What’s on the Horizon for EMEA M&A in 2024?

One of the pressing questions for dealmakers is, will M&A bounce back in 2024? While few expected to see the heady highs of 2021 in EMEA in 2023, there was a persistent optimism that the year would produce some good numbers. Unfortunately, that hasn’t happened: at Q3, the region saw deal volumes and values significantly decline both qoq and yoy per Mergermarket data.

So, what does this mean for 2024? Will there be a turnaround? If so, when? And why?

Optimism abounds

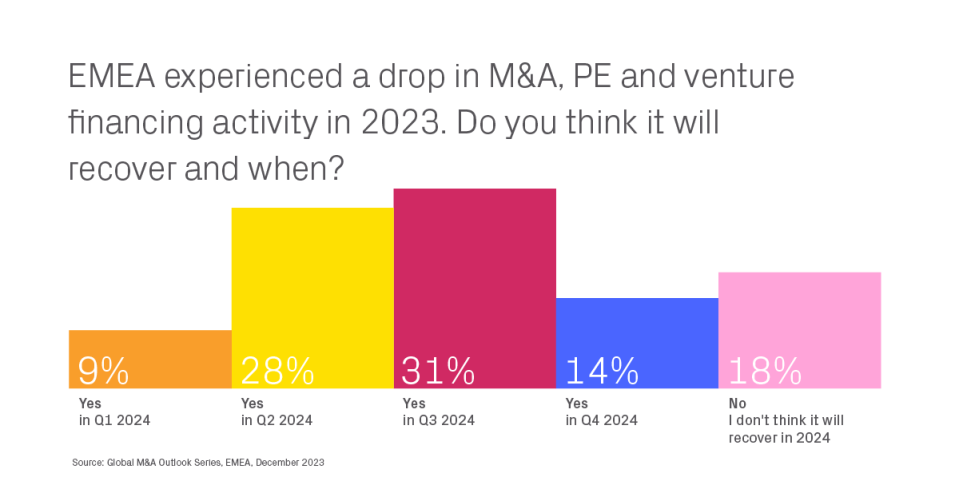

The optimism from this year hasn’t abated. If anything, the belief that EMEA will see a rebound in M&A in 2024 seems more solid than ever, according to a panel of experts and listeners at Datasite’s recent webinar on the challenges and trends that will shape M&A in EMEA in 2024.

And dealmakers believes that a recovery could happen in Q3 or even Q2. But it’s not just a gut feeling. There’s data to support this view. Datasite, which facilitates over 14,000 M&A transactions a year on its platform, has seen over 1,500 new projects start in the last three months in EMEA, which are expected to close in the next six to nine months.

So, why is there finally some light on the horizon? Inflation for one. It has broadly stabilized in EMEA and elsewhere. Which means valuations are easier. Which in turn makes people more comfortable with doing deals. And that adjustment to some stability or resetting of expectations shouldn’t be underestimated when it comes to getting deals done.

About Datasite

Datasite is a leading SaaS provider for the M&A industry, empowering dealmakers around the world with the tools they need to succeed across the entire deal lifecycle. For more information, visit www.datasite.com.