Why UK services exports have continued to grow post-Brexit

The resilience of exports from the UK’s service sector has been a success story despite the feared impact of Brexit.

Services exports reached a record £470bn in 2023, up seven per cent compared to the previous year adjusting for inflation.

Figures out yesterday showed that the UK was the world’s fourth largest exporter in 2022, up from seventh position in 2021, with the improvement attributable to the strength of the country’s services sector.

So what’s behind the surge in service exports? And why hasn’t Brexit damaged the sector more?

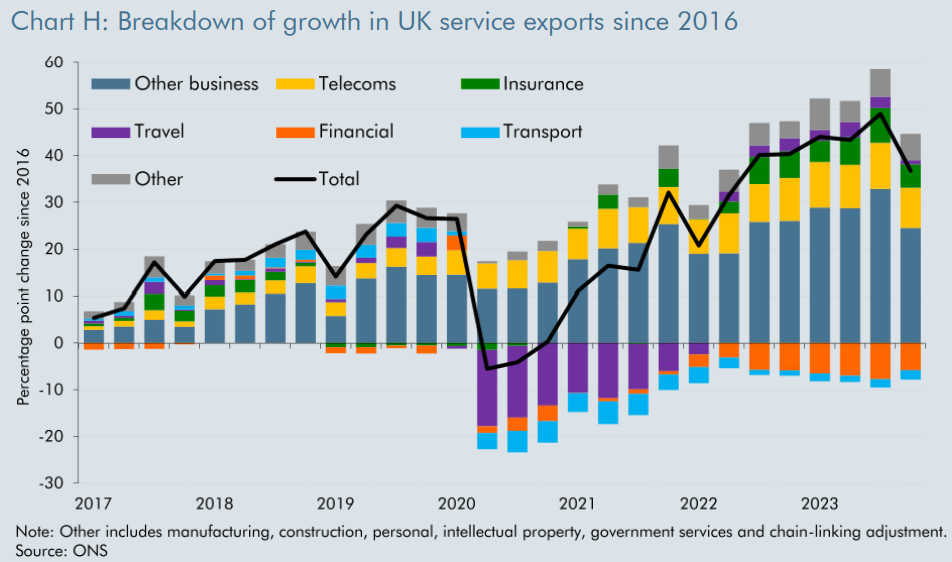

In March, the Office for Budget Responsibility (OBR) noted that around two thirds of the growth in services trade volumes since 2019 has been driven by ‘other business sectors’.

This catchy title includes some of the UK’s fastest growing sectors, such as consulting, accountancy and R&D. By contrast, exports of financial services and transport have lagged other sectors, declining 5.9 per cent and 2.0 per cent respectively.

“The UK has real emerging strengths in travel and professional services – alongside other business services such as law, auditing and accounting,” William Bain, head of trade policy at the British Chambers of Commerce told City A.M.

The OBR suggested a few points that could be behind the relative growth of business services. First, barriers to exporting to the EU in these sectors are likely to be lower than in more highly regulated services, such as banking.

It also noted that there had been particularly strong growth in service exports to the US, which could reflect US firms “outsourcing work to the UK”.

Global demand for business services is also growing, and growing fast. According to the Resolution Foundation, global trade in the services Britain specialises in has tripled since 2005.

London specifically has been a key driver of this trend, with its exports growing by nearly half between 2016 and 2021.

“The proximity of world-leading firms is a key draw, enabling international companies to access the best financial, professional and legal support in one place,” a BusinessLDN spokesperson said.

The UK should continue to capitalise on the rising tide of services trade. Services exports as a share of global trade set to rise from 25 per cent in 2020 to 28 per cent in 2035, according to the Resolution Foundation.

“Securing more opportunities in global services trade for UK companies should be at the heart of a refreshed trade strategy which government and business can work in partnership together upon,” Bain said.

So has Brexit been a boon for British trade? Well, its more complicated than that.

The UK’s goods exporters have not performed anywhere near as well as the service sector. Although global goods trade has come under pressure in recent years, the UK goods exports have fallen much faster than the G7 average.

Goods exports have under-performed the G7 average by 15 per cent since 2020

Barriers to trade between the UK and EU have certainly contributed to this fall. The Office for National Statistics said that around half of exporting firms had faced extra costs due to Brexit.

The BCC has previously called for primary regulations on traded goods should mirror the EU’s in order to keep business costs low.