Why digital infrastructure could emerge stronger from Covid-19

The Covid-19 pandemic has accelerated the need to modernise digital infrastructure networks. We expect that this will create new investment opportunities.

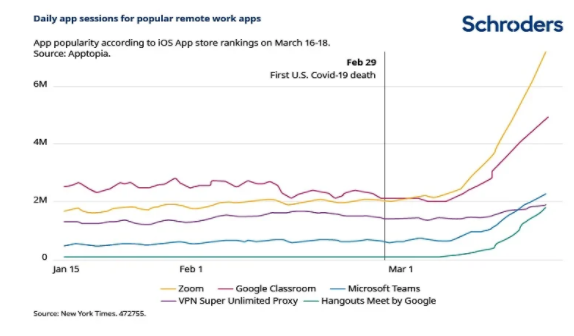

Surging online activity

Whether we like it or not, the Covid-19 pandemic has cemented our addiction to fast and reliable internet access. While speaking to colleagues remotely, food shopping online or monitoring our ‘smart home’ devices, a dropped Wi-Fi connection triggers a red alert in most households. Incumbent broadband providers have unfortunately experienced a rise in connection issues as online activity has surged during lockdown.

On a more positive note, cloud-based platforms such as Amazon, Zoom, Netflix and Ocado have risen to this challenge, having invested heavily in scalable digital infrastructure before the pandemic, in the form of software platforms and computer servers. This infrastructure enables them to securely process our orders, optimise logistics routes and deliver content on demand.

Having now experienced this potential, we believe their customers are unlikely to want less convenient ways of working, living and playing in the future. This means an accelerating need to modernise the digital communications networks that connect us to them.

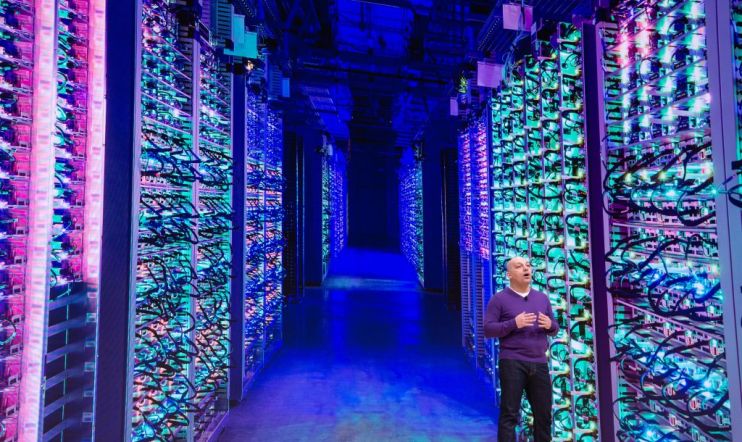

The role of data centres

Data centres play a mission critical role for their occupiers and have demonstrated extreme income resilience during the pandemic, with high rent collection and low levels of bad debts. They enable cloud-based services such as Netflix by housing computer servers and offering access to internet exchanges that tranmsit data to subscribers who stream their content. What is less visible is that these data centres and exchanges rely on a largely hidden external network of millions of fibre optic cable miles, cellular base stations, towers and countless signal transmitters.

Discover more:

– Read: Is the industrial sector positioned for even stronger growth after Covid-19?

– Learn: How working flexibly can give investors an edge

– Read: Why assessing sustainability is too important to outsource

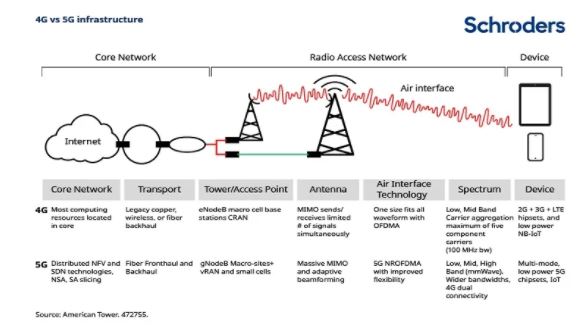

These networks are also critical for emergency responders, military communications and any other service that offers data access outside of a private local network. This includes Fifth Generation (5G) cellular technology that promises to accelerate mobile download speeds by up to 100x compared to those offered by Fourth Generation (4G) technology.

5G should enable emerging bandwidth-hungry technologies – such as driverless cars, online gaming and smart factories – to operate smoothly. The evolving network architecture (see image below) and our ever-increasing reliance on network access has made it clear to governments that they must invest heavily to remain globally competitive.

New age for digital infrastructure

China’s recent announcement of a $1.4 trillion stimulus package shifted focus from traditional infrastructure, such as roads and bridges, towards new infrastructure for the digital age. It is likely to target investments in artificial intelligence, data centres, 5G base stations, ultra high voltage power, electric vehicle charging, industrial internet of things and intercity transit.

Whilst China is playing catch-up in the data centre market, it already comfortably leads the world in mobile wireless coverage, hosting around 2 million active cellular towers. This is 1.5x the rest of the global industry combined, according to data from TowerExchange. China’s 5G equipment vendor Huawei has become the poster-child for ongoing trade tensions with the US, indicating its global importance to these communications networks.

Similarly, the EU is prioritising digitization as part of its €750bn Covid-19 stimulus package. We believe that digital infrastructure will remain firmly at the centre of the debate, as economies recover from the pandemic.

Global cities host the most valuable digital infrastructure

Our focus is on real assets in the world’s leading cities. It is clear to us that high quality digital infrastructure in these cities is becoming increasingly valuable as it sits at ‘the edge’ of the network, close to high volumes of customers and data. This proximity offers users the lowest levels of latency (delays when communicating), thereby improving customer experience and reinforcing demand.

A key feature of 5G is that the radio wavelengths used can transmit significantly more data, but over much shorter distances. This means signal transmitters need to be more densely packed to ensure full coverage. A lot more fibre optic cable, cellular towers and small cells are therefore required than for 4G signal, which travels further.

To justify this investment, mobile network operators (MNOs) will first target global cities with large populations of affluent consumers and businesses, where the potential 5G service revenue opportunity is larger. In turn, these cities will experience the highest quality of signal coverage, thereby reinforcing their productivity advantage.

The future control of 5G

Like data centre occupiers, the MNOs that use towers to transmit data are realising that it makes financial sense to share space on them with their competitors. The costs of deploying 5G transmission equipment and the time that it takes to densify tower portfolios make going it alone an unlikely route to scale their network rapidly.

MNOs in the US realised this some time ago, leading to a large and consolidated ‘carrier neutral’ tower, small cell and fibre industry, dominated by companies such as American Tower. Outsourcing in Europe and Asia is also gathering pace with Cellnex and China Tower recently raising billions of dollars in the public markets to extend their local leadership. These infrastructure owners then benefit from long-term, predictable lease payments from the MNOs which will operate the 5G network.

Digital infrastructure essential

Digital infrastructure is a rapidly evolving yet often overlooked asset class, backed by resilient income streams. We think it has an essential role to play in promoting future economic growth, with cities that under-invest likely to lose global competitiveness.

Misguided recent attacks on cell towers have highlighted the challenges involved in the roll-out of new technologies. In addition to such ESG risks, investors in this sector need to pay close attention to technological advances, such as quantum computing, which could disrupt traditional models. Investors able to navigate these changes and spot the global cities most likely to succeed could uncover some very interesting opportunities.

Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Any references to securities, sectors, regions and/or countries are for illustrative purposes only and not a recommendation to buy and/or sell.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.