Who’s making money from Covid-19 vaccines?

The distribution of Covid-19 vaccines is picking up pace globally. US President Joe Biden last month set a new target of 200 million vaccination doses to be delivered in his first 100 days in office. The original target of 100 million was achieved before his sixtieth day in office.

The speed at which drugmakers were able to discover successful vaccines, undertake the necessary clinical trials, and then bring them to market in large volumes is testament to the ingenuity and innovation within the pharmaceutical and biotechnology industries.

It shows what can be achieved when all participants – governments as well as companies – work together.

How have share prices reacted?

For investors, a key question is whether the vaccines will make money for the companies who invented them, and for their shareholders. So far, the stellar success of the vaccines from a public health point of view hasn’t been reflected in the share price performance of the companies involved.

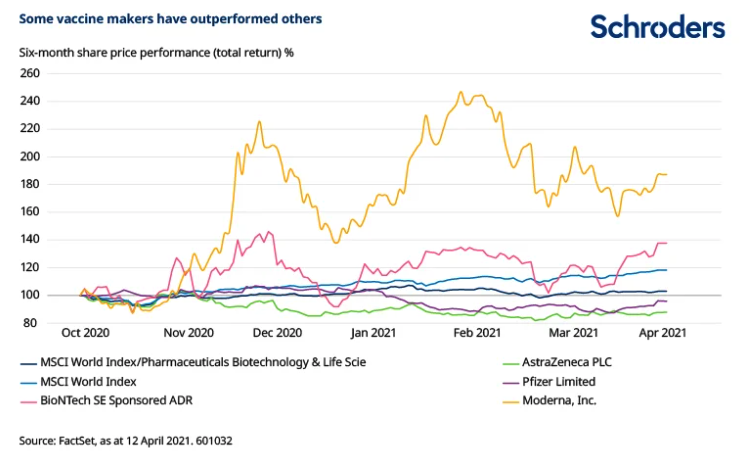

The chart below shows how Moderna enjoyed a share price spike alongside the announcement of its successful vaccine in November. BioNTech experienced a similar boost although the shares of its Covid vaccine partner Pfizer made smaller gains. Meanwhile, AstraZeneca shares have lost value over the last six months.

Supply problems and concerns over potential blood clots may have influenced these share prices moves, in addition to factors unrelated to the vaccines.

However, in part, some of the differences between the four companies’ share price performance may be down to the technology behind the vaccines.

BioNTech and Moderna are specialist biotechnology firms. The success of their vaccines vindicates the investment these firms have made in the novel mRNA technology. The value of this technology is shown by the speed at which the Covid vaccine candidates were produced, simply by using the genetic code of the virus. This mRNA technology will have many other applications aside from Covid.

One interpretation, therefore, is that the share price gains enjoyed by Moderna and BioNTech reflect the future potential of the mRNA technology, rather than the discovery of the Covid vaccines specifically.

Another consideration is that the companies behind the vaccines have the public good, rather than profits, at the forefront of their considerations.

Discover more from Schroders:

– Learn: The pros and cons behind the SPACs craze sweeping the market

– Read: Why the City must back Sunack’s vision for the stock market

– Learn: FOMO market is over – what next?

Putting the public before profits

As investors, we need to distinguish between the companies that have developed the vaccines, and those who are part of the vaccine production supply chain.

The developers – such as Pfizer, Moderna and AstraZeneca – have largely viewed this first phase of the vaccine drive as an act of public service. It’s part of the social contract such companies have: they want to show the value that an innovative biotechnology industry brings to society and to demonstrate how they can use their expertise to tackle a public health emergency like this.

AstraZeneca is the most obvious example as it is explicitly producing its vaccine on a not-for-profit basis. However, even Pfizer/BioNTech and Moderna are not charging real commercial prices for their vaccines, and so are not making substantial profits in this first wave.

This is in contrast to the companies involved in the vaccine production process. They are participating on a much more commercial level and pricing their products – glass vials, etc – accordingly. They will therefore see greater financial benefit from this current ‘emergency’ phase of the vaccine roll-out.

Pfizer and BioNTech are charging c.$39 for their two-dose vaccine in the US. AstraZeneca is charging $4.30-$10 for its two-dose vaccine.

Vaccine developers have also agreed to provide doses to COVAX at a not-for-profit price. COVAX is a global initiative to ensure low income countries have access to Covid-19 vaccines. Pfizer and BioNTech, for example, have agreed to provide 40 million doses this year to COVAX while AstraZeneca is providing at least 170 million doses.

Will investors see greater rewards?

However, the current cohort of available vaccines is unlikely to be the last. A number of Covid-19 variants have emerged and the efficacy of current vaccines needs to be tested against these.

Further variants may well emerge in future as a greater proportion of the world population is vaccinated, forcing the virus to mutate if it is to spread further. That could lead to a new phase in the production and distribution of vaccines.

Clinical trials are already starting on next generation Covid vaccines to tackle emerging variants.

Ultimately, we could see the Covid vaccines become part of the existing winter season vaccination programme. It may well be that a combined flu/Covid one-shot vaccine becomes available; companies are already working on that.

It’s that next phase when the developers like Pfizer/BioNTech and AstraZeneca will start thinking about these vaccines in more commercial terms, just as the producers of flu vaccines do. That will then provide more enduring, long-term value to these companies. And the companies in the supply chain will continue to benefit too, along with the developers.

Any company references are for illustrative purposes only and are not a recommendation to buy and/or sell, or an opinion as to the value of that company’s shares.

The article is not intended to provide, and should not be relied on, for investment advice or research.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.