Will CO2 rules choke car industry profits?

Europe’s car industry needs to tackle the huge challenge posed by new emissions regulations. But for those who do, it’s a major opportunity.

The commitment to limit global warming to 2 degrees is the greatest challenge of our time. If we’re going to meet it then we need to cut harmful emissions from industry, and we need to cut them fast.

Transportation is responsible for roughly 30 per cent of carbon emissions, and roughly a third of that is due to passenger cars. Strikingly, this is equivalent to emissions from coal-fired power stations, which are being phased out in many countries as a result.

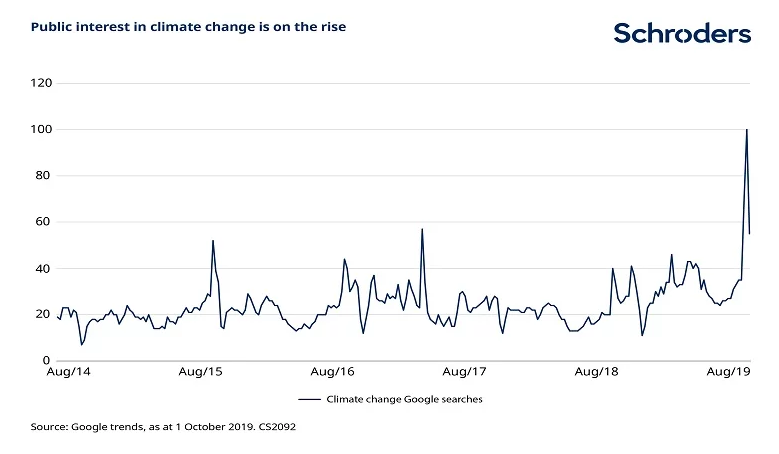

Public concern about climate change is on the rise. It is no longer something that can be ignored by companies, regulators, or investors. The chequered recent history of the car industry means that it is a prime target. Putting the industry on a more sustainable footing is crucial, both for the future of the planet and for the companies themselves.

What are the new emissions targets?

The regulators of car companies clearly agree and want carbon dioxide (CO2) emissions to fall. Our challenge as investors is to try and understand whether this is an opportunity or threat to companies’ growth and profitability.

The new rules set car companies an emissions target of 95g of CO2 per kilometre. This is for 95 per cent of their fleet as of 2020, and 100 per cent of the fleet as of 2021. For comparison, this is 20 per cent below the 120g per kilometre sector average from 2018 (find out more here).

Those who do not comply will face fines of €95 per gram over the target, multiplied by the number of cars sold in the EU.

The regulation is designed to encourage ongoing innovation in cleaner powertrains. The standards tighten over time and are currently expected to reach 60g by 2030. This means car companies have to halve 2018 emission levels by 2030.

How are car makers reacting?

The recent Frankfurt Motor Show showed that companies fully recognise the need to comply with the new regulations. But almost every European car maker has a different plan to tackle the task ahead.

Volkswagen (VW) has been the most proactive. It is putting its focus on pure electric vehicles (EVs) and aims to sell 500,000 EVs in 2020 to achieve CO2 compliance. This is the most commercially significant response of the European car makers to the new regulations.

It’s heartening to see VW embrace the challenge, given its role in the 2015 “dieselgate” scandal. That resulted in index provider MSCI downgrading VW’s sustainability rating to CCC – the lowest there is. But VW’s focus on EVs shows that lessons have been learned and changes are being made.

We feel it is important to identify those companies improving their sustainability, not just the ones who are already “best in class”. Only by supporting change can we hope to achieve global climate targets.

VW sells 10 million cars annually; its sheer scale means it has the capacity and deep pockets to make a significant investment in EV production. Other companies are making use of VW’s platform and expertise; for example, Ford is planning to use VW’s technology to build an EV for the European market.

For more read:

– Is Bill Gates right about the “zero” climate impact of fossil fuel divestment?

– Disruption from climate change is only just beginning for investors

– Have we reached a new tipping point in the battle to halt climate change?

