What analysing language tells us about inflation

With the headline consumer price index (CPI) rate at a 13-year high in the US, it is not surprising that companies are talking more about inflation.

It’s not just business surveys that show us this. You can also see it by looking at the transcripts of what the management teams of publicly-listed companies have talked about during earning calls.

Of course, it would be a painstaking exercise to manually go through thousands of earnings transcripts each month. This is where natural language processing (NLP) analysis comes in. NLP uses the power of computers to get insights from the text of written documentation. In simple terms, you can track the number of mentions of words and phases that appear in the transcripts.

Working with the experts in our Data Insights Unit (DIU), we find that there has been an unprecedented amount of inflation talk among US companies recently compared to the past. Meanwhile, corporate management teams appear to be more concerned about inflation than wages. Regarding supply chains, mentions of bottlenecks and disruptions have jumped because of the Covid pandemic.

Inflation talk among US companies has surged

Looking back over the last 15 years, US companies are certainly talking more now about inflation than they have ever done before. Chart 1 shows the number of mentions in the earnings transcripts of the word “inflation” accompanied by any of the words “rise”, “increase”, “higher” or “pressure”.

So, how does this inflation talk compare with the headline CPI rate? Before using the mentions of inflation, we have adjusted the time series. This is because the time series is volatile and has seasonality in that the number of earning calls and transcripts typically drops off towards the end of the earnings season.

Chart 2 shows that the mentions of inflation generally mirror the movements in the actual inflation rate. In other words, discussions among companies on inflation are confirming what is seen in the wider economy.

While the mentions of inflation do not seem to be a leading predicator of actual inflation, the data is available on a real-time daily basis. So, there is a bit more information provided by the transcripts before the headline CPI is eventually released during the month. There are also some interesting insights from looking at the discussions on inflation across the business sectors.

Have US companies been talking about wages?

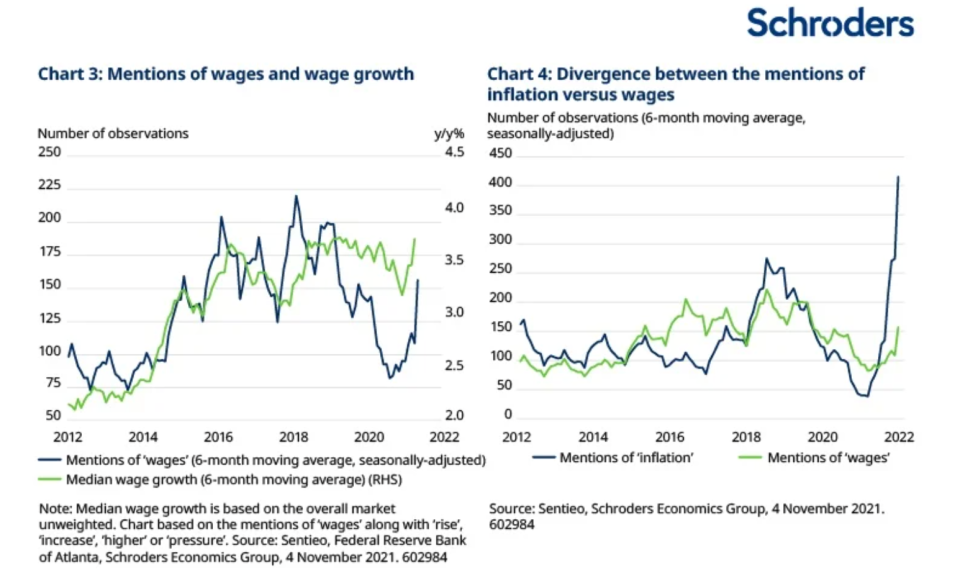

Repeating the same analysis but for the mentions of “wages”, we find that companies have been discussing wages more this year. In general, the mentions of “wages” have moved in sync with median wage growth in the US, although the latter has accelerated back to pre-pandemic levels (chart 3).

