Welcome to the world of decentralised finance

Decentralised Finance or “DeFi” for short is an ecosystem of financial tools and services that are built on open-source networks and do not involve any centralised institutions.

If you’re someone who takes an interest in the crypto space, you’ve probably heard about DeFi this year, as the space has rapidly grown from just over $600M in January 2020 to over $21B at the time of writing in total value locked (source: https://defipulse.com/), making DeFi the one of the most active parts of the blockchain space. Despite the COVID-19 crisis, people have been pouring into the DeFi space leading the charge in creating a new financial system.

Equitable financial ecosystem

Various reports suggest that the world has between two to four billion people with no access to financial services, especially credit. A significant benefit of DeFi is that it lowers barriers to entry for customers that are currently unable to access traditional financial services due to lack of digital identity, credit history, cost of access or documentation. DeFi tools and services are permissionless, so they are accessible to everyone regardless of financial background, gender, race, or other factors. Additionally, unlike traditional finance that still runs on mainframes and requires frequent downtimes for maintenance and batch processing, DeFi platforms and services are available 24/7 all over the world, encouraging new opportunities for people to manage their funds and improve their lives.

Transparent finance

When you typically think of finance, transparency is not a word that likely comes to mind. This lack of transparency has led to repeat, industrywide systemic failures culminating in global financial crises and bailouts. However, DeFi data and financial logic is public, so anybody can view and audit it. This means risks resulting from cybersecurity and systemic interlinkages among financial applications can be identified, detected and corrected before they result in crises. DeFi code is open source and readable by anyone which means incidents such as the SWIFT hack of 2015-2016 can be avoided and mitigated. The open source nature of DeFi also results in rapid innovation that is impossible to achieve in the traditional financial system as the slow progress of open banking indicates. Thus, DeFi in 2020 has seen the rapid creation of “money legos”, or financial building blocks that connect with each other and can be assembled similar to legos to make new tools and create innovative, safe and robust services to benefit consumers.

Decentralised Financial Applications: Use-cases

There are many sub-sectors under the DeFi umbrella that represent different types of inventive financial tools. From lending protocols to decentralised exchanges, different DeFi Dapps (decentralised applications) provide their own unique opportunities for users.

Lending and borrowing

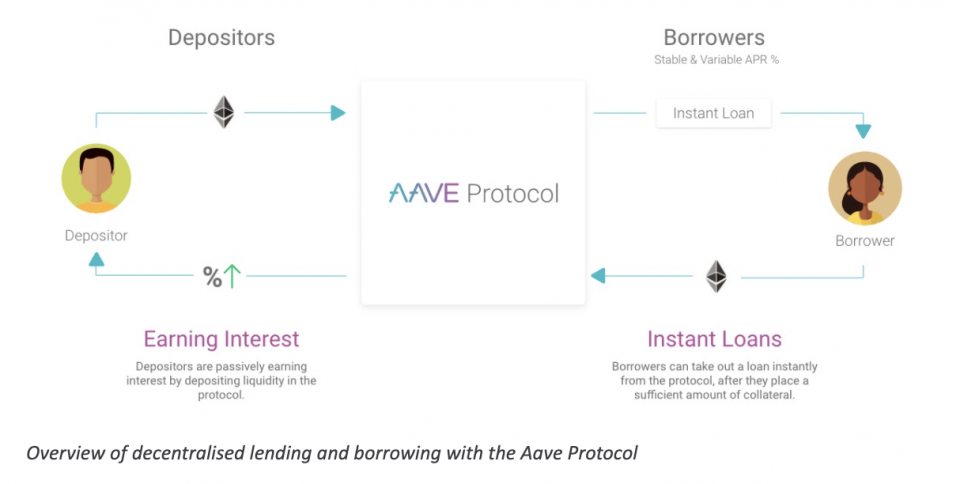

The most widely used applications in the DeFi space are lending and borrowing protocols. Aave, for example, is a DeFi protocol where users can deposit cryptocurrency assets to a liquidity pool and start earning interest on them while they are loaned out to borrowers. Interest rates for depositors are adjusted based on the liquidity supply and borrowing demand. Because there are no middlemen, rates for depositors have historically been higher than in a traditional bank. This has made DeFi lending protocols such as Aave an attractive way for people to maximize their passive income, as depositors accrue interest every second.

Users can also borrow cryptocurrency assets from the Aave Protocol, as long as they put up enough collateral in another asset. Loans are overcollateralized, meaning that in order to borrow, a user must put up more value as collateral than the value of the loan. If a borrower cannot pay back the loan or the value of their collateral falls significantly, then their collateral can be liquidated meaning it gets sold off at a discounted price to reimburse the protocol funds. This overcollateralization of loans means that the ecosystem is completely trustless, and lenders and borrowers can be complete strangers.

Stablecoins

One major benefit of DeFi is that cryptocurrencies can be used in many innovative ways that are not possible with fiat currencies (typical monies like the EUR or GBP. A stablecoin is a currency whose value is pegged to a stable asset, such as gold or fiat currencies. For example, USDC is a stablecoin pegged to the US dollar, so its value always stays in line with the value of the dollar. Stablecoins are especially useful for people in countries where the currency is volatile. Being able to hold stablecoins with a consistent value, and earn interest on them, making financial services accessible to parts of the world that were previously excluded.

Decentralised Exchanges

DEXs are cryptocurrency exchanges, such as Uniswap, where users can trade one crypto asset for another. Unlike centralised exchanges, DEXs have no central authority so users maintain full control over their assets. This makes DEXs more resistant to hacking, theft, and other vulnerabilities, because the funds always remain in the custody of the user, not the exchange.

Insurance

Although the DeFi space is developing rapidly, it is still an emerging space, and some users are concerned about smart contract failures and bugs. For people that want to insure themselves against smart contract issues, there are innovative decentralised alternatives to insurance like Nexus Mutual which utilise blockchain technology so people can share the risk together without the need for a centralised insurance company.

Looking at the future of finance

DeFi is moving towards mainstream adoption, and more inventive financial solutions are being built every day. There’s a wide range of use-cases that provide new opportunities for users to do things with their cryptocurrency that is not possible with fiat or in the traditional financial system. As the FinTech world takes notice and financial institutions invest more in DeFi, bridges are being built and new financial opportunities are being created.