of significant contracts in energy, minerals and life sciences during the period, all testament to the exciting position Wood holds in its key growth markets.

“As we look ahead, we are confident of our delivery both for the full year and medium term, including a return to generating positive free cash flow.”

Following today’s results, shares are down 1.3 per cent at 136.4p per share on the London Stock Exchange this morning.