Why renewable energy could gain from the green hydrogen trend

What effect will net zero have?

One of the most notable features of climate policy over the last couple of years has been the rise of national and supranational “net zero” targets. Countries and regions adopting these targets include Europe, the UK, China, South Korea, Japan, Canada, South Africa and a handful of US states.

Whilst these are long-term targets, the effects are incredibly powerful, dramatically more so than, say, an 80% decarbonisation target. Under an 80% carbon reduction target, a whole host of carbon-intensive industries might assume themselves to be in the 20% that doesn’t have to structurally change. Once a net zero target is adopted, there is nowhere to hide, and no opt-outs.

Which brings us to green hydrogen: the technology that is likely to be critical for addressing these harder to abate carbon emissions. Power generation and the automotive sector can be decarbonised through renewables and batteries. In certain regions, heating too can be decarbonised through the use of heat pumps powered by renewable energy.

These trends alone require significant build out of renewables. But for heavy transport and shipping, industrial processes such as steel production, long duration energy storage for the grid, and some forms of heating, the technological solution looks likely to involve green hydrogen.

Discover more from Schroders:

– Learn: Outlooks: What can we expect 2021?

– Read: Is the vaccine the shot in the arm the market needs?

– Watch: How climate change could affect your investment returns?

What does green hydrogen mean for the energy power mix?

Hydrogen is only classified as ‘green’ when it is created through electrolysis of water, with the electricity coming from renewable energy. Hydrogen used today is typically produced through coal gasification or from natural gas: definitely not green. Ramping up green hydrogen thus has a multiplier effect on the existing forecasts for renewables, which are generally focused on direct electrification and decarbonisation, rather than ‘indirect’ electrification and decarbonisation via hydrogen.

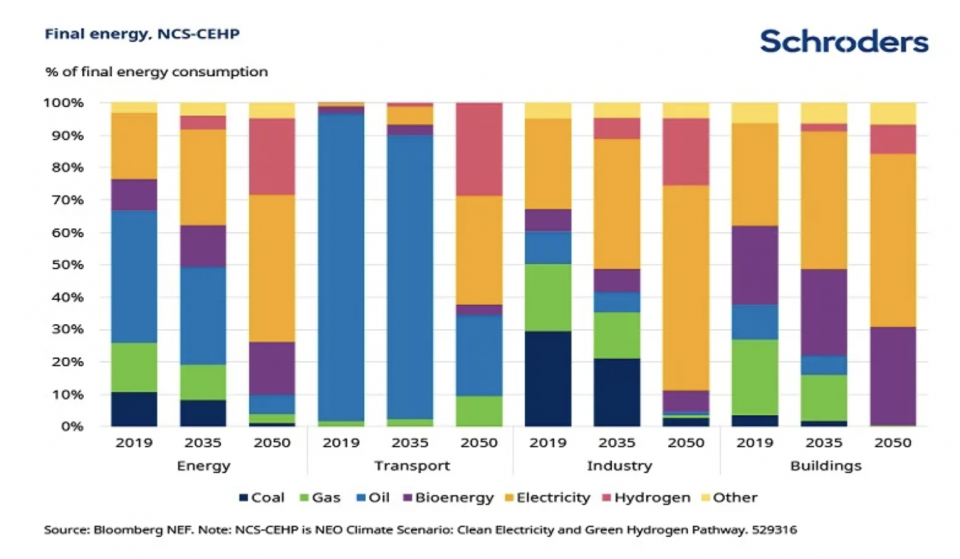

A new report by Bloomberg New Energy Finance (BNEF) maps out a potential energy transition pathway looking at how the world could decarbonise to a sustainable level (1.75 degrees of warming) based on the ramp up of clean electricity and green hydrogen. Hydrogen makes up less than 0.001% of final energy today, but under the BNEF scenario it grows to around 25%: a massive expansion.

Below: the growing share of electricity and hydrogen in BNEF’s clean electricity and hydrogen scenario:

How will renewable energy be impacted?

