Wind farm with potential to power 1.5m UK homes halted as industry urges government to bolster supply chains

Plans to build a new UK offshore wind farm that could have powered up to 1.5m homes have been halted today amid concerns over rising costs, reflecting growing concerns over the country’s investment climate as the government races to reach its net zero targets.

Swedish developer Vattenfall has blamed rising costs for the project’s stagnation, which have risen 40 per cent since it was first announced last year – and said it was now prepared to swallow a hefty impairment charge of £415.9m to bring the development to a halt.

“Increased cost of capital puts significant pressure on all new offshore wind projects,” it said in quarterly results on Thursday.

“So far, financial frameworks have not adapted to reflect the current market conditions.”

The company first won the rights to build the 1.4GW Norfolk Boreas off the coast of East Anglia in last year’s auction round, the fourth ‘contracts for difference‘ allocation window.

This was at a set fixed price of £37.35 per megawatt-hour for its electricity for the first 15 years, based on 2012 prices and linked to inflation.

Vattenfall no longer considers this viable, with growing industry concerns over the pressures inflation and challenging economic conditions are having on securing materials and developing projects.

The energy group confirmed it would now examine the best way forward for the entire Norfolk zone, which also includes the Vanguard East and West projects.

Combined, these three projects were expected to produce some 4.2 GW of electricity – enough to serve the needs of nearly 5m customers.

Dan McGrail, chief executive of trade association Renewable UK, has now urged the government to take into account global inflationary pressures which he warned have “significantly changed the economic landscape”.

The industry chief feared that competition for skills and supply chain is continuing to intensify, and called on the government to “step up with a robust response to enable industrial growth throughout Britain.”

He told City A.M.: “We need a stronger industrial strategy for the sector, which the Chancellor should support with new measures in the autumn statement as a matter of urgency. Growing the UK’s supply chain won’t only bring new jobs to Britain – it will also help to ensure we can get on with the job of building new projects to provide cheap power for consumers, strengthening our energy security and tackling climate change.”

Jess Ralston, head of energy at the Energy and Climate Intelligence Unit, argued the only way forward for the UK was to ramp up renewables and slash its reliance on fossil fuels.

“Costs of wind farms have been driven up by ongoing high gas prices causing supply chain inflation, just like for other industries. As the Office for Budget Responsibility recently stated, the UK is one of the countries still most reliant on gas, and this is putting us at risk of future crises potentially adding the equivalent of 13 per cent of GDP to national debt,” she said.

Government races to meet offshore targets

The outcome is a heavy blow to the government’s renewable ambitions, with Downing Street targeting 50GW of offshore wind generation by the end of the decade.

As the country is currently home to around 15GW of offshore wind turbines, it faces a vast investment challenge to meet its energy security targets.

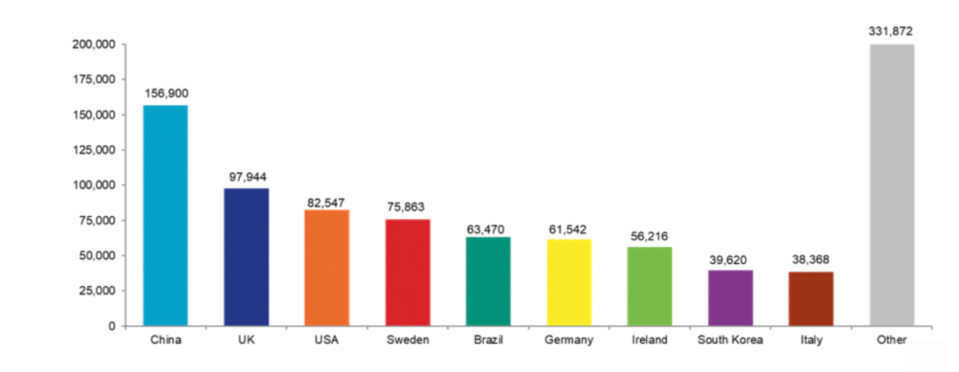

The UK is currently a world leader in offshore wind but faces challenges from multibillion subsidy regimes offered by rival markets such as the EU and US.

In this context, the government has also been criticised over the limited scale of funding for the fifth and current contracts for difference round, set at £205m – with concerns renewable generation prices could rise.

It has since pledged to consider reforms to the allocation windows so that the wider social benefits of wind turbines are reflected, rather than just prices.

When approached for comment, a department for energy security spokesperson said: “We understand there are supply chain pressures for the sector globally, not just in the UK, and we are listening to companies’ concerns. The UK is a world leader in offshore wind farms, home to the four largest in Europe, with enough capacity to power the equivalent of at least 10 million homes per year.

“The move to annual auctions was introduced in response to calls from industry to run more frequent auctions and is set to bolster further investment and increase developer confidence in the sector every year.”