What will Narendra Modi’s election win mean for the Indian economy?

Widely touted as the pro-growth option in India's most recent election, newly crowned winner Narendra Modi has been celebrated by investors.

Indian stocks have jumped on what appears to be a landslide victory, with the BSE Sensex pushing to record highs this morning as it became apparent that the man touted as India's most business friendly candidate seemed guaranteed a win.

Perception of Modi as being pro-business or pro-market doesn't necessarily marry up with his record as chief minister of Gujarat. He lucked out by taking over an already strong state, with a relatively young population.

This time Modi may not be so fortunate. Weathermen forecast a one-in-two chance of monsoon rainfall being more than five per cent below normal this year. "The last three times that happened agriculture growth in India averaged zero", Deutsche Bank analysts note.

Second order effects can be expected. While agriculture represents only 15 per cent of output, between 25-50 per cent of cars and two-wheelers are sold in rural areas, and estimates for the impact of a poor monsoon range from 0.5-1.75 percentage points off output and up to two percentage points on inflation.

If Modi wants to help the Indian economy, finding a way to make it rain would seem to be a sure success.

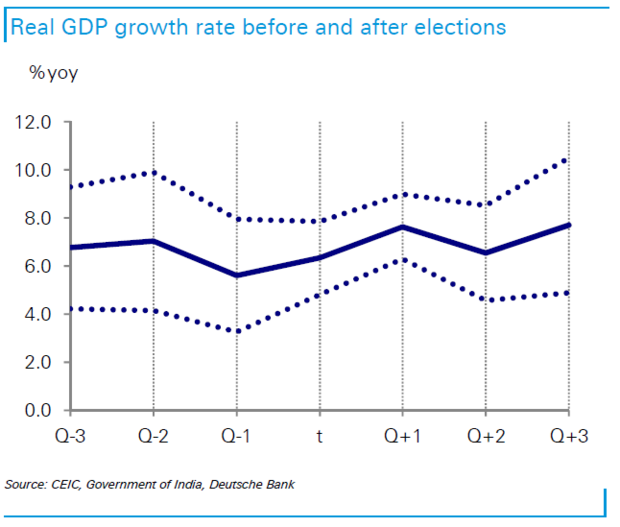

A separate report by Deutsche Bank analysts takes a look at historic Lok Sabha elections, which determine who sits in the Indian parliament's lower house.

They find that over the last two decades GDP growth has picked up gradually after each, on average increasing by one per cent within three quarters. Inflation and the rupee also tend to appreciate, with the currency rising by three per cent on average within three quarters of the last election. Foreign institutional inflows also tend to pick up robustly.

As such, Deutsche's analysts see some room for "enhanced performance of the economy in the coming quarters", but that merely assumes historical trends play out. For now, India's economic has "faltered markedly", as growth momentum has slowed, investment spending has collapsed, and high inflation has required the introduction of tight monetary policy.

"The ongoing market rally reflects simply expectations of a better tomorrow than a reaction to any meaningful change in economic performance in recent quarters," say Deutsche Bank analysts, who see real GDP growth of 5.5 per cent in 2015. And while Modi may enjoy some of these effects, "a sobering fiscal reality awaits".

"Stagnant revenues and sticky expenditures will make the job of further consolidation difficult." Despite a few years of decline in the Indian debt to GDP ratio, the road to further consolidation remains challenging, and sensitivity to shocks is now considerably higher.