Which region has suffered the most from UK’s £2.2 trillion fall in wealth?

The rise in interest rates has pushed total household wealth down across the UK, but the impact has been distributed unevenly around the country.

A new report from the Resolution Foundation has found that household wealth has fallen by £2.2 trillion since 2021 as higher rates impact house prices and pension valuations. Housing and pensions make up nearly 80 per cent of total household wealth, the think tank noted.

This means that the decades-long wealth boom, supercharged by the era of super-low interest rates over the 2010s, has been brought to an end. Total household wealth has fallen from 840 per cent of GDP in 2021 to around 630 per cent in early 2023.

However, London and the south and east of England have seen a smaller impact than Scotland, Wales and the north of England.

This is because more wealth is locked up in house prices in London, which have been impacted less by rising interest rates than the assets underlying pension funds, such as government bonds. The report noted that falling pension valuations has not translated into lower incomes for pensioners.

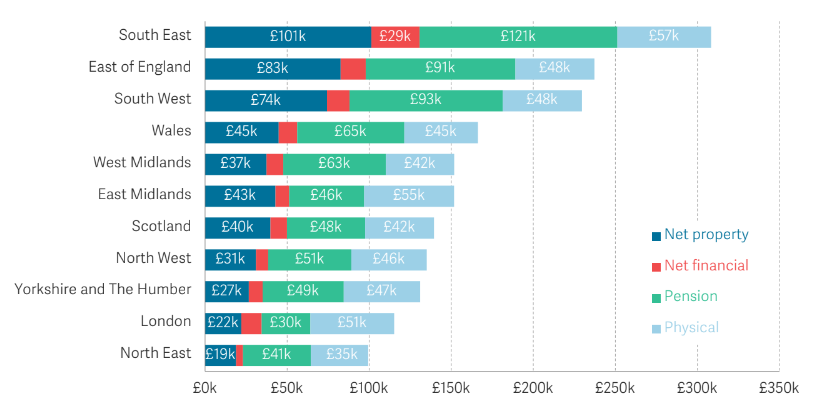

Wealth holdings vary significantly by nation and region. Source: Resolution Foundation.

While total household wealth has fallen 17 per cent in London and 19 per cent in the south and east of England since the start of 2022, it has dropped 26 per cent in Scotland.

Further falls in house prices, driven by higher-for-longer interest rates, would level out some of the regional disparities, the report noted. However, it could also put some households into negative equity.

Householders are more likely to fall into negative equity when their mortgage balance is higher than the value of their home. Over a quarter of mortgaged households in the north east have loan-to-value ratios of 75 per cent, compared to just seven per cent in London and the south east.

“High levels of fluctuation in Britain’s total household wealth and in varied regional wealth patterns bring home the need for fairer, more effective wealth taxation across the country,” the Resolution Foundation said.

Ian Mulheirn, research associate at the Resolution Foundation, said: “These regional disparities again highlight the need for a range of reforms to insulate households against wealth volatility that transfers resources between generations based on luck.

“Fairer and more effective taxation of wealth is a critical part of that agenda – with Britain’s biggest wealth tax, Council Tax, in particular need of reform to make it more fairly targeted and less regressive,” he added.