Why Quilter won’t be the next St. James’s Place

After St James’s Place announced last month that it was being forced to set aside £426m to pay back customers who had paid for annual reviews and then failed to receive them, all eyes have turned to Quilter as the next victim.

In Quilter’s 2023 results that were published this month, the firm revealed that it had been approached by the Financial Conduct Authority and it was now in the process of reviewing its past practice and data.

In general, fears around the wrath of consumer duty taking down the largest wealth managers have begun to ripple through the industry, especially after Phoenix Group said this week that it would be setting aside £70m in anticipation of Consumer Duty requirements coming into effect later this year.

However, Liberum analysts James Allen and Nick Anderson have now argued that worries about Quilter facing a massive payout are overblown.

The analysts explained that given Quilter’s adviser base is roughly a third of SJP, and Quilter’s ongoing service charges are around 20 per cent lower than SJP, that would mean that a payout of £426m for SJP would only translate to around £115m for Quilter.

Given that Quilter currently held net cash of £349m at the end of 2023, this would be more than manageable for them to pay off.

“This scenario assumes problems are as widespread as at St James’s, which we doubt, and also assumes that Quilter does not seek recoveries from its adviser base who would be the ones responsible for any shortfall in client servicing,” said Allen and Anderson.

Yesterday, the FCA published a review into retirement income advice, finding that only 2.9 per cent of customers across 231 advice firms had paid for ongoing advice but not received it in 2022.

“If the FCA’s survey is representative of what might be found during Quilter’s own internal review, any provision could turn out to be a rounding error,” said the analysts.

Allen and Anderson noted that each of Quilter’s businesses have had record-keeping systems in place “for a long time”, leaving them able to track which clients received which services, while SJP only began implementing Salesforce in 2021.

Meanwhile, Quilter already regularly reviews advisers, by undertaking sample-based assessments of ongoing advice, meaning that any advisers who had been failing to follow the rules would have been already subject to disciplinary action.

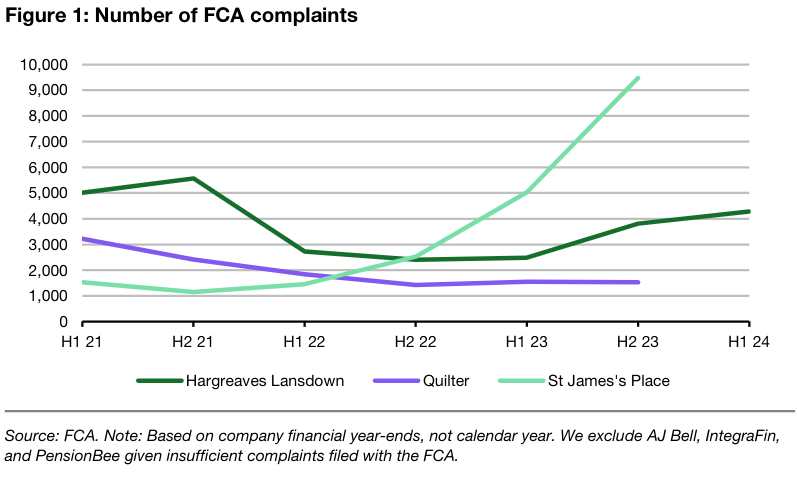

Finally, the analysts noted that a large reason why SJP had come under scrutiny in the first place was its high level of complaints to the FCA, while Quilter had received comparably few.