What impact will Russia’s invasion of Ukraine have on oil and gas?

Russia’s invasion of Ukraine is first and foremost a human tragedy. As investors though, our role is to interpret the market implications on behalf of our clients. Here, we consider the impact of the invasion on oil and gas markets.

Firstly, it’s important to understand how markets stood before the invasion. Global energy markets were already tight. Years of underinvestment, coupled with incredibly strong demand, meant that oil and product inventories were in deficit, and gas inventories were in a significant deficit.

There is no quick fix. Fossil fuels still account for 85% of the global energy mix. Hydro and nuclear account for a further 11% while wind and solar account for just 4%.

The recent increases in both natural gas and oil prices resulted in primary energy costs as a percentage of GDP reaching almost 8% in February. This is the highest monthly share of GDP in nearly a decade.

The rise is especially acute given that monthly energy costs were at just 2% of GDP in April 2020 – a multi-decade low. The recent increase in fossil fuel prices is the fastest since the late 1970s. In the past, a rapid increase in energy costs like this has triggered recessions.

No sanctions on oil and gas flows so far

Analysing the impact of the ongoing Ukraine crisis on energy markets is made more complex by the fluid situation around the exact nature of sanctions.

Currently, sanctions have been placed on individuals and major Russian financial institutions, but sanctions on the flow of energy (oil and gas) from Russia have been explicitly avoided.

The rapid escalation of Western sanctions will reduce European demand for Russian oil and oil products, even though sanctions are not designed to directly target Russian energy flows. However, this demand loss in Europe will be offset by increased demand in China. In the short term, natural gas flows should prove resilient unless the infrastructure used to transport the gas sustains damage in the conflict.

Western policymakers are reluctant to disrupt Russian energy flows, but there is increasing tension between this goal and the significant pressure to ramp up sanctions as the situation in Ukraine worsens.

We still expect Russian supplies to remain available to the market. However, a growing number of European and US buyers may decide to avoid these to reduce legal and reputational risk.

Limited immediate impact on supply

Russia exports 5.5 million barrels per day (m bpd) of crude oil, of which more than 3.5m bpd directly flows to Europe, with the rest going mostly to Asia. In addition, around 1.2m bpd of refined oil products are exported to Europe.

Of the 3.5m bpd flows to Europe, 1m bpd comes via the Druzhba pipeline and is dealt with by long-term contracts. We do not expect to see these exports being disrupted unless Russia decides to turn off the taps.

The seaborne market is where the trade flow shifts will occur. At least half of the waterborne flows to Europe can be redirected to China and India quite easily.

Despite some exported gas going through Ukraine, we expect gas flows to face the least disruption.

If sanctions were extended then there is some flexibility on oil. Russian oil imports to Europe could be replaced by imports from other countries. However, we were already forecasting a deficit in oil markets this year of 0.5m bpd. If sanctions result in Russia not being able to export 1-1.5m bpd then the 2022 oil market deficit could be significantly larger.

And there will be longer-term consequences for the Russian oil and gas sector. Western investment and financing are likely to dry up, as demonstrated by BP abandoning its stake in Rosneft. Buyers dependent on Russian oil and gas will be significantly reducing this exposure over the next few months and years.

Discover more by visiting Schroders’ insights or click the links below:

– Follow: Live blog: what does Russia’s invasion of Ukraine mean for markets

– Listen: Russian sanctions and what might happen if Russia turns off the taps

– Watch: Why now’s not the time to be making big bets

Global gas markets remain constrained

The global gas market is extremely tight currently. Unless demand falls this will remain the case for the next few years, as major new gas projects will not have any impact on supply until 2024 at the earliest.

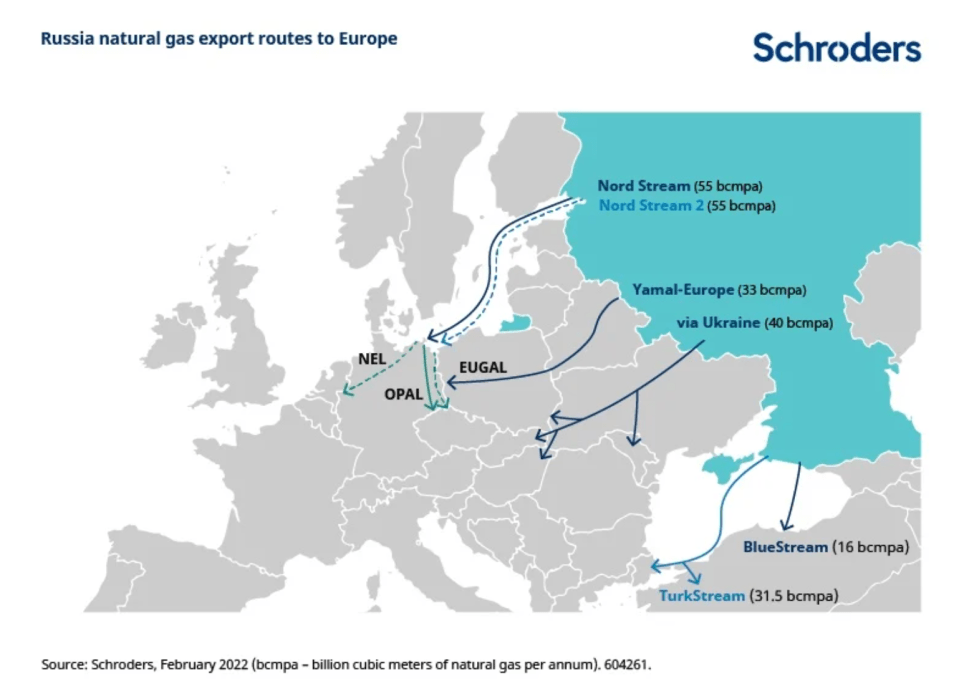

In Europe, Russian gas makes up around 35% of all gas imports, coming traditionally from four pipelines (Nord Stream, Yamal-Europe, Ukraine pipeline and Turk Stream).

