Week ahead: ECB Lagarde to sign off on another 50 point interest rate hike and Deliveroo updates markets

Topping City traders’ minds this week will be what is tipped to be another 50 basis point interest rate hike by the European Central Bank (ECB) on Thursday.

The monetary authority of the 20 countries using the euro has explicitly told markets to expect another steep rate hike this week and possibly more in the coming year.

President Christine Lagarde has adopted an extremely hawkish tone in most of her speeches this year in a bid to convince markets that the era of ultra low rates in the currency bloc is over.

Analysts said the tone of the decision statement and Lagarde’s press conference will be key to determining where borrowing costs will peak on the continent.

“It will also be important to watch whether the ECB pre-commits to a 50bp hike in May, as it did for the March meeting in February,” investment bank Nomura said.

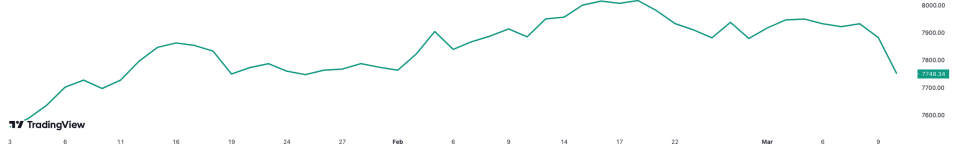

FTSE 100 is up around four per cent in 2023

“In terms of the tone of the meeting, we believe the ECB will likely want to be “hawkish enough” to maintain tight financial conditions in the euro area, and further support the view that the ECB will maintain rates higher for longer,” they added.

On these shores, fresh jobs figures on Tuesday are likely to show wages are still rising at a near-record pace but still being outstripped by inflation.

On the corporate front, Deliveroo posts final results on Thursday. The boost the firm received over lockdown as families used cash that would’ve otherwise been spent in restaurants on takeaways has receded.

Pest control firm and FTSE 100-listed Rentokil updates markets on the same day.

The premier index’s robust start to 2023 has lost some steam after it shed more than one per cent last week to finish at 7,748.34 points.

Despite those losses, it is still up nearly four per cent so far this year.

Thursday’s expected rise will bump borrowing costs to three per cent.