We’ve quickly jumped from a literary age to a time of video games

In the beginning…

First, there was the acoustic age, or spoken word, then the literary age, or written word, then the print age post-Gutenberg. We are now well ensconced in the electronic age which will continue to grow exponentially.

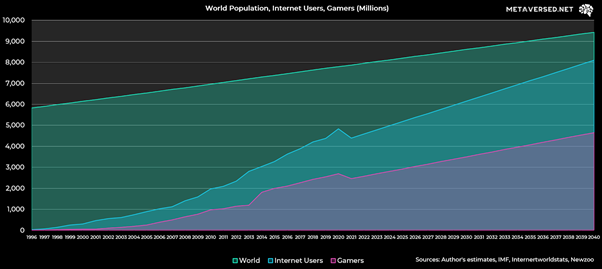

More than 2.7 billion video game players globally, or one in three people, would agree. Last year, almost $200 billion was spent on video games, having grown +19.6% year-over-year with China and the US making up about half of the market, or twice the revenue of film and music combined. Massive.

The pandemic restrictions to movement and travel have accelerated trends in the gaming market as online gaming provides a means for entertainment, escapism, and socialising which was the #2 reason people have spent more time playing games.

Humans are the networked species

The Metaverse represents our next great evolution as a networked species. It is the interface between the physical and virtual worlds. The economic, psychological, and social benefits are immense. As one of countless examples, online gaming platform Fortnite featured the Travis Scott concert where 12.3m players gathered in real time to witness the release of his new song.

In another example, gold farming and power levelling operations in MMOs (massive multiplayer online games) have been lucrative for those in many third world countries. It pays better to play these games and sell in-game currency than work a “real” job. In Venezuela with it collapsing currency, many survived and thrived by farming MMO Runescape gold and power levelling to buy supplies for their families. The average player earned 10-times the monthly income of an average doctor in Venezuela!

Interestingly, back in early 2020 when COVID-19 made its appearance, in-game Runescape gold prices (RSGP) actually appreciated by 50% in dollar value across March and April of 2020 as demand soared due to lockdowns.

NFTs revolutionise ownership

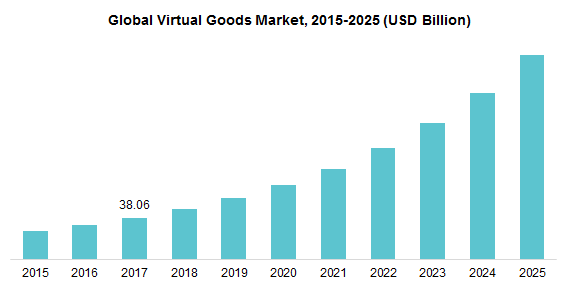

The virtual goods market is estimated to be around $50bn, and is expected to grow to $190bn by 2025.

(Courtesy https://www.adroitmarketresearch.com/industry-reports/virtual-goods-market)

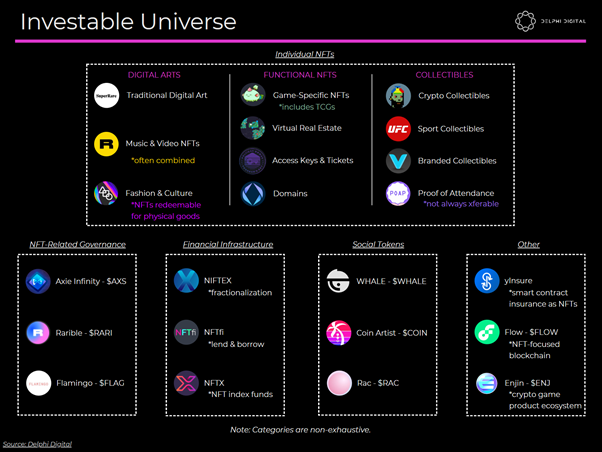

NFTs, or non-fungible tokens, connect digital goods to the offline world via the blockchain, revolutionizing ownership and identity. NFTs create a decentralized, universal digital representation and ownership layer. Open source blockchain technology tears down the barriers between digital worlds so one can take their digital items from one online gaming platform into any other.

In addition, the market for the creation of digital art and videos is massive. The band Kings of Leon announced in March that it would sell its latest album for a limited period – two weeks – for $50 as a bundle of a vinyl album and an NFT. After the two-week period, Kings of Leon would press no more copies thus bringing scarcity to the NFT.

A market has also emerged for tweets packaged as NFTs, including a sale for charity purposes of a screen shot of Jack Dorsey’s first tweet from 2006 which sold for $2.9 million. Indeed, from the time anyone went online, various segments of their digital footprints could be turned into NFTs that have value if the individual has in terms of their personal brand what others would see as valuable.

A broad spectrum of content will ultimately become tokenised as NFTs. Besides digital art, people are already tokenizing their digital footprints in the form of tweets, blogs, videos, podcasts, and music. Even individuals can tokenise themselves as such would represent their personal “brand” or perceived value in the decentralised marketplace. NFTs on the blockchain facilitate a broad spectrum of digital property rights.

One can even capture secondary sales fees (royalties) in perpetuity. In the final analysis, NFTs are useful for issuance, tracking, and monetisation of almost any creative endeavour.

Decentralization suppresses entities that suppress – the answer to censorship

These decentralised technologies can also help un-politicise what has been politically weaponised by centralised forces who have their own political agendas. In many cases, no longer are trusted third parties necessary as they can be replaced by decentralised blockchain platforms.

Meanwhile, the largest centralised web platforms in the world are influenced by politics. For example, President Trump was removed from most every major social platform while YouTube removed content that might upset the CCP. The ability to arbitrarily censor users has been abused. Those who go against the normal narrative are often “cancelled”, “blanked”, or outright banned. Those behind the largest media platforms tend to be on the anti-free market left thus are often guilty of suppressing democracy by practicing a form of authoritarianism. It’s no surprise that Silicon Valley tends to be on the left, and that Google among many other tech juggernauts give to the democratic party.

Despite the devolving, COVID-induced, anti-free market sentiment, virtual gaming worlds can actually bring free markets and economic freedom to second and third world countries that traditionally have placed citizens in economic shackles. Over time, this can level the economic playing field globally.

“Banking the unbanked” has been an ongoing theme since a friend of mine started BitPesa, a digital foreign exchange and payment platform that leverages blockchain settlement to significantly lower the cost and increase the speed of payments. Bye-bye Western Union.

That said, virtual gaming worlds which are taking pole position in the virtual economy brilliantly spur this narrative. As we become more and more of a digital, cybernetic species as predicted long ago by notable inventor, Ray Kurzweil, these online worlds will become increasingly more a part of life as we know it.

Dr Chris Kacher, nuclear physicist PhD turned stock+crypto trading wizard / bestselling author / blockchain fintech specialist / top 40 charted musician. Co-founder of Virtue of Selfish Investing and Hanse Digital Access.

Dr Kacher bought his first Bitcoin at just over $10 in January 2013. His metrics have called every major top & bottom in Bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoinhttps://www.linkedin.com/in/chriskacher/