Interest rate rise by the Bank of England is the “greatest risk” to house prices

House price growth for this year is on track to hit double-digit figures in a number of cities across Britain – providing the Bank of England doesn't hike interest rates anytime soon.

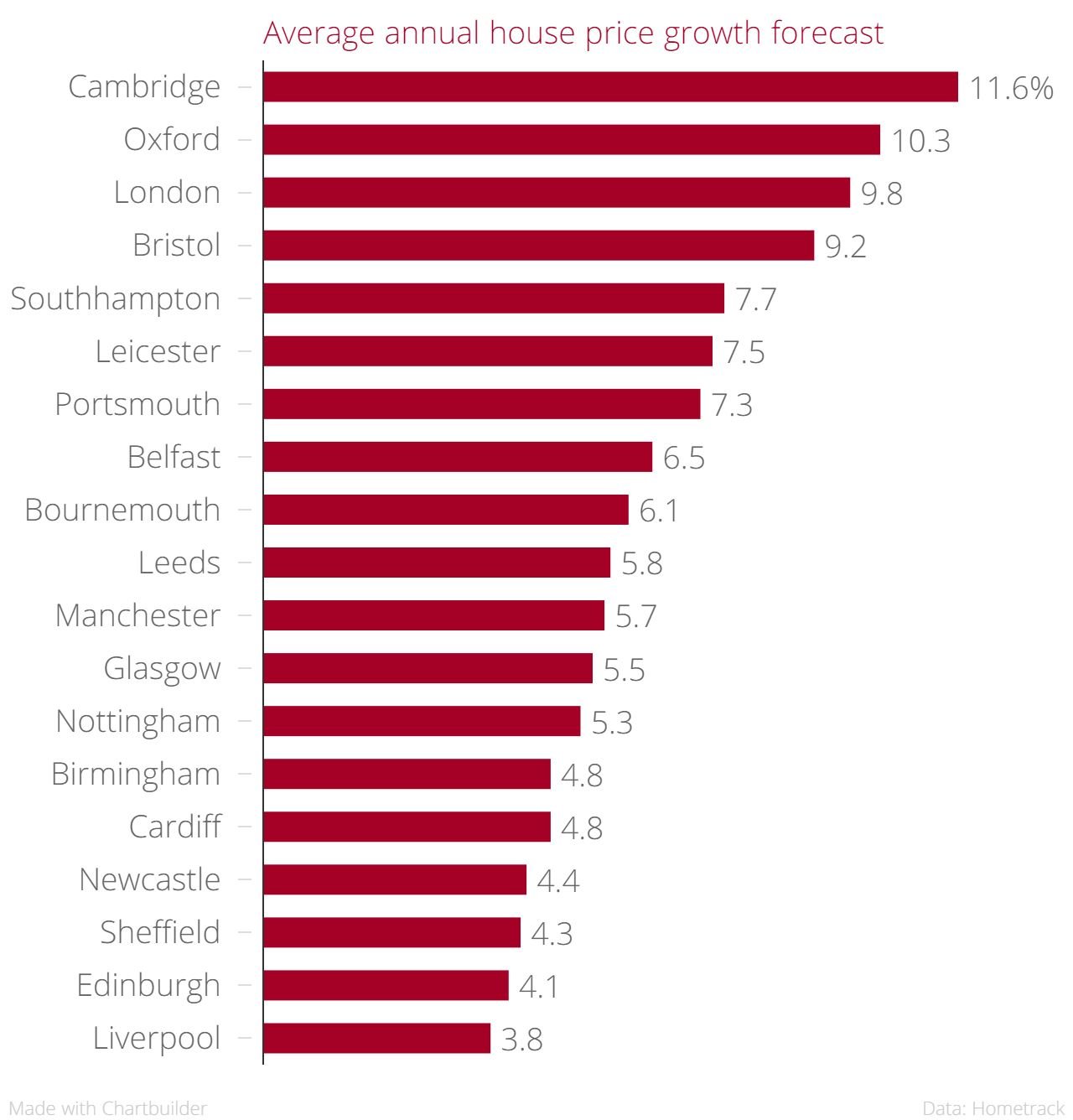

House prices in the 20 cities monitored by Hometrack's cities house price index rose 6.3 per cent in the first half of 2015, and look set to surpass 10 per cent by the end of the year. Cambridge, Oxford and London will lead the charge, with house prices expected to rise 11.6 per cent, 10.3 per cent and 9.8 per cent respectively.

Read more: The Bank of England could – and should– have raised UK interest rates much sooner

However, the biggest risk currently facing the housing market is an interest rate rise by the Bank of England. Governor Mark Carney recently warned that the rate decision will "come into sharper relief around the turn of this year" and the last minutes from the monetary policy committee's meeting showed pressure is building.

This would hit housing market sentiment because the majority of homeowners have variable rate mortgages, and have been paying off debts while interest rates have been low. A rate hike would make mortgage repayments more expensive, curb demand and lead to a "marked slow down in the rate of house price growth".

"The greatest risk on the horizon is an increase in interest rates, recently highlighted by the Bank of England governor. [Some] 57 per cent of outstanding mortgage debt is on variables rates which is lower than the 73 per cent high registered in mid-2012," it said.

Read more: The Bank of England should cut interest rates

"While a year’s worth of new buyers have been subject to tougher affordability tests, the majority of mortgagees have not."

"Many homeowners have continued to pay off debt while rates have been low, [but] any increase in mortgage rates is likely to impact market sentiment which given the shortage of supply would result in a marked slowdown in the rate of house price growth."