Perhaps the divergence is because corporate management teams have been less concerned about wages, or because other words are being used to refer to wages.

Clearly, companies have been mentioning wages more frequently this year, but the key word of conversation is inflation (chart 4).

Taken at face value, it appears that corporate managements are not so worried about wages. But if we see a significant pick-up in the mentions of wages over the coming months, this would be a sign that companies are turning more concerned about the second-round effects from inflation.

Meanwhile, there are sectoral differences in that the divergence between mentions of inflation and wages are less stark in some sectors (which is discussed in the next section).

Which sectors are talking about inflation and wages?

We find that companies in certain sectors, such as industrials and consumer discretionary, are consistently talking about inflation and wages over time (chart 5). But that’s not to say other sectors are not having many conversations on inflation and wages.

In fact, companies across most sectors have been discussing inflation and wages more than they have in the past (chart 6). To compare against history, we have standardised the latest observations on the mentions of “inflation” and “wages” and compared this against history over the last three years (this captures data prior to the pandemic).

The management of health care and financial companies have been most active in commenting about inflation and wages. For the consumer discretionary and staple companies, there is significantly more talk on inflation than wages during earnings calls.

In comparison, communication service firms have been more frequent in their discussion about wages than inflation. This may have a bearing on the profitability outlook of these companies.

Significant increase in discussions on supply chains

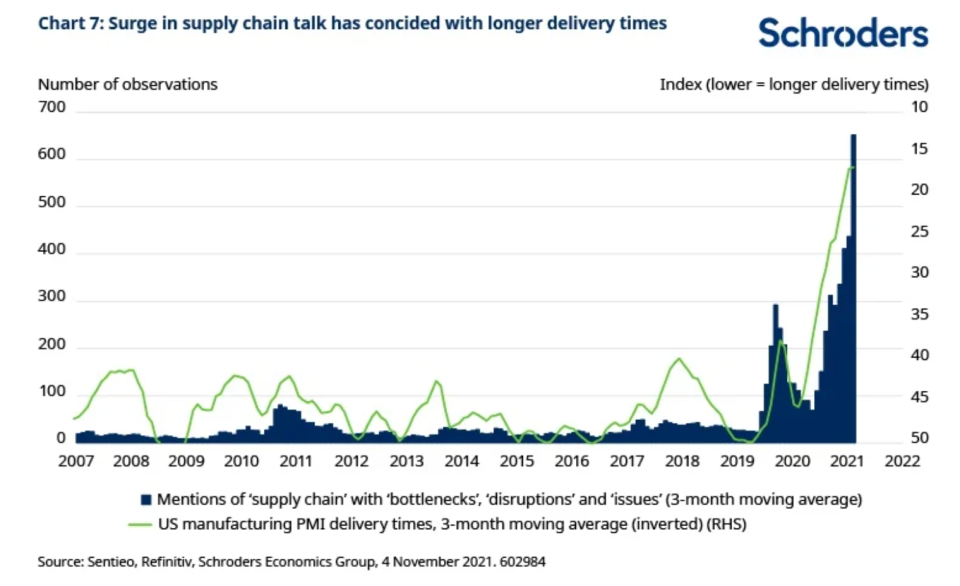

Unsurprisingly, the Covid pandemic has led to a significant increase in talk among corporates about supply chain bottlenecks, disruptions and issues (chart 7). This has coincided with the increase in supplier delivery times measured by the purchasing managers’ indices (PMI).

Meanwhile, the discussions on supply chain issues have been concentrated in the consumer discretionary and industrial sectors. Within industrials, autos have been mainly impacted by the shortages of semi-conductor chips. In the US, the positive contributions from car prices to the core inflation rate are running at historical highs.

Looking ahead, one of the key discussions to monitor is what companies are telling us about supply chain bottlenecks. If we start to see less talk about these disruptions, then there could be some welcome relief ahead for the parts of inflation that have so far proven to be the most stubborn.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.