Why Deutsche Bank is going to war with NGOs on wheat

Gamblers might think they're due a win after a string of losses, but most of us figure that taking a bet on an event doesn't affect its outcome.

But some NGOs say the opposite, if your bet is a futures contract, and you're an investor gambling on the value of commodities, like food.

The NGO Foodwatch alleges that the activities of companies like Deutsche Bank do precisely that, increasing the prices that the poorest have to pay to eat.

Last Wednesday a Foodwatch representative argued that Deutsche has been unable to "weaken the argument that their financial products contribute to price increases in food products, nor could it finally rule out connections to hunger".

Foodwatch wants to see European policymakers restrict what they identify as purely speculative trading in commodities futures, and to see institutional investors, like insurance companies, banned from commodities trading entirely.

The idea that financial speculation drives up food prices has become a meme in recent years – less clear is how gambling on the future value of a good can affect the outcome. Paul Krugman, the Nobel-prize winning economist, says it can't: "[A futures contract] has no, zero, nada direct effect on the spot price." That's true regardless of the size of positions taken by financial institutions.

If investors did want to profit from higher futures values, and to affect spot prices – the prices actually paid for goods – then they'd need to stockpile the physical goods, in order to take advantage of futures contracts. If this were happening then we'd expect to see inventories rising. While cereal stock-to-use ratios are up, their fall has largely been cyclically driven, falling dramatically in 2007/08. Now the ratio is set to rise to 23.9 per cent, back to where it was in 2003.

Deutsche Bank defends its trading operations in a 2012 report, stating that "there is convincing evidence that derivative markets have had a dampening influence on volatility in the spot market." Rising prices in the futures market also "provide strong price signals to which supply will react within the constraints of growing seasons."

Even the authors of research that note correlations between futures prices and spot prices "agree that unresolved methodological challenges and current data weaknesses make it impossible to prove causality," says Deutsche Bank. "We need more, not less, financial investors willing to supply the capital required to modernize agriculture and provide infrastructure finance. We also need the hedging products and the markets to provide them. In other words, we need 'speculators' willing to bear these risks."

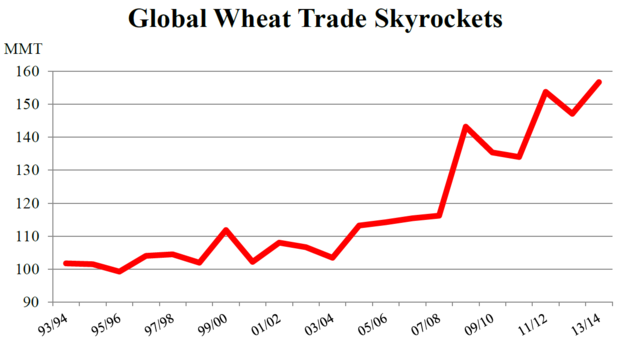

Explaining the dramatic increase in cereals prices requires an understanding of the primary drivers of supply and demand – and there has been a gargantuan increase in the latter. The USDA's most recent grain report states that the global wheat trade has risen by more than 50 per cent in just 10 years. "Expanding populations, rising incomes, changing tastes, and government policies" have contributed to phenomenal demand in the Middle East, North Africa, and Sub-Saharan Africa.

Source: USDA