Why today’s inflation data is still bad news for a bruised Bank of England

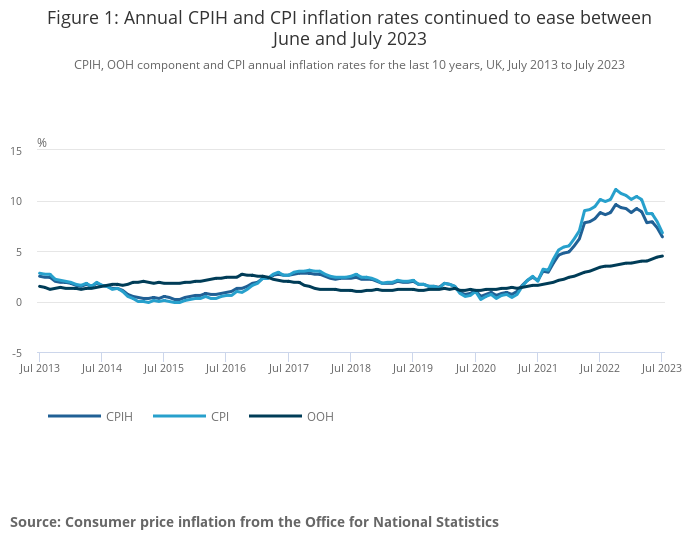

Inflation falling to 6.8 per cent will be greeted as ‘good news’ by this morning’s radio bulletins.

Government ministers will no doubt claim it’s a sign of ‘the plan working.’

But the fall in the headline inflation figure is driven by energy price falls – predictable, and because of the energy price cap, now a time-limited, one-off bonus to the figures.

No, the real story this morning is that core inflation – stripping out energy, food, alcohol and tobacco – has remained exactly where it was in June, at 6.9 per cent.

Even worse, services inflation actually rose in July, from 7.2 per cent to 7.4 per cent.

In a services-led economy, that’s not good news at all.

Yesterday’s wage growth figures suggested that the UK may be in a wage price spiral.

Well, with core inflation refusing to fall, that looks even harder to refute.

David Baker, a Partner at Mazars, said it was hard to see the cycle being broken,

“The surprise strength of CPI suggests that higher inflation in the UK may be becoming endemic as companies are enjoying an environment where input prices can be passed through to consumers, and low unemployment strengthens the hand of employees in the face of higher debt servicing costs,” he said this morning.

But it’s not just the cost of what you buy that’s going up as wages go up. Housing, too, continues to climb aggressively.

The Office for National Statistics’ preferred inflation measure – CPIH – includes housing costs, too.

That fell substantially, because it includes the more than 20 per cent fall in gas prices.

But rents and imputed rents both went up significantly in July, too, piling further pressure on household budgets.

Bank of England governor Andrew Bailey may be feeling a degree of relief this morning.

But it’s hard to see a world in which the Monetary Policy Committee aren’t forced into at least one further rate hike when they next meet once they dig into the small print.