Which equity sectors can combat higher inflation?

Some investors are worried that inflation is set to rise. We look at which equity sectors could prove to be the most resilient.

The sharp rise in bond yields over recent weeks has rattled equity markets amid fears that fiscal stimulus and a post-pandemic spending splurge could stoke higher inflation.

Five-year inflation expectations, as measured by the yield difference between nominal and inflation-protected US Treasury bonds, have rebounded sharply from their pandemic lows and are now at 2.5% – their highest level since 2008.

Moderate inflation is generally good for equities because it tends to be associated with positive economic growth, rising profits, and stock price gains.

However, things can quickly turn ugly for stock market investors if the economy overheats and inflation rises too high.

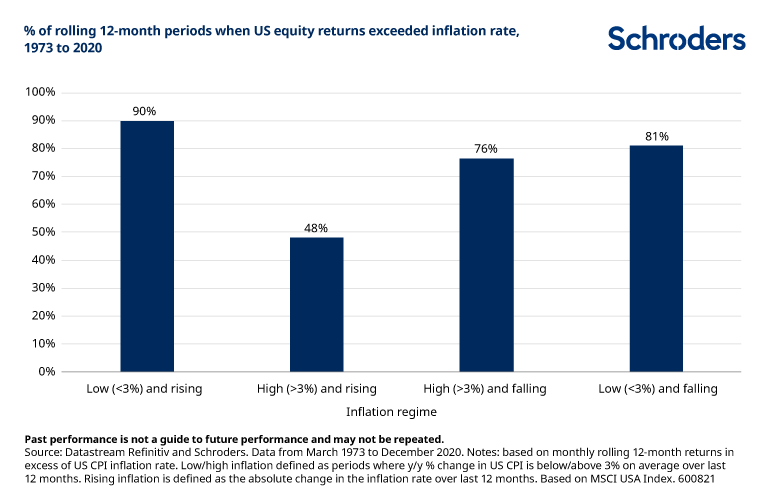

Our research has found that equities outperformed inflation 90% of the time when inflation has been low (below 3% on average) and rising – this is where we are today.

But when inflation was high (above 3% on average) and rising, equities fared no better than a coin toss, as shown in the chart below.

Fortunately, not all sectors are equally affected and some may prove more resilient than others if inflation takes off.

Discover more from Schroders:

– Learn: What 175 years of data tell us about house price affordability in the UK

– Read: How investors can access the UK’s industrial recovery

– Watch: The telecoms business which pioneered a payment system lifting thousands out of poverty

What is the relationship between equity prices and inflation?

In theory, equities should offer a buffer against inflation because a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices.

On the other hand, this may be offset by a contraction in profit margins given an increase in companies’ input costs.

In practice, the impact of inflation on earnings will vary by economic sector and its ability to pass on higher input costs to end consumers.

But as long as input costs do not increase at the same rate as revenues, the rise in profit margins should translate into greater nominal earnings.

The problem is that the market will often discount those future cash flows at a higher interest rate when inflation rises, to compensate for the fact they are worth less in today’s money.

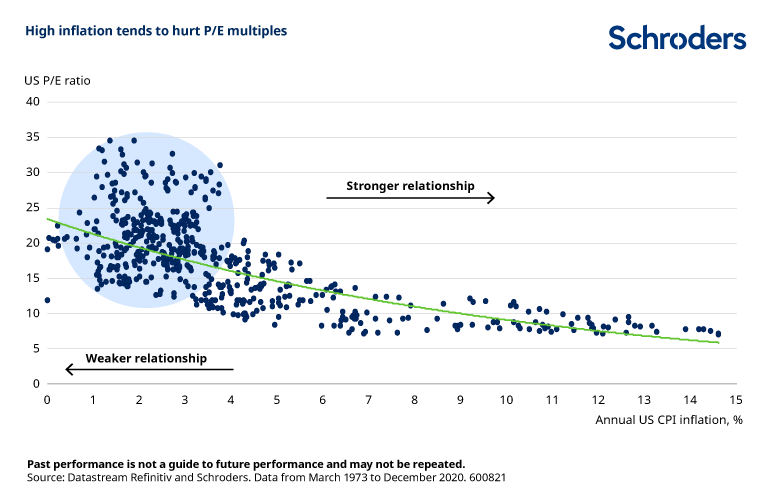

All else being equal, the higher the level of inflation, the greater the discount rate applied to earnings and therefore the lower the price-to-earnings (P/E) ratio investors are prepared to pay (see next chart).

