What investors are looking for in today’s US jobs report

Investors are hooked on this afternoon's US jobs market report.

We've got the critical nonfarm payrolls (NFP) number coming up, and analysts expect to see that 215,000 jobs were created this April.

If that happens, it'll be the strongest month for the US labour market since November, the month before the country saw a period of terrible weather begin.

The headline unemployment rate is also expected to slip a notch, down from 6.7 per cent to 6.6 per cent. That would be the lowest it's been since December 2008.

If figures come in line with expectations or stronger, then the data may provide signs that the US will see a strong rebound from almost no growth in the first quarter of 2014.

Other indicators suggest that we should see a healthy print today, as payroll-processors ADP saw 220,000 new private payrolls in April, and March's ADP figure has been bumped up from 191,000 to 209,000 after revisions.

Similarly, the employment component of the ISM manufacturing survey rose from 51.1 to 54.7 in April, signalling faster job growth in the sector. Mads Koefoed, head of macro strategy at Saxo Bank, says there are signs of a normalisation "following many months of weather-distorted reports."

Even the lowest estimate given by surveyed analysts – of 155,000 additions – is still above the average rate of job creation in the US this year. IG's Brenda Kelly says that "today's number needs to be fairly strong to keep the upward momentum going in stock markets after four consecutive days of gains."

Investors may also be keeping an eye out on earnings data, after Federal Reserve chair Janet Yellen signalled that she was looking at wage growth as an important labour market indicator.

Cats vs Dogs

After a disappointing performance from feline analyst Geoffrey Boycat last month – he refused to make an NFP guess at all – we're switching things up.

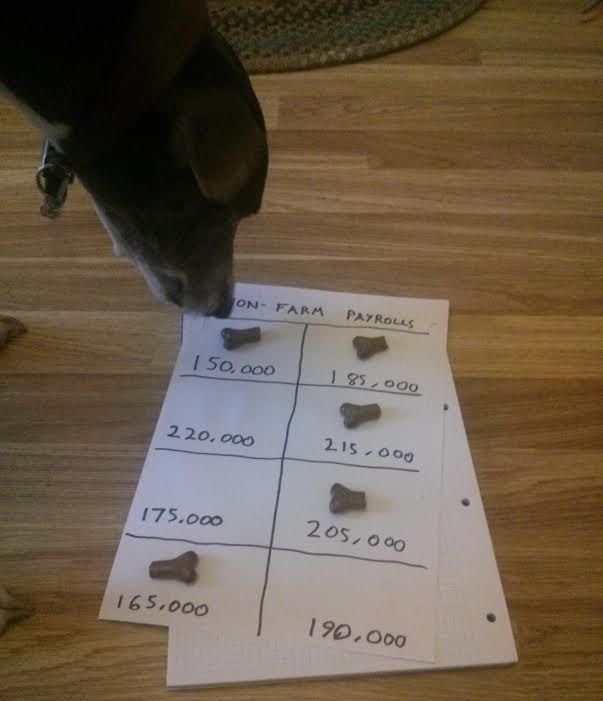

We'll be using longdog Blue to guess the monthly NFP figure. Blue is five years old (35 in dog years), and belongs to our economics reporter, Mike Bird.

He's gone for a bearish 190,000 this month, well under analyst expectations. Clearly his confidence hasn't been boosted much by those other surveys.

While this is our first estimate from a canine analyst, the feline analysts have so far gone 2-1 in beating the consensus forecast. Can Blue do better?

After making his call, Blue went straight for 220,000, then all the other options available to him. Forecasting is hard work.

Update: Blue was far too bearish, as NFP smashed expectations. The release saw a print of 288,000 jobs added this April.