Why has an Enfield Barclays branch been given Grade 2 listed status?

An “exuberant” Barclays branch in London, home to the world’s first automated teller machine (ATM), has been given heritage status as the number of ATMs around the country continues to decline.

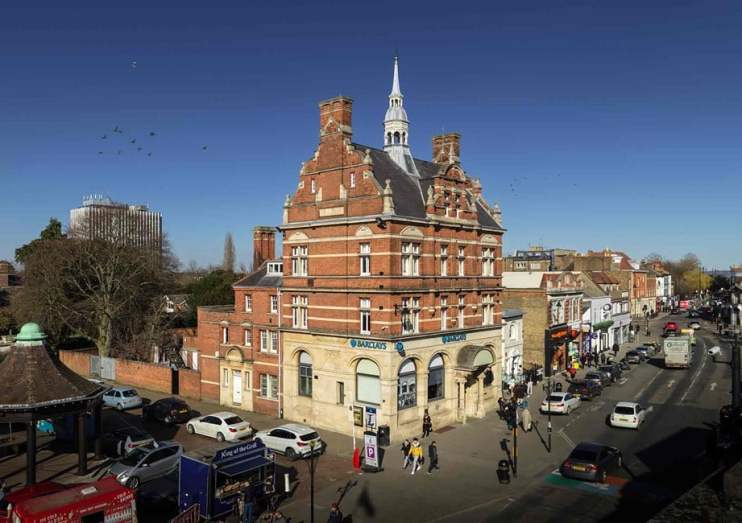

The bank branch, situated at 20 The Town, Enfield, was fitted with the world’s first ATM in 1967 by the actor and comedian Reg Varney. According to Historic England, the event drew “crowds of spectators”.

The national heritage body said the installation was “a major technological development” as it gave the building Grade II status. In fact, in 2009, Paul Volcker, former chair of the Federal Reserve, described the ATM as the “only useful innovation in banking for the past 20 years”.

The site at Enfield was chosen for the ATM for its “good pavement access” and “high windows”, amongst other reasons. Architectural historian Nikolaus Pevsner described the building as “exuberant Flemish Renaissance”.

Since its launch the ATM has spread around the world, heralding the beginning of 24/7 banking. ATMs have been installed in Buckingham Palace, church organs and Alice Cooper’s car. An ATM with Latin instructions has even been set up in the Vatican.

Leader of the listing team Sarah Gibson “its extraordinary to think how much has changed since 1967 when it comes to everyday banking.”

“While our use of cash has fallen in recent years as contactless technology dominates, it still remains a lifeline to many and I’m glad to see this building recognised for its contribution to that story of evolution,” she continued.

In the UK, the number of ATMs peaked in 2015 at over 70,000. Since then it has fallen each year with just over 51,000 remaining in September 2022.

This has coincided with the falling number of bank branches in the UK. Since January 2015, 5,162 bank and building society branches have closed. According to Link, a further 242 closures are scheduled for 2023.

This has sparked concerns from customers and lawmakers alike. Last year the Financial Conduct Authority was granted new powers by the government to ensure that cash withdrawal facilities remained available in communities across the country.

Banks have also attempted to provide more flexible options for cash withdrawals, such as cash pods.

A recent survey found a third of customers preferred doing their banking in-person, with 44 per cent of over-55s saying they would rather visit a branch.