Why the Occupy Wonga campaign may want to check its sums

Campaign group Occupy London is to mobilise this Mayday, in order to fight what they see as "the new economic fascists" – pay day loan companies.

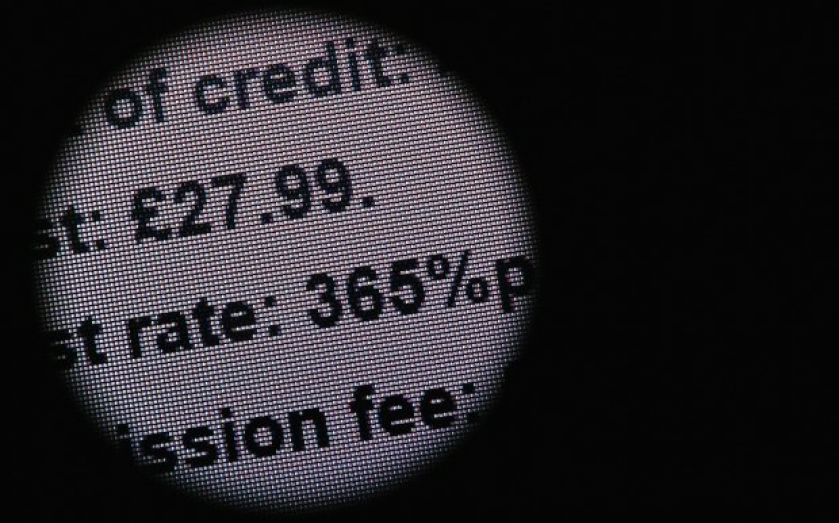

An email from the group, announcing the launch of "Occupy Wonga", states that "we see the most vulnerable people in society being charged immoral interst rates".

So on 1 May, Occupy London plans to "be paying Wonga some interest, but not with 5853 per cent APR."

Like everyone else then.

Wonga, like other payday lenders, is required to display a representative APR by regulators, but it's not a useful measure of how much interest a borrower will actually pay.

In the case of Wonga, interest does not compound for longer than 60 days beyond the initial loan period (of one to 46 days). No-one has ever paid anything like the astronomical interest that representative APR implies – and the interest on Wonga loans can often be cheaper than bank overdraft fees.

Sam Bowman, research director at the Adam Smith Institute, points out that representative APR "is designed to show interest-on-interest compounding over a year, and is an inappropriate measure to use for a loan whose term is a month or so."

"The real problem is that people are poor enough to have to rely on these sorts of lenders. Wonga et al only exist because their customers have no better alternative," says Bowman.

Payday lenders remain vastly preferable to illegal loansharks – and that's why borrowers use them.