Why high rates affect the UK’s public debt more than other G7 countries

Chancellor Jeremy Hunt will likely be working late into the night as he looks to make the maths add up ahead of the Spring Budget on 6 March.

One thing that has made life more difficult for the Chancellor – who is under pressure to cut taxes ahead of the next general election – is the surge in debt interest costs, which will cost the Treasury tens of billions of pounds over the next few years.

The Bank Rate has climbed from just 0.1 per cent at the end of 2021 to a post-financial crisis high of 5.25 per cent. Although debt interest spending is now on the way down, the higher cost of borrowing means it is expected to be around 4.3 per cent of GDP in 2023-24, the second highest level since World War Two.

That is a lot of money. Put another way, government spending on debt interest this year will be nearly double the UK’s spending on defence.

So it’s worth asking whether the decisions the government have taken over the past couple of decades have increased its exposure to interest rate risk unnecessarily.

There are a couple of obvious candidates.

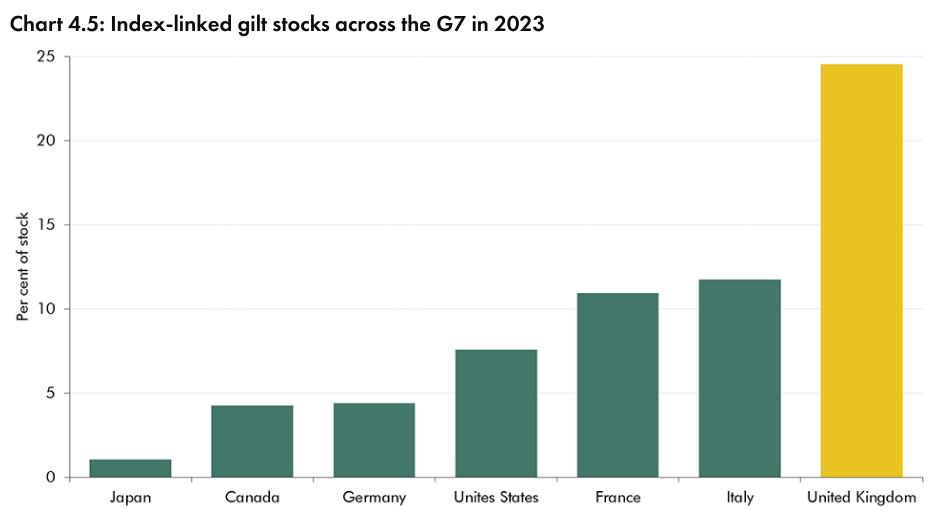

First, the UK’s debt has a much higher proportion of index-linked gilts, known as ‘linkers’, than many other advanced economies. ‘Linkers’ effectively tie the government’s interest payments to inflation.

These bonds were introduced in 1981 in an attempt to assuage concerns among international investors that the UK was not serious about getting inflation down.

‘Linkers’ quickly became popular and now make up around a quarter of UK debt. Italy, which has the next highest amount of index-linked guilts, has just 12 per cent of its debt tied to inflation, while this figure falls to less than 10 per cent in the US and Germany.

The argument in defence is that investors pay a premium for inflation protection allowing the government to offer investors a lower yield.

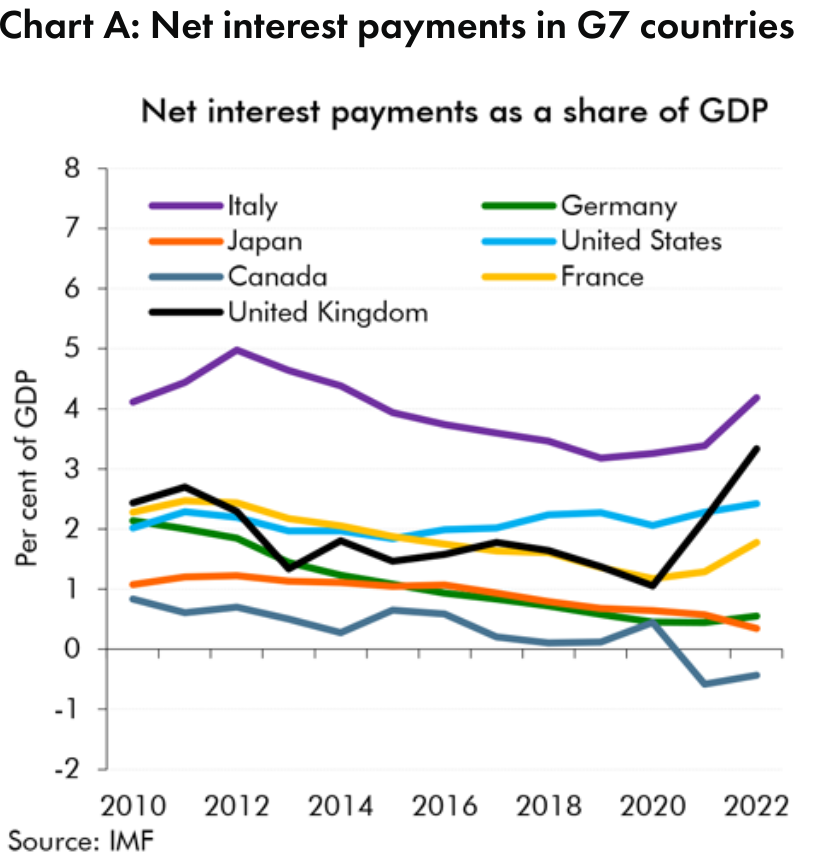

The problem, however, is that when interest rates start rising, the government has to pay out more in debt interest payments. The UK’s debt servicing costs have increased far more quickly than other advanced countries.

In 2022, the UK spent around 3.3 per cent of GDP on net interest payments compared with the G7 average of 1.7 per cent, with only Italy (which has a significantly higher debt stock) spending more as a share of its economy.

So have they been worth it in the long run?

The Debt Management Office (DMO) suggests that the government made savings of £77bn on gilts issued since 1981, prior to August last year. Not bad.

However, there are very good reasons to think that inflation, while coming down now, will be higher over the coming years than in the previous four decades. DMO analysis suggests that as long as the retail price index averages less than three per cent over the life of the bond, then the government still gets value for money.

That looks like a much riskier bet in 2024 than it did in 2014.

Another factor impacting the UK’s exposure to higher interest rates is quantitative easing, the Bank of England’s programme of hoovering up bonds.

For over a decade after the financial crisis the Bank was buying government bonds on the secondary market in an attempt to stimulate the economy.

To buy the bonds, the Bank created new commercial bank deposits on which it had to pay interest. This effectively ties the gilts bought by the Bank directly to changes in interest rates. In a way, this turns fixed-rate debt into into floating rate debt.

Now that interest rates are significantly higher, the government is transferring commercial banks billions of pounds via the Bank of England. Over the lifetime of the programme, taxpayers could be on the hook for as much as £130bn.

Policymakers at the Bank have stressed that QE – and its reverse, quantitative tightening – should be judged by its macroeconomic effects rather than its cost effectiveness.

There is no doubt that QE was crucial to help address the 2008 financial crisis, but the Bank has come under criticism for the scale at which QE was pursued during the Covid pandemic.

The government could have borrowed from the market instead, locking in the very low rates that existed at the time of the pandemic, rather than exposing itself to the risk of interest rates rising in the future.

The UK is fairly uniquely exposed to the impact of high interest rates and it’s not clear that all of the government, and the Bank of England’s, decisions have been completely worth it.