Why investing sustainably can get you better income and better outcomes

For those that remain sceptical, we show that an integrated ESG approach can improve income stability.

Not only is it possible to combine income investing and sustainable investing, we believe you can actually make your income more resilient, smooth and reliable by investing sustainably.

Many things have changed for investors in a post Covid-19 world, but the needs of income investors haven’t. They still want their income to be high, stable and not at risk of being impaired by dividend cuts or persistently low yields.

We think income should be sustainable in both senses of the word: in terms of time horizon (because, by definition, it doesn’t just happen once), and from an environment, social and governance (ESG) standpoint.

Clearly, the environment in which income investors are operating in has changed. So have the tools they are using. We need to look at more than just financial metrics to gauge the likely stability of future income streams. And with the heightened risk of income being impaired across asset classes, there is evidence that a sustainable approach can help mitigate this risk.

Discover more:

– Read: WFH: Is it the death knell for offices?

– Learn: Why UK businesses need a £30 billion injection

– Watch: Why markets rise when economies fall

Diversifying an income stream by taking a multi-asset approach can reduce the volatility of the income. However, this can only take you so far.

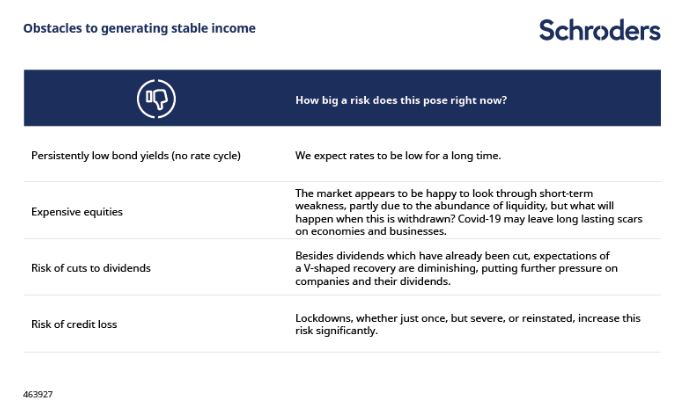

Many income investors are concerned about impairment risk, as the chart belows shows. Bond yields are at all-time lows, not to mention the fact that income from equities is discretionary at the best of times, let alone when governments are forcing companies to cut dividends.

We therefore need to do other things to reduce the risks to a smooth income stream. Taking ESG factors into account can help and, in fact, the recent crisis has shown this.

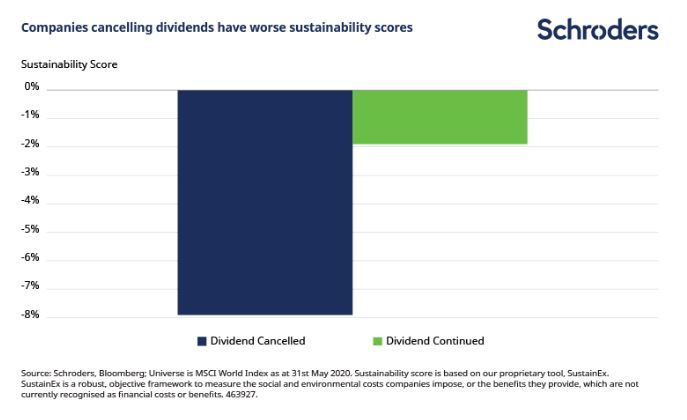

By the end of May we had seen 12.5% of companies cut or suspend dividends globally and we expect this trend to continue.

However, companies leading on the sustainability front have been less likely to cut dividends compared to the companies with poor sustainability scores. This is shown in the chart below where we compare the sustainability score of companies that have cancelled dividends with the sustainability score of companies that have maintained their dividends.

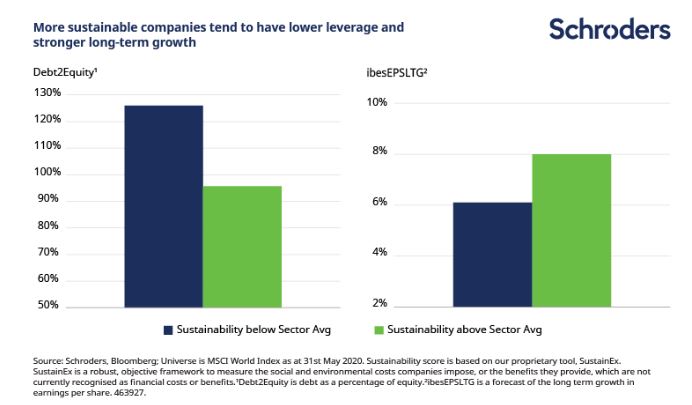

This divergence highlights the importance of sustainable business practises. Sustainable companies tend to have a more conservative dividend payment policy, they tend to operate with less leverage and target stronger long-term growth that benefits all stakeholders such as the environment, governments, customers, employees, and communities.

We do not know how long the effects of Covid-19 might linger, but we know that the issue of sustainability is not going away.

We believe that, by definition, companies that are unsustainable are unlikely to provide consistent and reliable income, or good outcomes for society as a whole.

Even for those investors who might be ambivalent about the theme of ESG, we think the case for investing income portfolios sustainably is compelling if you want a smooth income stream.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.