Who’s next? Industry debt mountain threatens more than Thames Water

Thames Water’s travails have taken the media spotlight in recent days, and deservedly so, with growing fears the country’s largest supplier could be on the verge of collapse.

Shareholders injected £500m into the company in March, and committed to a further £1bn in funding before discussions later faltered – with chief executive Sarah Bentley abruptly stepping down last week, and the supplier bringing in crisis manager Sir Adrian Montague as its new chairman.

Ofwat has sought to ease consumer fears over Thames Water’s troubles.

It recognises the suppliers ”significant issues to address” including the “need to improve their financial resilience” but also pointed to the group’s ”strong liquidity position….. with £4.4bn of cash and committed funding”.

However, the government appears unconvinced with Whitehall and regulator Ofwat now reportedly drawing contingency plans – similar to the crisis measures brought in to protect Bulb Energy when it fell into de-facto nationalisation.

Reflecting the scale of such a rescue plan, Bulb had one-tenth of Thames Water’s 15m customers, and cost £3bn in gross funding to support the fallen supplier on life support with transfusions of public cash.

Who could be next?

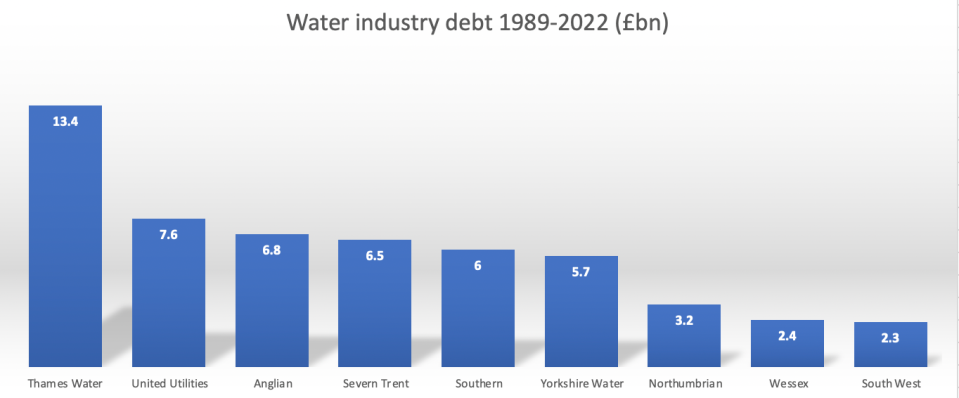

The company’s £13.7bn debt pile is not unique in the industry, even if it places Thames Water top of the pops among its peers.

Debt is commonplace across the water sector, with suppliers collectively accruing arrears of £65bn despite widespread underinvestment – including £54bn across the big nine suppliers between 1989 and 2022.

Rounding off the top five are United Utilities (£8.2bn), Severn Trent (£7.2bn), Anglian Water (£6.5bn) and Yorkshire Water (£5.7bn).

Over the same time period, they paid £66bn out to shareholders – averaged £2bn per year since privatisation over three decades ago.

Last December, industry regulator Ofwat flagged five water suppliers whose financial resilience it was most worried about.

Alongside Thames Water, it revealed Portsmouth Water, Yorkshire Water, Southern Water and SES Water will face its “highest priority for engagement.”

Just last week, Yorkshire Water also reported a £500m successful scramble for funds.

The firm said the move was part of a long-term equity plan, playing down the prospect of problems at the supplier – but with its debt levels any move it makes is rightly scrutinised.

Especially when the debt ratios are also so high.

While Thames Water’s 80 per cent leverage is significant, it barely contrasts with other suppliers – with South East Water reporting a leverage of 74.8 per cent while Affinity Water has a ratio of 74 per cent.

Now, the consequences of this are being felt with the country’s creaking, leaking pipelines insufficient to cope with rising demand from a growing population and warmer summer weather and colder winters over the past two decades.

Investors turn away from water sector

Ofwat’s industry reports reveal that of the UK’s 17 water companies, only three had a gearing ratio below the 60 per cent – which the watchdog considers a healthy target range for debt levels.

Jefferies is unimpressed, warning that “Thames Water’s financing situation exacerbates the challenges facing the water sector.”

The investment analyst fears the “sector faces an increasingly difficult challenge of balancing the growing need for environmental capex with customer affordability, whilst also enhancing its financial resiliency.”

Meanwhile, company credit ratings across the have dropped to their lowest levels in 30 years.

It is now predicting further regulatory risks for the industry, and recommends a close-to-nil premium on trading in listed water companies.

This financial shakiness across the entire industry means its difficult to predict which supplier is next to report difficulties, but it also means its hard to make a case for any of them being in particularly healthy shape – despite Ofwat and Water UK attempting to reassure customers.

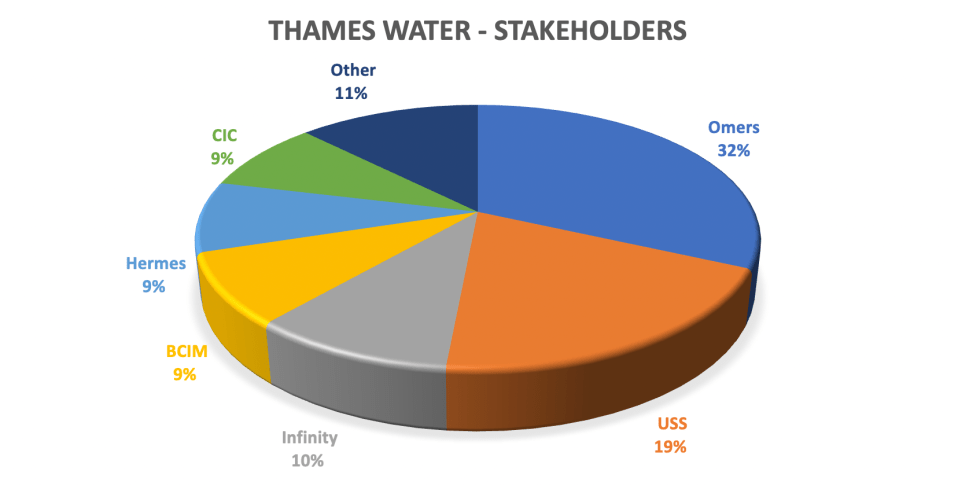

What also makes it more challenging is that six of England and Wales’ water companies are either owned or controlled by overseas investors.

