What does value investing have in common with Forrest Gump?

Gump is rewarded for his determination and resilience in the face of vicious storms in the 1994 film “Forrest Gump”. We believe returns could be bountiful for the genuinely long-term and patient value investor too.

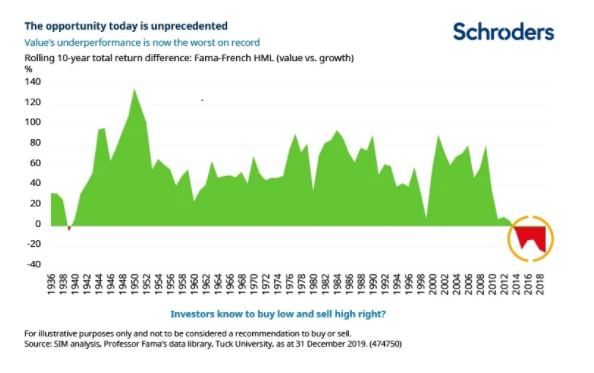

When I look at a chart like this, I think one of two things. Either it’s different this time for some reason or this is the buying opportunity of a generation, relative to other equity investments investors can make right now.

Is value investing obsolete?

I don’t believe value investing has become obsolete. As a style of investing, value isn’t fundamentally broken; it’s a human phenomenon that hasn’t changed. Value investing is still about constantly exploiting the irrational behaviour of emotional investors; being brave when investors are fearful and wary when they are ebullient.

When I look in the markets or read the news, I see humans behaving like humans everywhere. I don’t think we’ve become radically more rational or less emotional.

So if humans haven’t changed and value investing is still relevant, is this the buying opportunity of a generation?

Value stocks are as beaten up as they’ve been in nearly 100 years; investors have fled to what they perceive as to be the safe harbour in the current value storm: growth stocks.

Discover more:

- Learn: Why digital infrastructure could emerge stronger from Covid-19

- Read: Investors crave knowledge – but where do they find it?

- Watch: Is Big Tech under threat?

Where is best to invest in a storm?

But what if the port is the worst place to be? What if it’s better to be bobbing out at sea with a bit of volatility rather than risk being hammered against the harbour walls during the storm?

Look at what happened to Forrest Gump and Lieutenant Dan in the award-winning 1994 film “Forrest Gump” starring Tom Hanks. The duo join the shrimping industry with Gump’s newly-purchased shrimp boat. But the competition is tough and their endeavours are highly unsuccessful; their nets pull up only old shoes and toilet seats.

Soon a hurricane sweeps through the area, destroying all their competitors’ boats. As the sole surviving vessel after the storm, the pair have the seas to themselves and haul net after net bulging with shrimp, finally reaping the bountiful rewards of their resilience and determination.

It’s not a subtle analogy. Value as a style has performed so terribly over the last decade that it may well seem as though value managers have been fishing in the wrong seas. But for those with enough grit and patience to weather the storm, the rewards could be substantial.

Time to be brave?

While past performance is not a reliable indicator of future performance, history suggests that the best time to buy (and also the worst time to sell) has been after sharp pullbacks in relative performance.

The biggest rewards can come from being brave during the scariest times. For investors willing to ride out the turbulent seas, the potential rewards could be considerable once the tide turns.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.