A new pipeline (Nord Stream 2) has been built which was meant to bring additional gas supply to Europe from Russia but Germany has halted the approval process due to the events in Ukraine.

The flows through the Ukrainian pipeline have been declining over the last two years from 90 bcm per annum to around 40 bcm per annum, partly as a result of Russia redirecting gas through alternative routes and partly to meet its own rising demand trends.

This means that, even assuming no further sanctions, the flow of gas from Russia to Europe is still likely to be constrained in the event of a protracted war in Ukraine.

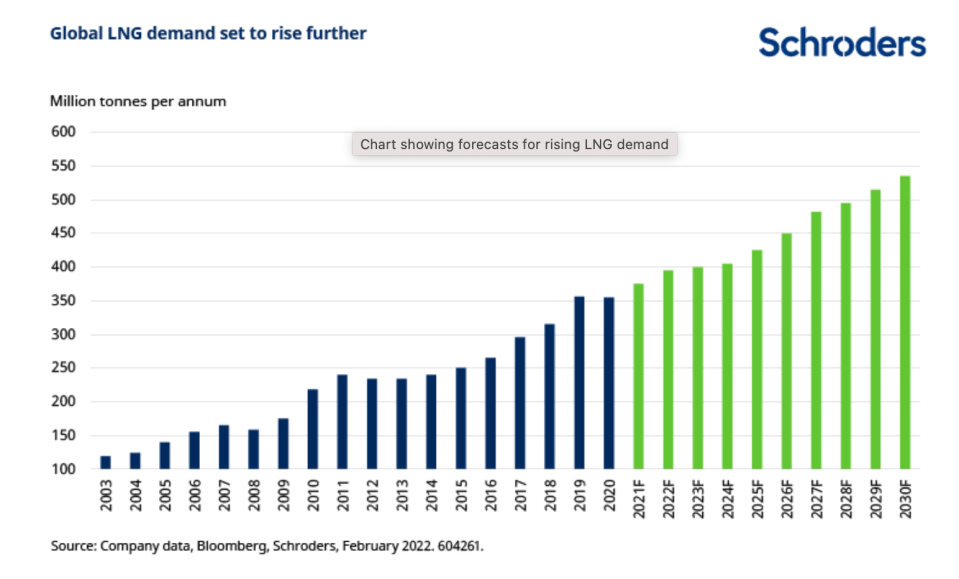

Global demand for LNG is rising

Over the last six years, Europe has attempted to reduce its dependency on Russian gas by significantly increasing its LNG (liquefied natural gas) import regasification capacity. As much as Europe is reliant on natural gas from Russia, it is now very reliant on imported LNG volumes to meet its energy needs.

But Europe is not alone in seeking LNG imports. As developed countries have been scaling back and shutting down their coal-fired power generation, they are using combined cycle gas turbine capacity (CCGT) to meet energy demand.

Emerging markets such as China and India are still building out their CCGT capacity in parallel with their massive expansion of renewable generation capacity.

Even though we expect the wind power market to grow by at least 150% over the next decade and the solar market by at least 200%, this does not imply that demand for gas falls over the same period.

Given the need to shut down a considerable amount of coal production, natural gas demand is likely to increase at around 4% per annum over the next decade to help fill the power generation gap.

The recent unprecedented tightness in global gas markets is a direct result of underinvestment, compounded by strong demand trends. The lack of investment and cancellations of large scale gas projects was firstly due to the collapse in regional prices in 2018/2019, and then the impact of Covid-19 in 2020.

What could bring prices down?

As we’ve already said, there is no near-term easy fix in terms of energy prices.

On the gas front, over the next few years, the US has the potential to emerge as a significant exporter of natural gas given its resources base in the Appalachians and Permian regions. Much of this is likely to feed into European markets.

For oil, a notable feature of this crisis so far has been silence from OPEC (the Organization of Petroleum-Exporting Countries). Spare capacity within OPEC is limited but Iran remains a wildcard.

Talks in Vienna are ongoing to restore the 2015 Iran nuclear deal, which would allow Iran to sell oil on the international market. We expect a deal to be approved over the next few weeks. If it is, the supply response could be quite quick (two to three months) as Iran has around 105 million barrels of crude and condensate in storage. This would provide some near-term relief to oil market prices.

Secondly, from Q4 2022 onwards we are entering a period where a few non-OPEC and OPEC projects are starting up. This may also provide some relief to crude markets towards the end of the year.

Another possibility is that, with oil and gas prices already elevated, any further rises could lead to recession and a more pronounced fall in demand.

To conclude, we have two core take-aways:

- There is no quick fix for European gas and electricity markets without demand destruction. Further investment in global gas markets will be needed over the next few years in order to diversify supply away from Russia, while at the same time causing the least disruption to industrial and residential users of energy. Because of the need to reduce coal-fired generation, natural gas still has to be used as a bridging fuel for the energy transition. Long-term security of supply has become ever more important.

- The events in Ukraine will only speed up the energy transition. Energy independence through cheap and sustainable power will be at forefront of every policymaker’s decision-making process from now on.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.