WeWork – and Neumann – enjoy share boost on belated Wall Street debut

Shares in WeWork rose as much as 12 per cent on its first day of trading on the New York Stock Exchange, as the office space provider’s two year journey to a public offering finally came to a head.

WeWork began trading its shares today after shareholders approved a $9bn merger with special-purpose acquisition company (Spac) BowX Acquisition Corp.

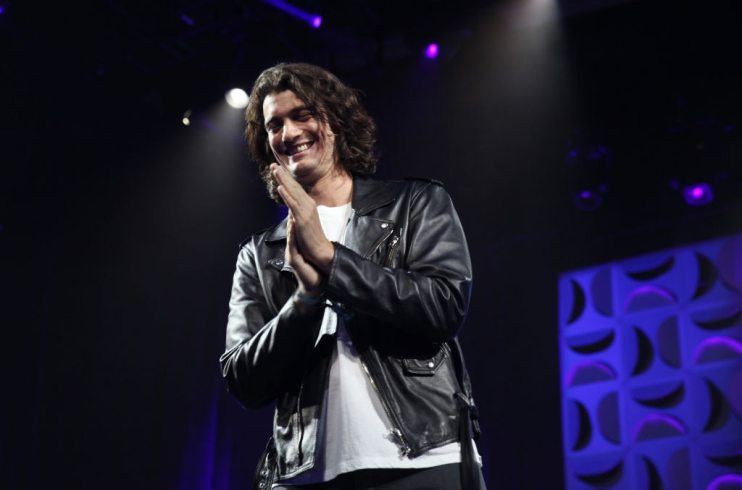

Meanwhile, ousted co-founder Adam Neumann partied with early employees of the company a few blocks away, as his 11 per cent stake in the business took on a value of $1bn.

WeWork’s $9bn valuation upon listing is dwarfed by the $47bn valuation that notorious ally Softbank valued it after a fundraising round in 2019, months before its first attempt at an IPO failed.

The company has lost $5bn over the last three years and incurred costs of $793m this year alone, from closing sites and finalising a settlement with notorious Neumann, who was booted out after its valuations plunged in 2019 and the company was forced to abandon its original floating plans.

Things unravelled quickly after its losses were revealed and its practices, including the erratic behaviour of Neumann, were questioned.

Real estate mogul Sandeep Mathrani then took the helm.

Mathrani has closed over 150 WeWork sites since the start of the pandemic in an attempt to downsize and cut the company’s losses.

As WeWork celebrated its debut today, executive chairman Marcelo Claure told CNBC: “You’ve said this is a story with drama.”

“Sure, this is a story where a lot of people wrote documentaries that it was the end of WeWork. Well the resistance, the persistence of these people is incredible. This company is here, is stronger than ever, and no doubt that we’re going to be celebrating many more milestones.”