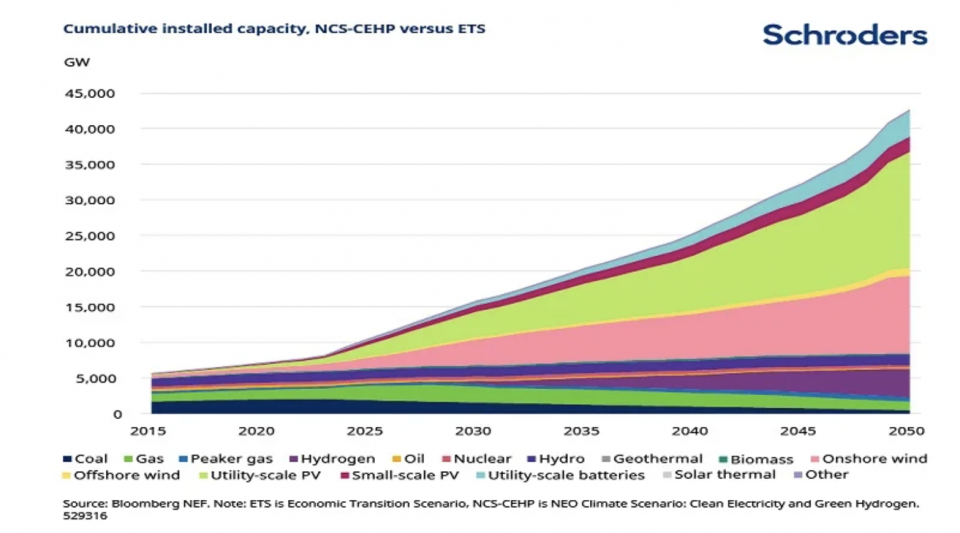

Under the sustainable scenario, the global power sector expands to 43 terawatts (TW) in 2050, from 7.4TW in 2019 as electricity takes share from other energy sources. Solar PV capacity rises to 16TW, from 0.64TW in 2019, and onshore wind capacity rises to 11TW, from 0.6TW in 2019. For context, it took around 20 years to reach the 1TW milestone of combined solar PV and wind installations.

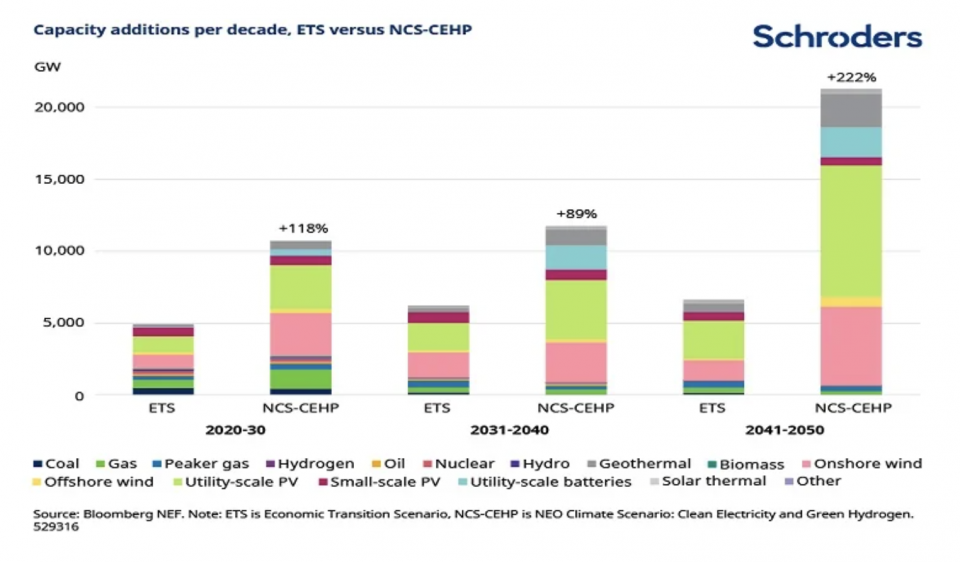

For the next two decades, this scenario requires almost 1TW of renewables to be added every year (375 gigawatts (GW) of wind and 540GW of solar PV). For 2020, BNEF forecasts approximately 72GW (0.07TW) of wind installations and approximately 127GW (0.13TW) of solar installations. It is clear that renewable deployments must accelerate considerably in the coming years.

Below: the difference in cumulative installed capacity (top) and capacity additions per decade (bottom) in BNEF’s clean electricity and hydrogen scenario vs their ‘base case’ economic transition scenario.

What’s the cost of supporting green energy growth?

A step change in capital investment is needed to support this renewables build out, even accounting for continued cost declines. Just focusing on the evolution of the power system under the sustainable scenario requires around $35.1 trillion of investment in batteries and power generation over the next 30 years (BNEF estimates).

Layering on the additional capacity needed to create green hydrogen for sectors which can’t be decarbonised through direct electrification would require a further $11.6 trillion.

How does impact investors?

The expansion in the size of the renewable market would benefit not just the renewable equipment makers (turbines, solar panel supply chain, inverters) but also the beneficiaries of the ancillary equipment spending required to integrate it all into the system, for example cables and networks. The question now is how much is already priced in?

Whilst there is much uncertainty around the pathway mapped out above, and the economics of green hydrogen will have to be closely monitored, what is clear to us is that this potential growth is not yet being factored in to estimates.

- For more on sustainable investors visit Schroders’ sustainability hub.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.