Why are we so bullish on crypto?

Cryptocurrency markets have exploded on to the scene. They have momentum, driven by institutional interest, technological progress, financial innovation, macroeconomic factors, and the collective power of the people. These are the most exciting times since the inception of the crypto markets and will change many lives. It is of the utmost importance to understand why.

Bitcoin

The blockchain and the crypto markets started in 2009, with bitcoin, a trustless peer-to-peer form of payment that aimed to remove middlemen. The world’s biggest cryptocurrency was created by Satoshi Nakamoto in response to a global financial crisis started by financial institutions. These institutions worked behind the shadows and created derivatives on loans that couldn’t be repaid. Eventually, the world economy collapsed and bitcoin emerged from the ruins to bring transparency to our financial system.

Move out the way, gold

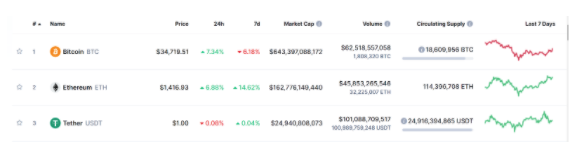

In 2020, Bitcoin had outperformed the combined gains of the Dow Jones and gold market by 10 times. And at the beginning of 2021, Bitcoin reached its all-time high of $41,000 in the midst of a global crisis.

The looming fear of massive inflation amidst the money printing frenzy has everyone running towards a safe haven asset that can serve as a store of value. Traditionally, this spotlight was held by gold, but now bitcoin is solidifying its position as a better vehicle for this purpose. After all, bitcoin is more scarce, easier to transport, highly divisible, faster to transact, and is transparent for everyone to see.

The bitcoin party is just getting started

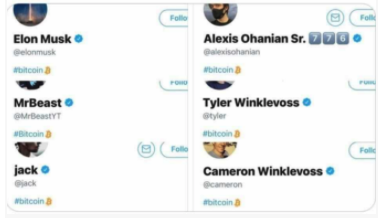

This has led to bitcoin captivating everyone’s attention, from banks, billionaires, institutions, celebrities, pop culture, retail investors, and even the naysayers. The bitcoin party has just begun and everyone wants to be a part of it.

Financial institutions are making bold predictions on Bitcoin’s price. J.P. Morgan suggests that bitcoin can reach $146,000 in the long term. Insiders at Citibank forecast that bitcoin will reach an all-time high of $318,000 by December 2021.

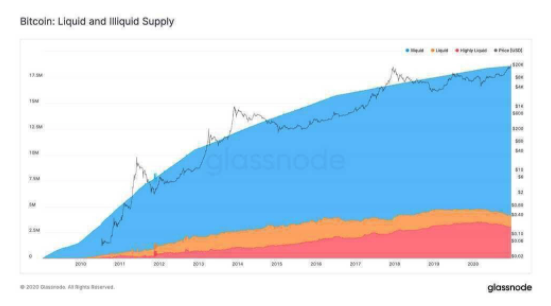

Institutions aren’t just making price predictions; they are gaining exposure by putting their money where their mouths are. MicroStrategy’s Michael Saylor is on record saying “I have bought — either through MicroStrategy or other entities I control — 88,000 bitcoin. I never sold one Satoshi.” Today this amounts to over $3 billion dollars. According to Glassnode, it is estimated that 78% of bitcoins are illiquid, as they are held in cold storage as a store of value investment rather than for trading.

Institutions aside, some of the brightest minds in the world are showing interest in bitcoin.

“I think bitcoin is a good thing. I’m a little bit late to the party, but I am a supporter of bitcoin” Elon Musk said recently.

The effects of COVID-19 on the global economy will continue to resonate until 2025, potentially costing as much as $35.3 trillion. Consider that figure alongside the fact that global debt grew by $19.5 trillion in 2020 alone, and the need for a store of value asset that can withstand inflation is immediate. In today’s digital environment, many are agreeing that bitcoin best fills that role.

