Why I can stomach higher equity valuations – Schroders CIO

The rising involvement of retail investors has been an intriguing trend during the pandemic, culminating in the surge and slump of GameStop shares.

As an industry, we worry about the disconnection of individual investors from financial markets, the hubs of wealth creation. Direct ownership of shares by individuals has been declining for decades. For that reason, the growing fervour for stock investing that had been growing throughout 2020 should be welcomed. The more recent encouragement of novice investors to buy wildly inflated stocks, however, should not.

For many, GameStop shares will be the one and only time they buy a stock, left only with a memory of their part in the “angry bubble” and a stinging loss. I worry about the risks being taken at a time when wealth and health is already a pressing concern.

We have seen retail investor exuberance pervade markets before. Back in January 2000, working as a young analyst I was among the buyers of tech start-ups. It’s easy for new investors to be engulfed by speculative fever.

The rise of the lockdown investor has been explored in this column before with our observations on the growth of the Robinhood trading platform during lockdown 1. But then, as now, my focus was on valuations and the other critical factors driving markets.

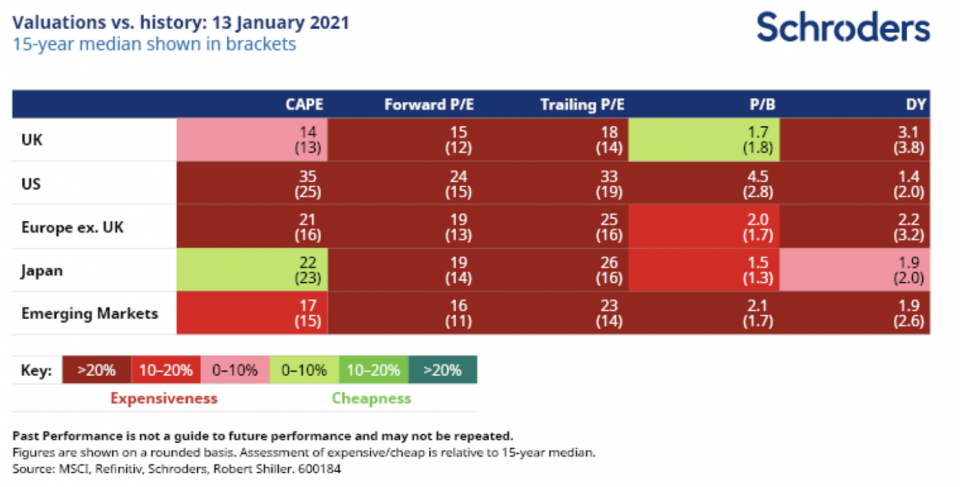

Our expectation that vaccines would provide a shot in the arm for recovery stocks has proven so. Markets have risen quite a way since then and, as we pointed out last month, valuations for major markets look expensive against historic norms. [See below, with detailed descriptions of the metrics used here].

The key below the chart explains which colour denotes how expensive the market is compared to its history over the last 15 years. So the darkest red blocks show that on that particular valuation measure, the market is 20% more expensive than the median of the past 15 years. The green shows which markets are 0 – 10% cheaper than the median of the past 15 years.

But it’s not reason to stop believing in equities.

As we struggle with home-schooling and dark days, it is easy to feel dejected. However, work by our Data Insights Unit suggests that we should start to see the benefit of vaccines in the US and the UK as we move into the spring. Green shoots are beginning to emerge and central banks will not want them to be trampled by tightening monetary policy.

Quite simply, the sheer scale of economic stress created by lockdowns makes the unwinding of stimulus measures unlikely, a view reinforced by the Federal Reserve last month.

This leaves us to ponder a scenario where economies recover and bond yields stay low, which helps to underpin equity valuations. Markets feel bubbly but bubbles tend to get pricked by higher rates. For now the central bankers are keeping their needles safely tucked away.

What about inflation? There’s much talk of the Roaring Twenties and the subsequent price pressure that could ensue. But it’s too early to be concerned. There is little evidence of dangerous inflationary pressure. In fact, a little inflation would support the story of global recovery yet wouldn’t be enough to prompt central banks to raise rates.

I can therefore stomach the risk of higher valuations in equities. As we lift our heads and move into spring, the news on the virus may continue to improve. At that point it might be time to take some profits and enjoy a little sunshine.

– For more visit Schroders insights and follow Schroders on twitter.

Important information

Investors should beware the temptation to simply compare a valuation metric for one region with that of another. Differences in accounting standards and the makeup of different stock markets mean that some always trade on more expensive valuations than others.

This information is not an offer, solicitation or recommendation to buy or sell any financial instrument or to adopt any investment strategy.

Finally, investors should always be mindful that past performance and historic market patterns are not a reliable guide to the future and that your money is at risk, as is this case with any investment.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.