Week ahead: Drama in Westminster to grip City, but don’t forget about ECB

The City’s attention will be gripped by the race to Number 10 this week, but there are some substantial economic announcements elsewhere in the pipeline that deserve a closer look.

The European Central Bank (ECB), the monetary authority of the 19 countries using the euro, is expected to hike interest rates 75 basis points for the second time in a row on Thursday.

Historic high inflation is sweeping through Europe, forcing the ECB to pivot from ultra-loose monetary policy.

Borrowing costs in the bloc have been in negative territory for over a decade in a bid to stimulate spending and ease pressure in debt markets.

However, president Christine Lagarde and co lifted them to zero in the summer.

The policy shift underscores how surging prices are forcing central banks around the world to recalibrate their approach to the economy after years of backing cheap money after the financial crisis.

Nonetheless, the City will be keeping tabs on every twist and turn in the Tory leadership race, which is likely to spit out a third prime minister this year on Friday.

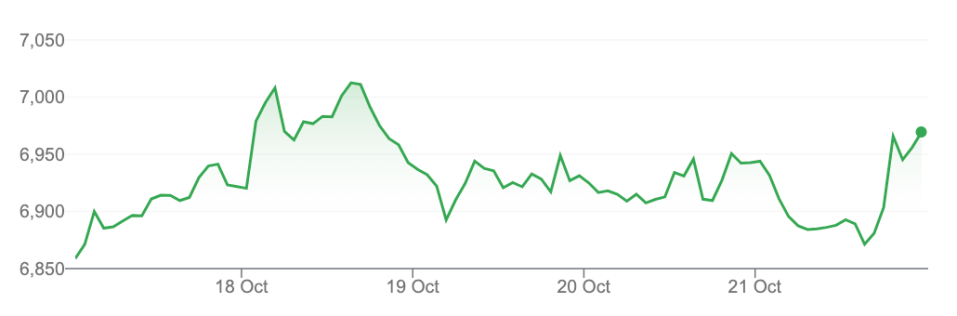

FTSE 100 rose over 1.6 per cent last week

Analysts said keeping Jeremy Hunt as chancellor is crucial to the new PM’s capacity to reassure markets of the UK’s financial credibility.

“While a new PM would be within his or her rights to leave their stamp on the Budget, a departure from this week’s new course, or even the timetable, risks inflicting renewed damage to the UK’s credibility,” experts at Investec said.

New PMI data out tomorrow could flash another signal indicating Britain’s economy is flatlining. Last week, data from the ONS showed retail sales dropped 1.4 per cent over the last month to below pre-pandemic levels for the first time.

UK banks kick off third quarter earnings season this week, with Asia-focused lender Standard Chartered updating markets on Wednesday.

The sector is expected to have been boosted by rising interest allowing them to charge more for loans.