Why the network state is the next logical evolution to current forms of governance: Part 2…

Covid showed it only takes a few people at the top to quarantine and lockdown the planet, the equivalent of house arrest. The masses are easily controlled.

FDR in 1933 made it illegal to hold gold then revalued it from $20.67 to $35 an ounce. This served to devalue the dollar which was tied to the price of gold, effectively imposing a massive overnight tax upon revaluation so that less gold was required to back the dollar which enabled the Fed to print more money.

Similar concerns have been voiced about the US and other major governments making it illegal to hold Bitcoin while banning crypto. Such would hamper exponential growth of crypto in those countries. Indeed, banning various aspects of Bitcoin by China and Russia have simply sent Bitcoin to more allowing jurisdictions.

But for the sake of argument, if Bitcoin and crypto were globally banned, both would just relocate to a black market such as the dark web where a multi-trillion dollar economy continues to grow. It would fuel the black market.

Alternatively, it could coalesce into a network state where Bitcoin is the currency. At first, there may still be remaining onramps from fiat to crypto. But in time, should such onramps be closed, with sufficient network effect from a growing membership, those who opt-in would earn crypto in the form of Bitcoin or alt coins. No fiat would be necessary to create an economy. Goods and services would be transacted in crypto.

But fiat-to-crypto onramps would increase once again because a booming, open source, composable Web3 metaverse with cryptographically provable growth in GDP would further enable digital defence against outsiders while earning it diplomatic recognition as a sovereign state, capable of self-sufficiency and trade with other states. In time, fiat-to-crypto onramps would flourish as such a network state would become worthy of trade as a partner with governments, ie, nation states.

Fuelling the growth is Web3 composability where each can build on top of others’ creations. Such a cooperative creator economy would grow much faster than traditional competitive economies without having to resort to violent conquest or coercion but through innovation. Blockchain can serve as the backbone of each network state.

Each individual would have their own decentralized identity via ENS or the equivalent which would define their citizenship to the network state(s). The freedom to assemble, transact value, and communicate in a censorship resistant fashion would exist outside the interference of nation states. Indeed, from mail to email, taxis to Uber, banks to Bitcoin, and courts to moderators, these transformations have been transferring control from nation states to digital networks.

Nevertheless, history shows when governments ban something, that something thrives underground. Prohibition in the 1930s or the reefer madness campaigns against marijuana in the 1960s or the “Just Say No” anti-drug campaigns in the 1980s did not stop millions from using the illegal substances. Millions of families in countries such as Venezuela have used Bitcoin to convert their plummeting currencies into Bitcoin even though it is an imprisonable offence.

Wealthy Chinese have used Bitcoin to move more than the maximum allowed $50k USD equivalents out of the country. It is nearly impossible for governments to control such behaviour. While governmental surveillance techniques evolve, so do workarounds against such surveillance.

Ultimately, peer-to-peer decentralized, open source, secure networks have proven to be immune to government control. P2P illegal file sharing which started in the 1990s with Napster continues to grow exponentially despite the billions of taxpayer dollars that courts used to try to stamp out Pirates Bay type websites.

Bitcoin is similar. Web3 fuels DAOs and DApps thus drains power from centralized systems whether political or corporate. Content creators own their creations so it is more economic to become a publisher of your own and found your own company than work for the establishment. In effect, Web3 and Bitcoin will create a media and money power that overshadows existing centralized systems.

Satoshi created a digital network without any central authority. Bitcoin is decentralised, distributed technology across a continuum of a near infinite number of devices thus evades conventional minds who can only declare that it has no value.

Likewise, Web3 enables the individual to port their digital data anywhere while Web3 login enables them to amass followers and communicate with anyone in Web3, away from the permissioned systems of Facebook or YouTube. In Web3, any user can port their followers and creations from one platform to another.

With the majority of people realizing that centralised systems own their data, control their movements, control their fiat capital, and control their communication, decentralized free platforms such as DeSo (decentralised social) are gaining popularity.

In time, such systems can win out over the centralized versions of YouTube and Facebook because they are more economic and free- you cant get globally censored or de-platformed AND you own your data so you would get more than a minuscule slice of the profit share.

An example of how the network state can trump the nation state

In part 1 of this article, I discussed the differences between the network state and the nation state. While I have written about the numerous uses for NFTs in a prior article, one problem with the Pirates Bay analogy above is that centralised front-end websites can get shut down.

Smart contracts can reside on the decentralised blockchain but users typically interact with them through front-end websites hosted on legacy web servers managed by centralized companies. For example, many Pirates Bay equivalent front end websites have been taken down over the years even though for each one removed new ones would launch making the effort on behalf of courts to eradicate p2p file sharing futile.

