Who joins Lloyds Bank on this list of cheap UK shares to buy?

By Graeme Evans from interactive investor.

Performance of UK-exposed stocks is at an eight-year low and this is the cheapest region around.

Cheap-looking UK-focused stocks were in the spotlight as asset managers increasingly turn their attention to Europe in the face of darkening skies for global equities.

The attraction of European equities was highlighted by UBS in an update to its database charting the influence of geographic exposure on 404 MSCI Europe-listed companies. The note reiterates ‘buy’ recommendations for the likes of Lloyds Banking Group (LSE:LLOY) and Morrisons (LSE:MRW), adding that the relative performance of UK-exposed stocks is now at an eight-year low.

While Brexit uncertainty ahead of the 31 October no-deal deadline accounts for much of this value shortfall, UBS adds that eurozone-listed stocks with mainly European exposure were also attractively valued.

The assessment follows guidance earlier this month from strategists at BlackRock (NYSE:BLK) and Morgan Stanley (NYSE:MS), with the latter now bearish on global stocks through its lowest allocation to equities in five years. MS prefers European equities over US and emerging market stocks.

BlackRock has also lowered its growth outlook, but adds that the potential for softer monetary policy at the European Central Bank means it has upgraded European stocks from ‘negative’ to ‘neutral’.

In terms of finding value in Europe, the UBS report looks no further than the UK and those eurozone-listed companies with more than 35 per cent of their sales generated in the UK.

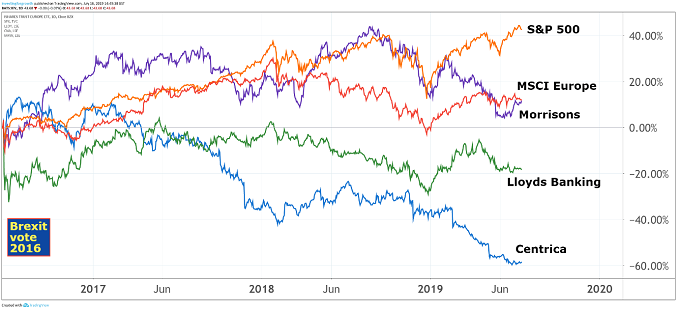

Source: TradingView Past performance is not a guide to future performance

Unsurprisingly, the UK has been the worst-performing major market in both dollar and sterling terms since the Brexit vote in 2016. Non-UK domiciled stocks with high UK sales have also underperformed, meaning UK-exposed stocks trade with a forward price/earnings (PE) multiple of 11.8x and a 4.9 per cent dividend yield that represents a 36 per cent premium to the long-run average.

With bond yields at historic lows, European dividend yields are also significantly more attractive than companies with exposure to the US and emerging markets.

UBS notes that, while earnings momentum for UK-exposed stocks has been weak, there are tentative signs that the downturn bottomed out at the end of 2018.

The broker lists 44 MSCI Europe-listed stocks with significant UK exposure, including many well-known FTSE 100 index constituents. Twenty currently attract ‘buy’ recommendations from UBS, with the price upside as high as 39 per cent in the case of Barclays (LSE:BARC).

There’s also a potential 29 per cent upside for Lloyds Banking Group (LSE:LLOY), which generates all its revenues in the UK, and 25 per cent gain for Morrisons. Among companies where less than half the revenues come from the UK, UBS has a price upside of 15 per cent for Aviva (LSE:AV.) and 25 per cent for struggling income stock Centrica (LSE:CNA).

Looking at eurozone-listed companies, UBS said that those with a domestic focus were trading at a 21 per cent PE discount compared to their international counterparts.

The broker added:

“We screen for eurozone domestic stocks that have positive earnings growth in 2019 and 2020, are cheaper than peers and have positive earnings momentum. We would highlight names such as Eiffage (EURONEXT:FGR), Vinci (EURONEXT:DG) and Allianz (XETRA:ALV).”

10 UK-exposed MSCI Europe Companies rated ‘buy’ by UBS

| Company | Share price (p) | Upside to UBS price target (%) |

|---|---|---|

| Lloyds Banking Group (LSE:LLOY) | 58 | 29 |

| MorrisonS (LSE:MRW) | 208 | 25 |

| British Land (LSE:BLND) | 537 | 38 |

| Land Securities (LSE:LAND) | 838 | 28 |

| Barratt Developments (LSE:BDEV) | 626 | 4 |

| Berkeley Group (LSE:BKG) | 3,827 | 23 |

| Persimmon (LSE:PSN) | 1,929 | 36 |

| Taylor Wimpey (LSE:TW.) | 164 | 16 |

| Royal Bank of Scotland (LSE:RBS) | 230 | 26 |

| Next (LSE:NXT) | 5,460 | 15 |

Source: UBS *Prices as of 16 July 2019

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.