In the case of Thames Water –its backers include Canadian pension giant Omers as its largest stakeholder, but also features the Chinese Investment Corporation – a state-backed vehicle – and Infinity, a UAE-based group.

While Thames Water investor Universities Superannuation Scheme has publicly lent its support to the company – City A.M. has approached every other investor in the company and so far received no comments, creating a deafening sense of silence over the supplier’s fortunes.

However, with such high debt burdens, it is difficult to have such certainty in any supplier’s future.

What happens now?

Liv Garfield, chief executive of Severn Trent, has invited other utility chief executives to an “off-the-record roundtable” with economist Will Hutton.

In confidential emails first reported by the Evening Standard, she outlined proposals for suppliers to remain privatised but be reformed as ‘social purpose’ vehicles with more stringent regulations funding and environmental concerns such as leaks.

She added, she has been in discussions with Labour – which is widely tipped to win next year’s election and are over 20 points ahead in the polls – over reforming the sector.

Business and trade committee chair and Labour MP Darren Jones declined to lend his support re-nationalisation last week, recognising that it was an “option, but not necessarily the right one.”

In his view, the problem was not the ownership model, but instead the behaviour of “the directors and the shareholders who own and operate these businesses.”

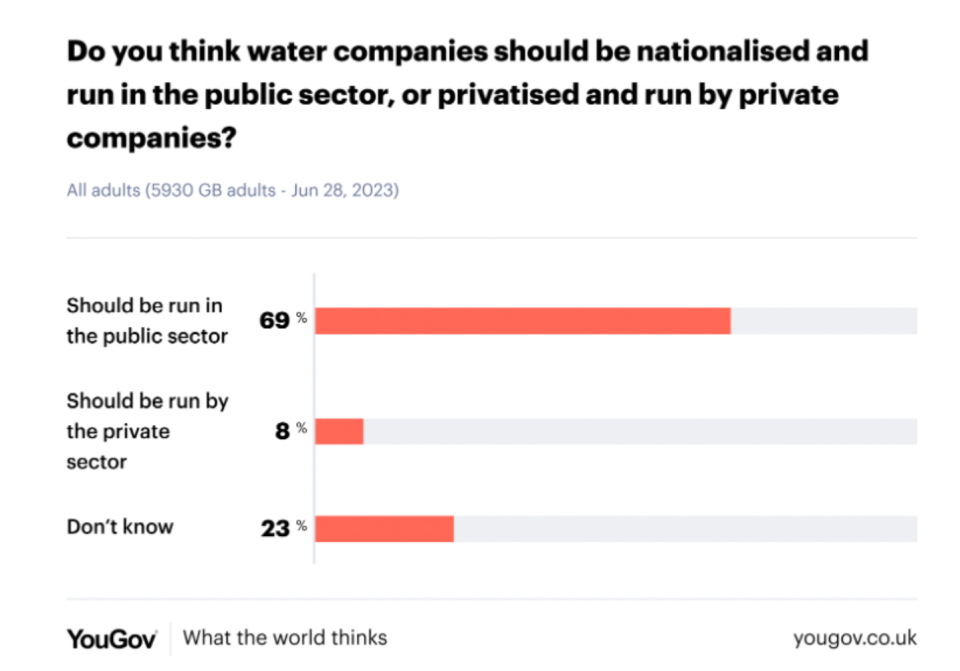

However, nationalisation is now increasingly popular with the British public, with seven in ten supporting taking water companies back into public ownership according to YouGov polling.

So far, Therese Coffey, environment secretary, has been absent from the debate, having unveiled a new industry plan for water earlier this year which included unlimited fines for sewage dumping.

Chancellor Jeremy Hunt met with Ofwat last week, with the regulator agreeing to push suppliers further help vulnerable customers.

But there is still the painful possibility of higher water bills, raising the prospect of potentially 40 per cent higher bills to tackle sewage leaks, increased demand and climate change.

Water UK has also confirmed to City A.M. that households will have to foot the bill for companies’ £10bn plans to tackle storm overflows this decades

| Chief executive – Supplier | Pay (salary, bonuses, dividends) |

| Liv Garfield – Severn Trent | £3.2m |

| Steven Mogford – United Utilities | £3.2m |

| Sarah Bentley – Thames Water* | £2m |

| Liz Barber – Yorkshire Water | £1.4m |

| Peter Simpson – Anglian Water | £1m |

Currently, 20 per cent of UK water bills each year pay dividends and interest payments, according to the Competition and Markets Authority.

This comes with executive bosses also facing criticism over pay, with Liv Garfield the highest paid chief executive in the industry.

Thames Water’s struggle for cash is likely to drag on for days and weeks, but the latest event to keep an eye on is tomorrow’s committee session in Westminster – with the House of Lord’s industry regulatory panel set to grill Ofwat’s chairman Ian Coucher and chief executive David Black over the state of the industry.

The following week, the MPs from the House of Commons’ environment, food and rural affairs committee will also grill Ofwat, alongside Thames Water and environment under-secretary Rebecca Pow.

This might give us some answers to questions over sewage leaks, company performance, customer service, and how the industry ended up with a vast debt mountain that threatens the entire sector.