Regulation & adoption

Regulation has always been a challenge for the crypto space. Regulators have expressed concerns about crypto being used for money laundering and its associated contraband. However, we have made great strides towards achieving regulatory clarity and creating a more transparent industry. Now, regulators are realizing that despite the undeniable challenges in regulating the industry, the technology is innovative, transformative, and beneficial to the financial system. In fact, it offers many tools to help combat terrorist financing and money laundering. Moreover, the sector is filled with good actors trying to actively help law enforcement.

The Office of the Comptroller of Currency (OCC) issued a guidance letter in early January 2021 that may be a turning point in how regulators view the industry. The guidance letter gives the green light for the federal banking system to transact in stablecoins for payment activities and other bank-permissible functions.

“Our letter removes any legal uncertainty about the authority of banks to connect to blockchains as validator nodes and thereby transact stablecoin payments on behalf of customers who are increasingly demanding the speed, efficiency, interoperability, and low cost associated with these products,” the OCC wrote.

Stablecoins have played an important role in the crypto markets. They provide the industry with stability in a volatile market. Tether, which, at more than $27B at the time of writing, ranks third in market capitalization, is the largest stablecoin in the market. It is critical in providing liquidity for the markets and for DeFi applications such as Aave and Compound, which offer decentralized lending and yield earning capabilities. As of October 2020, Tether had reached $600 billion in cumulative transaction volumes. Tether trades up to 4 times its market cap in 24-hour volume on a daily basis. More significantly, the Tether volume is about the same as bitcoin and Ethereum combined. As more investors purchase bitcoin as a store of value and stake their Ethereum, Tether will play an increasingly important role in providing liquidity to the ecosystem.

Combining the speed, efficiency, innovation, and liquidity of stablecoins will not only increase the legitimacy of the crypto markets but will create a highway of exchange between legacy finance and the crypto markets. Today’s economy operates 24/7, yet banks and clearing houses often stop working outside of 9 to 5 on weekdays. The amount of friction involved in moving large sums of capital across the globe will pave the way for the continued growth and adoption of stablecoins such as Tether.

Chainalysis has been working with government agencies, exchanges, stablecoins, and other cryptocurrency businesses to provide valuable information on what’s happening on the blockchain. Chainalysis has been able to track crypto wallet transactions and link them to Twitter hackers, assisting the U.S. Department of Justice — and other law enforcement agents around the world — in arresting alleged wrongdoers and in seizing their property. Chainalysis’s tools provide transparency for wallets and promote a safer industry: a welcome sight to regulators, exchanges, investors, and customers.

Conclusion

The future of the crypto market has never been brighter. The fundamentals continue to grow stronger. All signs in the market are pointing to a dramatic change in the financial markets, as people are given the tools to exercise their freedom. Crypto has given the people the tools to exercise more control and autonomy, all within a framework that emphasizes responsibility and transparency. We are for the crypto markets, fundamentally because crypto was made for the people.

Paolo Ardoino, CTO at Bitfinex. Paolo joined Bitfinex at the beginning of 2015 and now serves as Chief Technology Officer.

After his graduation from Genoa’s Computer Science University in 2008, he started working as a researcher for a military project focused on high-availability, self-recovering networks, and cryptography. Interested in finance, Paolo began developing financial related applications in 2010 and founded Fincluster as CTO in late 2013. Backed by two financing investment rounds, Fincluster delivered an advanced, modern and accessible web platform serving different clients with customization capabilities.

Paolo eventually joined Bitfinex as Senior Software Developer in 2014, tasked with trading engine development, platform scalability, and high-availability. Later in 2016, Paolo transitioned to the role of CTO. As CTO of Bitfinex, Paolo’s role is to manage the development team, evaluate new technologies, design and develop the Bitfinex backend platform. In addition to this, Paolo also serves as Lead Backend Developer at Bitfinex.

Crypto AM: Technically Speaking in association with Zumo