Note, however, that the relationship is more ambiguous at low levels of inflation (e.g. below 3%), where other factors may be driving valuations.

Which equity sectors may offer shelter against rising inflation?

An inflation hedge is an investment that provides protection against price increases. So how often do different equity sectors achieve this and how large is that protection?

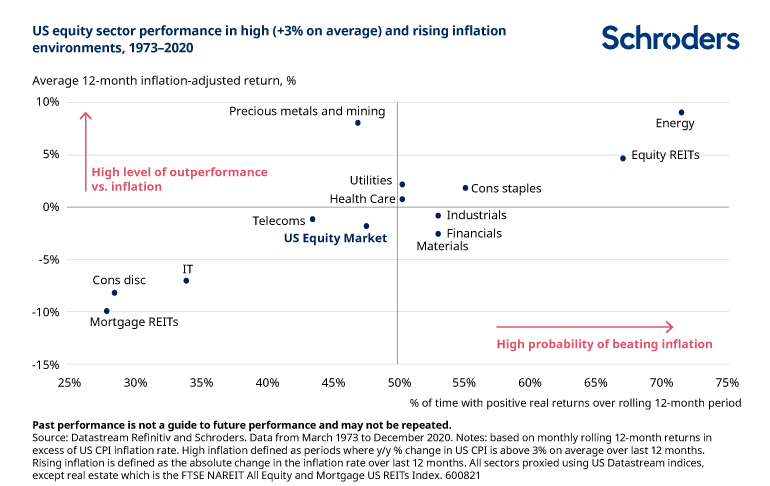

That’s illustrated in the following chart. The x-axis shows the percentage of rolling 12-month periods since 1973 when equity returns exceeded inflation in high and rising inflation environments – a measure of how consistently each sector has beaten inflation in these environments.

The y-axis shows the real (inflation-adjusted) return achieved during those periods – a measure of how much they have beaten inflation by, on average, in these environments.

Although equities in general perform quite poorly in high and rising inflation environments, there are potential areas to seek refuge at the sector level.

The energy sector, which includes oil and gas companies, is one of them. Such firms beat inflation 71% of the time and delivered an annual real return of 9.0% per year on average.

This is a fairly intuitive result. The revenues of energy stocks are naturally tied to energy prices, a key component of inflation indices. So by definition they will perform well when inflation rises.

Equity REITs (real estate investment trusts) may also provide protection. They outperformed inflation 67% of the time and posted an average real return of 4.7%.

This makes sense too. Equity REITs own real estate assets and provide a partial inflation hedge via the pass-through of price increases in rental contracts and property prices.

In contrast, mortgage REITs, which invest in mortgages, are among the worst performing sectors. Just like bonds, their coupon payments become less valuable as inflation increases, sending their yields higher and prices lower to compensate.

The same thing is true of the promised future growth in profits for IT stocks. The bulk of their cash flows are expected to arrive in the distant future, which will be worth far less in today’s money when inflation increases.

Financials, on the other hand, perform comparatively better, as their cash flows tend to be concentrated in the shorter term.

But high inflation can still be harmful, especially for banks, because it erodes the present value of existing loans that will be paid back in the future.

Utility stocks display a somewhat disappointing success rate of 50%. As natural monopolies, they should able to pass on cost increases to consumers to maintain profit margins. However, in practice, regulation often prevents them from fully doing so.

What’s more, given the stable nature of their business and dividend payments, utility stocks are often traded as “bond proxies,” meaning they might be bid down relative to other sectors when inflation takes off (and bond prices fall).

Meanwhile, although gold is often touted as a hedge against currency debasement fears, the track record for companies in the precious metals and mining sector is mixed.

On average, such firms posted an average real return of 8.0% in high and rising inflation environments. But the likelihood of this happening was akin to a coin toss – they beat inflation only 47% of the time, considerably less than many other sectors.

In summary, if inflation does pick up at some point, equity prices could react unfavourably, but some sectors may absorb the impact better and others are even poised to benefit.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.