Why is the FTSE 100 nearing a record high with a recession looming? It ain’t the economy, stupid

The FTSE 100 is becoming one massive hedge fund.

That’s why it’s doing so well when all the doomsters have warned the UK is headed for a long, albeit shallow, recession over the next year.

Of course, the stock market isn’t the economy. How many high street coffee shop owners do you know that worry about how small movements in the pound will change demand for morning cappuccinos?

The FTSE 100 is the home of the biggest companies in the UK. They face fundamentally different trade offs and are exposed to different markets than those in the real economy (Main St to the Americans).

Let’s look at one sector: commodities. A huge chunk of London’s top index is made up of producers of copper, coal, oil and other raw materials. In City jargon, they’re “old economy” stocks that rely on production methods and products first engineered decades ago.

Since probably after the financial crisis, traders around the world have slammed London for being too heavily geared to carbon emitting, oil guzzling, less dynamic companies.

They turned to Wall Street and saw Facebook (now Meta), Apple, Google (now Alphabet) and Microsoft turbo-charge the Nasdaq index. That good mood spread to the US’s other top indexes, the S&P 500 and Dow Jones.

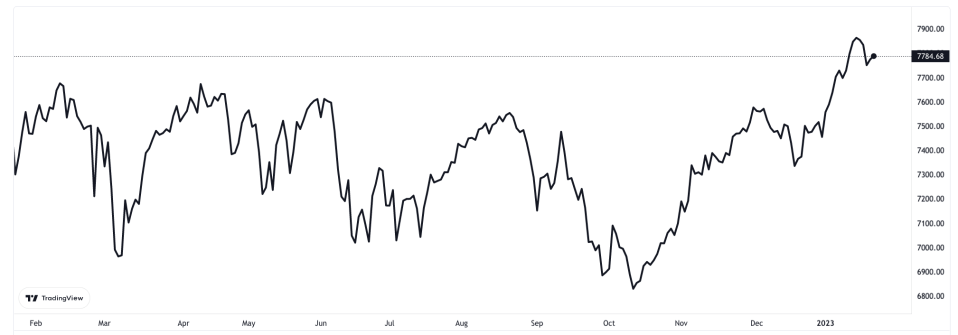

FTSE 100’s new year rally has taken it to near a record high

Yes, these companies were very much at the sharp end of technological innovation, especially during the pandemic when white collar workers everywhere turned their kitchens and bedrooms into home offices.

Investors even cheered European stock markets. Dare I cast readers’ minds back to traders welcoming payment provider Wirecard into Germany’s Dax index with open arms.

London was the laggard. It was home to a plodding stock market, too heavily reliant on big commodity producers’ dividends to attract capital.

The tide of opinion has turned.

Those same investors that slammed the City for being a dinosaur are now waxing lyrical about the old economy stocks.

Why are these big input producers lapping up the praise of the global financial community?

Because the stock market isn’t the economy.

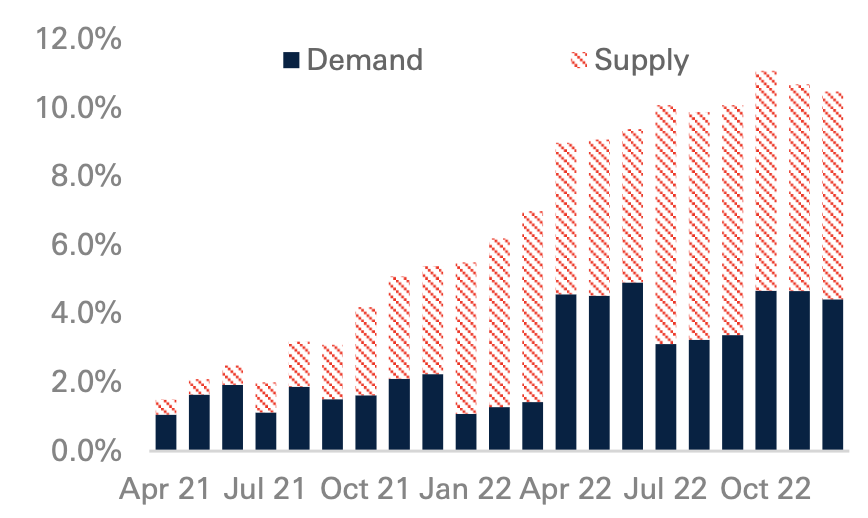

Energy prices surging after Russia’s invasion of Ukraine rattled gas markets – a jolt intensified by low storage levels and poor nuclear production – led inflation in the UK to a 41 year high of 11.1 per cent last year.

That, alongside tax rises and higher food bills, has put households on course for the biggest drop in their living standards on record.

But, the gas surge has lifted income at big energy firms, who prop up the FTSE 100.

However, gas prices are back below Russia-Ukraine war levels. Those good dynamics are fading.

What has seemingly driven the new year rally in the City is China dismantling its zero-Covid policy and reopening its economy. Beijing’s decision has bumped markets globally, but more so in London.

China is a massive consumer of raw materials. It’s going to need a lot of them to power its economy back to full strength. That demand will flow into the FTSE’s big players.

Experts are worried inflation could stick around for a bit longer as China re-enters the global economic stage. Doubt many are warning of an income drop at London listed miners, oil producers and commodity manufacturers.

Energy supply side shock has fuelled inflation

The pound’s slide last year to a record low against the US dollar, after Liz Truss’s mini budget spooked investors, has nudged inflation higher due to the UK having to pay more to import products.

Lots of experts say this is offset by demand for British exports rising, but this hardly shows up in the data due to the same firms having to import inputs to make said exports.

Again, while that has been bad for most households, it’s good for the FTSE 100. Loads of companies on the index generate their earnings in foreign currency, so they receive a bump when converting their cash into pounds, known as foreign exchange arbitrage.

Yes the FTSE 100 closing in on its record high is a ray of light amid the recession warnings. But again, for those at the back: the stock market isn’t the economy.

A PLACEHOLDER BUDGET

No one’s expecting fireworks from Rishi Sunak and Jeremy Hunt at the 15 March budget. It’s probably going to be a stop gap to the run up to the general election when the pair are likely to offer tax giveaways to cosy up to voters.

Good news though: The OBR will bump their forecast for GDP higher. The Bank of England’s likely to do the same at next Thursday’s rate decision.

YOU MIGHT HAVE MISSED

A howler of a correction from the Office for National Statistics yesterday set econ Twitter alight (there were a full seven angry people). The UK’s official bean counters revised down their estimates for output per hour worked growth rate in 2021 from 22 per cent to negative 1.8 per cent. Yep.

WHAT I’M READING

Speaking to this week’s column, the boffins at investment bank Nomura say they’ve seen an outpouring of cash from the UK stock market since around July, mainly driven by energy prices coming off the boil. They also reckon the pound will hit $1.32 against the US dollar by the end of the year. Below parity that ain’t.