Wirecard shares skyrocket just days after filing for insolvency

Shares in insolvent German firm Wirecard have rebounded more than 200 per cent just days after filing for insolvency.

Wirecard, which premiered on Germany’s Dax index with a €24bn valuation in 2018, filed for insolvency last week after auditors found a €1.9bn black hole in its accounts.

The payment processor firm first said “fraud of considerable proportions” could not be ruled out before saying it was more likely that the €1.9bn simply did not exist.

After that disclosure Wirecard’s share price dropped more than 80 per cent in just five sessions, from €104.50 per share to just €17.16.

This morning the firm started the day at €1.70 per share, climbing 212.26 per cent to €4.00 by 9.15am. The firm had hit highs of €191 last summer.

Last week, IG analyst Chris Beauchamp said: “While the shares might appear to be an ‘obvious’ sell, there is always the potential for a quick and dramatic rebound, even if it does not last.”

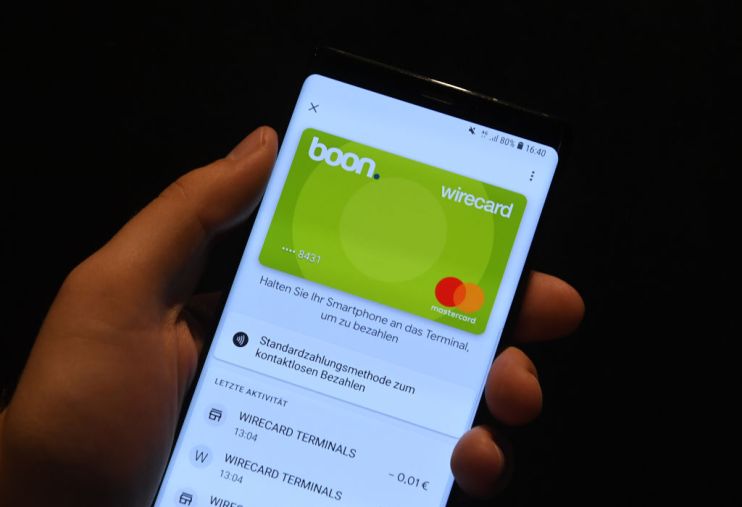

The UK’s Financial Conduct Authority (FCA) last week ordered Wirecard to cease all regulated activities following the news of a financial blackhole. The watchdog said it had immediately placed requirements on the firm’s UK business, meaning customers’ money cannot be accessed.

Wirecard’s auditor EY is also coming under increased scrutiny after the Financial Times revealed it had failed to carry out a standard audit procedure on the firm.

It is claimed that between 2016 and 2018 the Big Four firm did not directly check with Singapore’s OCBC Bank to confirm the lender held large amounts of cash on Wirecard’s behalf. Instead, EY relied on documents and screenshots provided by Wirecard and a third-party trustee.

It is facing mounting legal action too after the German shareholders’ association SdK said it had filed a criminal complaint against EY.

Japanese company Softbank has also said it will sue the auditor after investing in Wirecard last year, according to Der Spiegel.