Who will win the EV charger race?

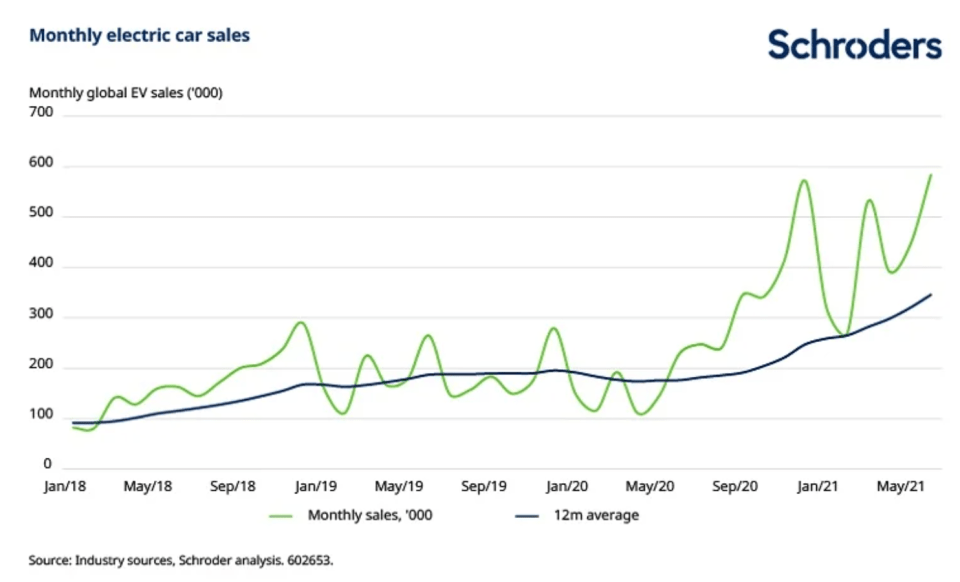

Sales of electric vehicles (EVs) have been remarkably strong recently. In the 12 months to June 2021, sales of EVs were more than 160% higher than in the same period a year earlier and were up by more than 130% in the comparable period in 2019 (according to BNEF data).

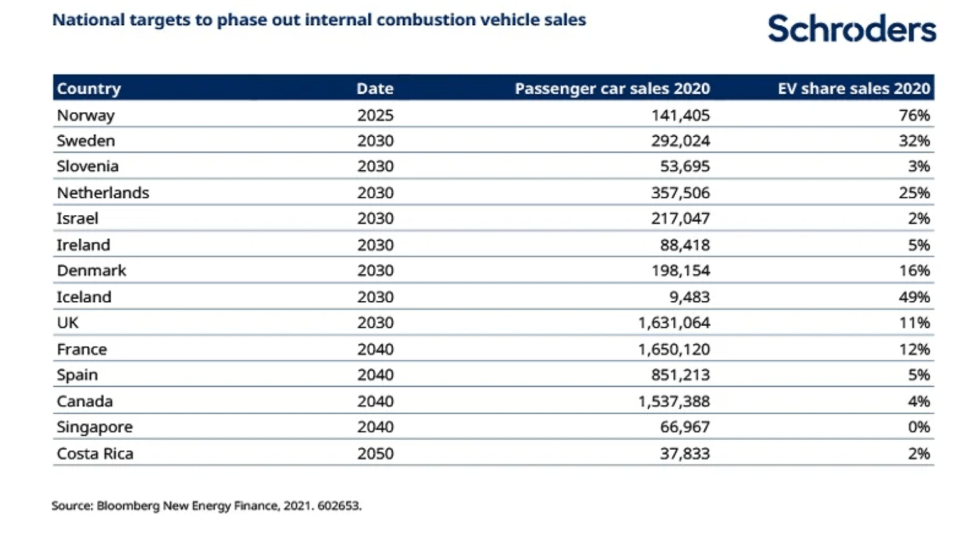

So, although the transition to EVs is truly underway, this is just the beginning and there is a lot further to go. In the UK, for example, EVs accounted for 11% of total passenger vehicle sales last year. However, that share will have to rise to 100% in fewer than nine years if the target to ban sales of new internal combustion engine (ICE) vehicles by 2030 is to be met.

On the commercial vehicle side, more and more companies are committing to ambitious decarbonisation targets, which means emissions from commercial vehicle fleets are coming under scrutiny. The 111 members of the ‘EV100’ group, which includes companies such as Tesco and Ikea, have committed to switch their fleets to EVs and/or install charging for staff and/or customers by 2030.

In addition to these policy and target tailwinds, the economics of EVs continue to improve as the industry expands. Indeed, EVs are expected to become cheaper than ICE vehicles within the next few years. This will be an important tipping point for the market which will further accelerate the transition.

How big could the EV charging market be?

According to estimates by Bloomberg, more than 300 million new EV charging ports (across residential, public, fast charging and fleet) will be required globally by 2040, up from fewer than six million today. The enormous volume of chargers required to support the shift to EVs (both passenger and commercial), means this is expected to remain a growth market until around 2035, when investment in charging infrastructure peaks.

Under Bloomberg’s more ambitious growth scenario, more than 500 million chargers would be required globally by 2040, representing almost $1.6 trillion of cumulative investment in EV charging infrastructure.

What are the opportunities and challenges?

Until recently, it has been difficult for equity investors to directly access the EV charging theme: either because the companies were private, or because small EV charging businesses were tucked away in larger, diversified companies.

However, a raft of EV charging companies have gone public in the past 12 months, often via special purpose acquisition vehicles (SPACs). Consequently, the opportunities for investors have expanded considerably.

While the proliferation of well-funded EV charging companies bodes well for the industry’s ability to support the energy transition, it also raises a pressing question from an investment perspective. With so many companies jostling for a piece of the action, will competition prevent these companies from achieving decent returns?

– Read: COP26: a quick guide to common climate terms

– Listen: Podcast: Good COP, bad COP

– Watch: The company using education to help save lives in India

What does this mean for investors?

Many of these companies may be able to continue to do well in the short term as the EV charging sector continues to expand rapidly. In the long term, however, the gap between those companies which have managed to create real customer retention (for example, through selling software subscriptions) and those whose business model is focused primarily on selling the charging hardware or electricity, may become more apparent.

Investors who remember the evolution of the solar manufacturing industry over the last 10 years will be all too familiar with the idea that a market can grow rapidly while delivering poor returns to shareholders. As investors in climate change, our role is to look beyond the eye-catching growth numbers and seek out those companies with durable long-term competitive advantages.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.