Will pressure on Chinese tech firms spark renewed interest in value stocks?

The flotation of Ant Group in December last year was supposed to be a landmark event. The initial public offering (IPO) was set to raise $37 billion, valuing Ant at over $313 billion and making it the biggest IPO ever.

It was due to list in Hong Kong and Shanghai, rather than having a US listing in the form of an American depositary receipt (ADR) as has typically been the case for other Chinese companies (ADRs allow shares of a foreign company to trade on US markets).

The flotation would have been a strong statement about China’s leadership of the digital world and its ability to grow and finance big tech companies. But it didn’t happen, because the IPO was pulled just four days before it was due to take place.

We may never fully know the reasons why the IPO wasn’t allowed to go ahead. However, there are some inferences we can draw about what it might mean for investors in China and other emerging markets.

The lesson from Ant Group

Ant Group is the finance and payments affiliate of stock market giant Alibaba, an e-commerce group which is to China what Amazon is to the developed world. Such stocks have performed very strongly in the past few years, alongside other Chinese digital economy leaders such as Tencent (a technology group that also includes a payments arm) and Meituan (another shopping platform).

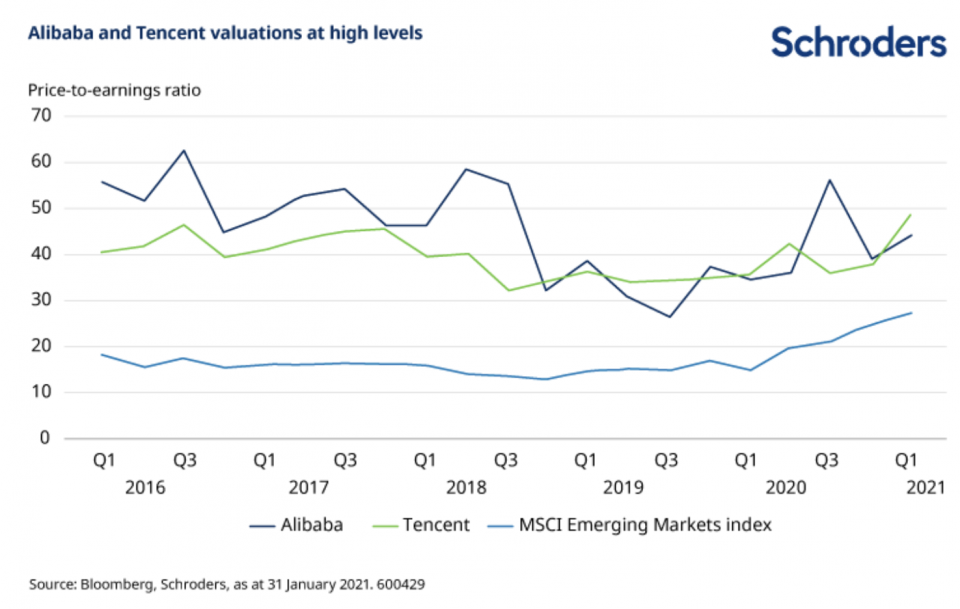

The rise of such stocks has been seemingly unstoppable. Even the coronavirus outbreak only served to strengthen demand for their products and services. The result is that their valuations crept up to extremely lofty levels.

As value investors, we’re looking to buy stocks which trade at a significant discount to their intrinsic value. This means looking for companies on cheap valuation metrics, typically low multiples of their profits or assets, for reasons which we believe are not justified over the longer term. We are therefore always wary of valuations at such high levels.

It is true that expensively-valued stocks can carry on being expensively valued for a long time. But when a stock is apparently “priced for perfection” – i.e. high expectations are baked into the price – then it doesn’t take much to go wrong for the price to fall sharply.

Discover more from Schroders:

– Learn: What are the three ‘P’s of sustainable investing?

– Listen: Why the 21st century belongs to Asia

– Watch: Will 2021 be the time for investors to stop hibernating?

China’s e-commerce and other tech stocks have grown to be very large, very rapidly. Until now, there has been little in the way of regulatory scrutiny holding them back. In 2015, the Chinese authorities did open an investigation into Alibaba’s relationship with third party sellers, partly related to sales of fake branded goods. However, the current investigation, and the last-minute halting of the Ant Financial IPO, potentially point to a greater level of scrutiny in future.

What does this mean for value investors? Well, there are no certainties in equity investing, but it could mean that lowly-valued parts of the Chinese equity markets, which have been in the shadow of the tech giants, may now draw greater interest from investors. We think shopping malls and banks are two areas of interest.