Meanwhile, BMW is largely relying on plug-in hybrid electric vehicles (PHEVs). These are a better fit with its existing business, both in terms of what its customers want and in terms of technology investment that BMW has already made.

Companies are keen to protect pricing, with firms such as Mercedes-owner Daimler balancing the demands of profitability with the potential for fines or the need to buy carbon credits. Others in the industry may consider mergers; it could make sense to merge to gain access to another firm’s EV capabilities rather than invest in a whole new platform.

What next?

Car companies and investors have to debate several questions, with sometimes contradictory answers. On the demand side, will customer tastes move away from high emission SUVs in favour of EVs? And if so, when? What type of vehicle should car makers produce – pure EVs, hybrids, or traditional internal combustion engine cars?

And the big question for both the car companies and investors is: what is an acceptable profit margin? Currently, EVs are loss-making but the economics are starting to change. Many firms have already made big investments in EV technology. They can start to draw the benefit of that as demand grows, supply chains are created, and economies of scale come into play. On average EVs are expected to reach breakeven in terms of profits in 2022/23.

The new regulations speed up the changing economics for the car companies. For example, VW’s Golf actually becomes unprofitable once the CO2 impact is included whereas the ID (a battery electric vehicle) would see its profitability soar when adjusted for carbon.

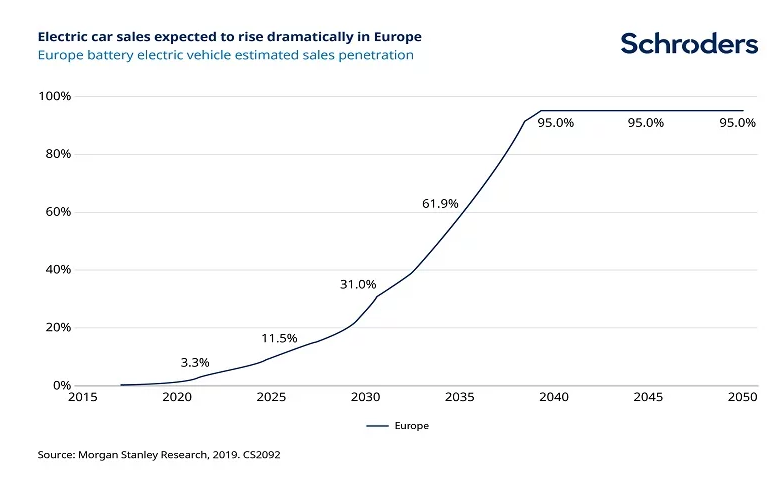

It’s clear that this is a period of rapid change for the industry. It’s impossible to be precise about timings but over our lifetimes the type of cars sold is likely to change dramatically.

What is the impact for investors?

The car industry is becoming a case study for reducing CO2 emissions. The transition from a dirty industry to a clean industry in a short space of time is without doubt the greatest challenge facing the car makers. The prospect of fines and having to invest in EVs potentially poses a short-term threat to profits. However, this transition is also an opportunity and those car makers who can adapt their businesses for the long term should thrive.

Take-up of EVs is one of the metrics tracked by the Schroders Climate Progress Dashboard, which monitors whether we’re on track to limit global warming to two degrees. Progress is better than in many other areas but it’s clear that there is still more to do and we hope these new CO2 regulations will make a difference.

The regulations come as a welcome reminder that companies have to consider the needs of all their stakeholders. Shareholders are one part of this alongside employees, suppliers, regulators, government, and the environment. These new emissions targets, and the threat of fines, reflect the increasing willingness of regulators to make companies pay for the side-effects, or “externalities”, that their operations have on others.

As investors, we believe we should be attempting to capture the value of these externalities, positive or negative, in a company’s valuation. A negative impact potentially poses risks to profits, reputation and ultimately share price, while a positive externality is a beneficial impact which falls outside typical financial analysis. We have a tool – SustainEx – that helps us to identify and measure those risks and reflect them in our investment decisions. This means we are as prepared as possible for the uncertain future ahead.

- Read more on how sustainability could affect your investments here.

Visit Schroders insights and follow on twitter for more view and analysis

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.