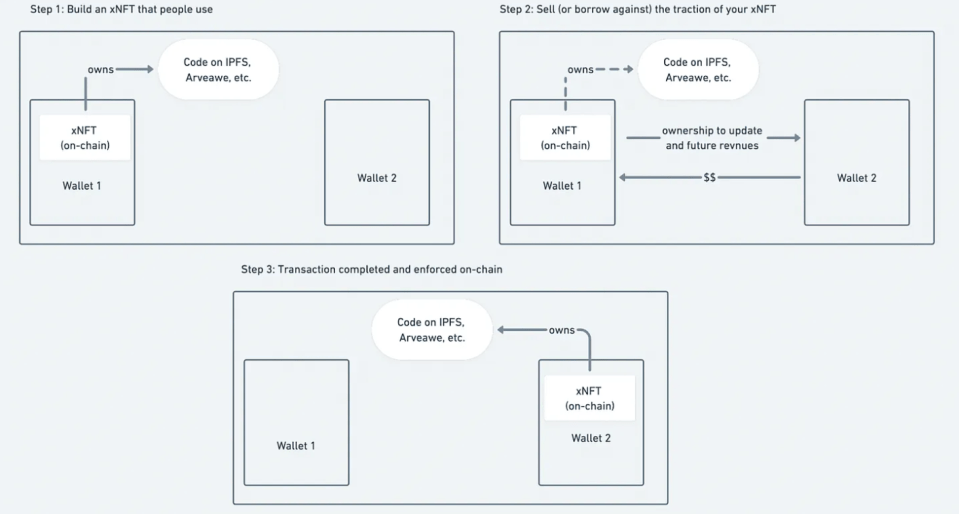

But just as with nature, technology finds a way. Executable Non-Fungible Tokens (“xNFTs”) exist on the Solana blockchain. Developers can use xNFTs to build and display web3 applications locally while maintaining the ability to communicate outside of these local sources using decentralized code.

When a user opens an xNFT, its code is executed through a decentralized environment. This capability to run code within the NFT itself can prevent front-end censorship.

Here is an xNFT overview:

Source: Moralis.io

Soaring inflation from government overregulation

Current nation states control prices through artificial monopolies which result in soaring inflation across various industries.

Given the record pace of rate hikes since the Fed started to tighten, a historically hard recession in the US, UK, and EU is in the offing as various metrics are already showing that delinquencies are soaring as nearly 2/3 in the US and UK are living paycheck-to-paycheck which will inevitably impact corporate earnings and unemployment.

Meanwhile, sticky inflation is due to persistent supply chain issues, supply shortages of critical commodities such as fertilizer and wheat contributing to food inflation, as well as government anti-competitive overregulation in industries such as healthcare, housing, and education which prevents fair competition.

Government overregulation is due to government subsidies and regulations which restrict supply by preventing new competition which causes prices to rise. As one of many examples, the Dodd Frank law prevented new bank creation.

But overregulation is nothing new. In the 1930s, the US government gave Ma Bell an artificial monopoly causing all telephonic innovation to come to a grinding halt for the next few decades. Same for other major industries over the last century which greatly hampers progress.

Indeed, back then and in various markets such as today’s healthcare, education, and housing, new technologies would lower prices as they do in unregulated industries such as computers, mobile phones, and big screen TVs. Instead, new tech is prevented by nation states from manifesting in these overregulated industries.

So services remain expensive relative to goods mainly because they are prevented from becoming tradable. Healthcare, education, and housing could become tradeable if governments allowed them to be, but they don’t in the name of protecting the consumer, jobs, and the suppliers, none of whom get protected in the end since excessive inflation across these industry groups is the end result. Everybody loses.

As one of many examples where trade could reduce the skyrocketing price of education, higher ed has forcefully pushed back against online competitors as big money universities lobby politicians. Start-ups like Udacity couldn’t get accreditation and therefore couldn’t compete with schools that got governmental subsidies.

Producers are also protected by way of anti-trade and anti-technology arguments against cheaper prices which spurs government regulations to make such industries anti-competitive, much as Ma Bell was given that artificial monopoly in the 1930s.

The reality is that when consumers have more money to spend on everything else due to lower prices in one or more industry groups, the standard of living rises.

That new spending creates new jobs and industries into the market of infinite human wants and needs, which is why through the years, technological advancements never increase overall unemployment. For example, the unemployment of the horse & buggy operators due to the automobile certainly did not arrest job growth in transportation.

By the same measure, one might rhetorically ask if we want to ban recorded music to boost the employment of musicians? Such a ban makes zero sense, so why are we forcing education to remain in physical classrooms?

AI will be an amazing lever to turn what are now labour intensive services into tradeable technology goods at far lower prices. Today, doing that is mostly illegal in the name of protecting people’s jobs as well as the producers.

This is all illustrative of the lack of deeply understanding a situation which ends in policies that hamper economic growth and ignite inflation. The failure to see how things interconnect drives politicians to pass uneconomic laws which result in higher inflation, and this costs everyone in the end.

We have seen this lack of depth of understanding in global warming, COVID, drugs, sex, terrorism, and anti-money laundering issues. Most of these controversies have become weaponized by mainstream media resulting in emotional, leftist, woke, reactionary and uneconomic laws that get enacted.

Decentralisation the way forward

The more the Web3 multimetaverse decentralises centralised systems, the greater will be the force with which to be reckoned. The network state will become the most populated form of governance.

Bitcoin (or some equivalent which has yet to be seen) will be the trade capital. Privacy will be reinforced. People will own their own digital creations while anyone can port their creations and followers anywhere within this metaverse.

Global censorship, cancel culture, and de-platforming will become a distant memory. The network state will likely grow exponentially since it is far more economic and utilitarian, ultimately enabling people to earn more money for their efforts while owning and controlling their digital creations.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first Bitcoin at just over $10 in January-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in Bitcoin since 2011 to within a few weeks. He was up in 2018 and 2022 vs the avg performing crypto hedge fund (-54% 2018 [PwC], -47% 2022 [BarclayHedge]) and is up well ahead of Bitcoin & alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold.

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Bio: https://drive.google.com/file/d/1GBlOzJdp3XaDJaeuE6gp8xg2iBMwqRuO/view

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/triquantumtech

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial

Interviews & Articles: https://www.virtueofselfishinvesting.com/news