Shopping malls – the rise of the consumer

The rise of China as a consumer society has occurred hand-in-hand with the rise of the internet. As a result, the amount of retail space in China is far lower than in some other regions. Analysis from 2019 showed the US had 23.5 square feet of retail space per person, compared to just 2.8 in China.

The popularity of online shopping is unlikely to wane anytime soon. However, there is an opportunity for real estate firms in China to develop modern shopping malls that serve not only as retail spaces but as entertainment venues, with restaurants, cinemas and other leisure options. As in other geographies, Chinese consumers increasingly demand experiences, not just goods.

Several real estate firms appear to be among the cheapest parts of the market. However, extra research is needed to identify the businesses with the best business models who are able to adapt to changing consumer demands. But just as a little bit of bad news can signify deep trouble for over-valued stocks, so a little bit of good news – or simply an absence of bad news – can be very powerful for a lowly-valued stock.

Do banks offer value?

The banking sector is another where we think regulatory scrutiny of Ant Group could lead investors to reconsider the merits of more lowly-valued businesses.

Ant Group has two broad segments: payments service Alipay and a consumer finance operation. The latter has grown substantially as a type of “shadow” bank, benefiting from reduced regulation compared to ordinary banks (many of which are partly state-owned). Ant Group styles itself as a platform, connecting lenders with borrowers, and so hasn’t had to hold capital against assets in the way that ordinary banks do, leading banks to complain of unfair competition.

Speculation abounds as to what regulatory measures the Chinese government might impose on Ant Group. Regulators will need to tread carefully: the payment services offered by Alipay, and Tencent’s WePay, are used daily by much of the Chinese public. Recent press reports suggest that the finance operation is likely to face increased regulation, potentially leading to reduced profitability and lower lending volumes. State-owned banks may then be called on to fill the lending shortfall.

But beyond any operational impact on Ant Group, investors need to consider the sentiment impact of such increased regulatory scrutiny. The state-owned banks may see a benefit in terms of increased loan volumes. Even without that though, it seems clear that the tech giants can no longer count on favourable treatment or a smooth path to further expansion.

What do valuations look like?

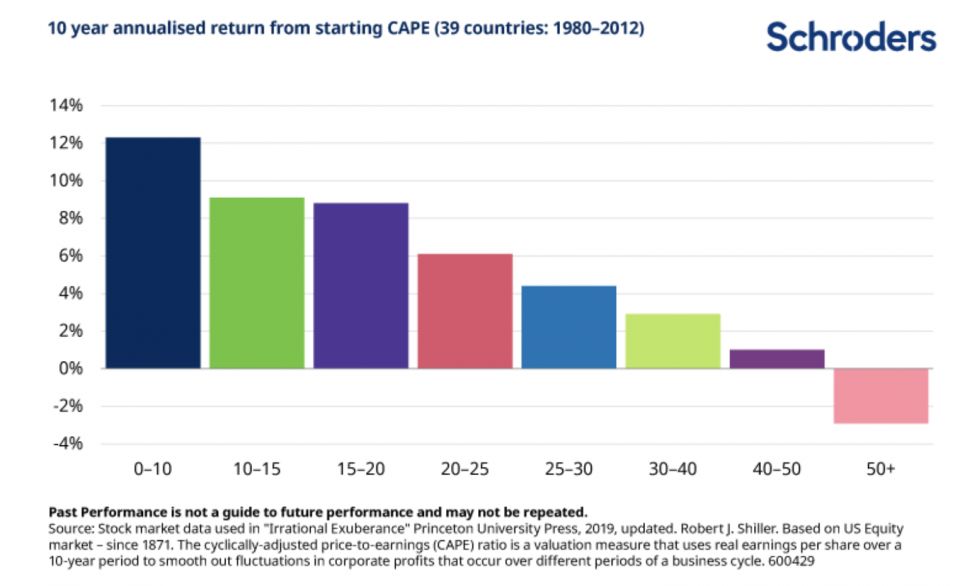

High growth is often the focus in emerging markets but data suggests that the value style still performs in the region. The chart below shows the 10-year annualised investment return for different starting valuations.

We can see that the cheapest stocks – those with a starting price-to-earnings ratio of 0-10x – have typically produce the best returns over the subsequent ten years. The most expensive – those with a P/E ratio of 50+ – have delivered the worst.

Clearly, past performance is no guarantee of future returns. However, the recent difficulties of one of China’s highest profile growth stocks could see investors re-assess the merits of some of those cheaper stocks.

Topics:

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.