When will the Bank of England, Federal Reserve and ECB start cutting interest rates? Sooner than you think

Central banks around the world this year are going to take their lead from an unlikely source: the Bank of Canada.

While being the central bank of a G7 country, it’s not exactly the biggest of players in the global monetary policy and financial network.

Tiff Macklem, the BoC’s chief, has led one of the most aggressive campaigns against inflation over the last year or so. Under his stewardship, borrowing costs in Canada have risen rapidly, powered by a one-off whole percentage point rise.

Neither the Bank of England, US Federal Reserve or European Central Bank (ECB) can say they’ve done that.

Last week, Macklem nudged rates 25 basis points higher. But the statement, alongside the decision, was prophetic of what is to come from other rate setting institutions this year.

The BoC said it now intends to “hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases”.

Forward guidance is back.

After central banks last year killed it off due to rapidly changing economic conditions, it’s back in vogue as a tool to deliver monetary policy objectives.

The BoC’s statement is an explicit shot at markets to hold fire and not expect more tightening any time soon. Basically, its intention is to shape expectations in financial markets, exactly what forward guidance is designed to do.

Jerome Powell, Andrew Bailey and Christine Lagarde, you’ve been warned.

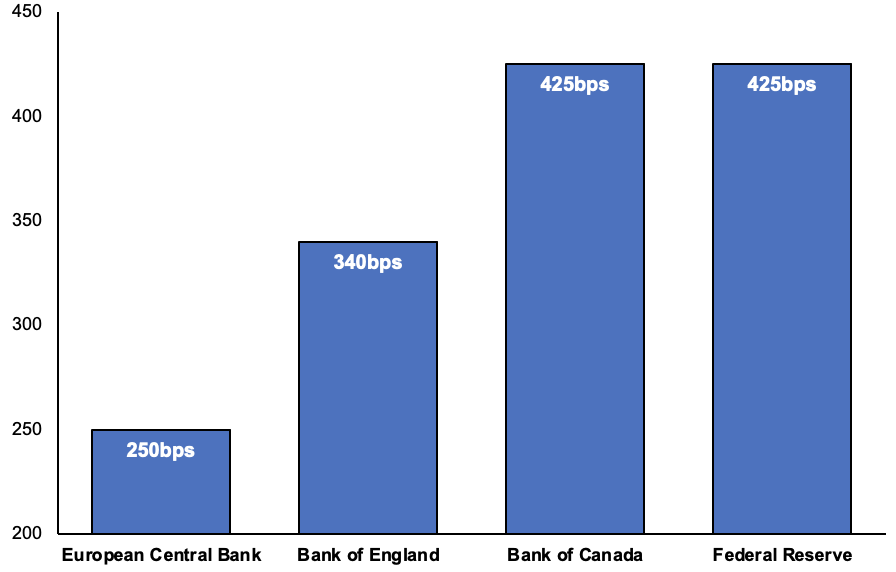

Central banks’ cumulative tightening cycles

It’s not going to be this week. All three leaders and their respective rate setting teams will hike, probably 25 basis points from the Fed on Wednesday and 50 basis points from the ECB and Bank on Thursday.

The ECB’s hiking cycle has a lot more legs due to it trailing the Fed and Bank. Financial markets also need jolting out of a psyche of expecting a free lunch after years of negative interest rates in the eurozone.

So why are central banks going to ease off the brake?

Businesses are being crushed by struggling to find affordable credit. That’s chilled activity, raising the risk of unemployment rising.

Incentives for households to save are now much stronger. Coupled with rock bottom confidence and worries about being laid off, consumers are stockpiling funds for a rainy day.

As a result, the UK and eurozone (not so much the US) economies are wilting. A slowdown in spending will put extra downward pressure on prices.

Monetary policy operates with a lag, so it would be counter-intuitive to keep raising rates so aggressively when doing so is likely to push inflation below central banks’ two per cent target.

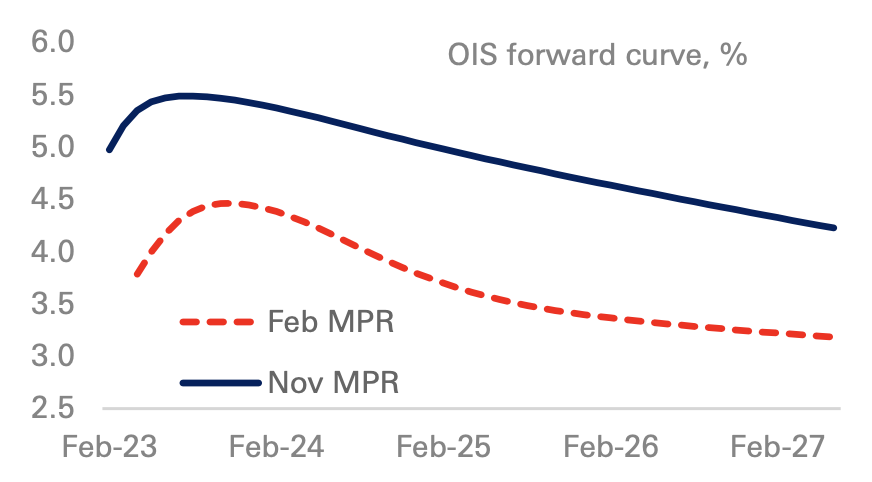

In fact, the Bank even hinted it agreed with that argument in November, forecasting inflation would fall below its two per cent target in the middle of next year if it sent rates above five per cent – what markets expected at that time.

UK market expectations have scaled down

Central banks essentially want to push inflation down without tipping their respective economies into a recession, achieving the so-called “soft landing”.

Their repeat jumbo hikes aren’t likely to fully filter through the economy for a few months yet. Inflation is already on a downward spiral and tightening more now risks overdoing it.

That argument probably holds less sway in the corridors of the ECB’s Frankfurt office, but eventually heads will start turning, maybe in the second half of the year.

So, yes, rate hikes from the three big players this week. Pain for mortgagors, joy for savers.

But the moves will take the Fed, BoE and ECB all a step closer to the end of their respective tightening cycles.

In fact, the first set of rate cuts could come as soon as Christmas this year.

HUNT’S BOOSTERISM

Chancellor Jeremy Hunt’s speech at Bloomberg HQ last Friday had a whiff of hastiness about it.

Most of what he covered had already been announced. He devoted a large chunk of time to reinforcing the government’s commitment to halving inflation, getting debt down, blah, blah, blah, I forget.

In terms of policy, there was none. It felt as if the government just had to say something positive about the economy to avoid getting all the blame for the coming recession. There’s certainly a lot to be optimistic about.

A proper roadmap toward growth has to come sooner rather than later. Chop chop.

WHAT I’M READING

Investors’ concerns have shifted from super high inflation to the world’s richest economies stumbling over growth, according to this month’s Top of Mind report by investment bank Goldman Sachs. Bond markets have been rallying hard over the last three months or so, indicating markets think central banks will have to cut rates to lift their respective economies out of recession. Big risk to growth this year are commodity shortages caused by China’s economic reopening, Goldman suspects.

YOU MIGHT HAVE MISSED

Income inequality in the UK is ratcheting up. During the cost of living crisis, the richest households bagged a £1,000 income increase, while the poorest actually lost around £600. That has raised the country’s gini coefficient, a measure of gaps between incomes in a country.