Week ahead: Bank of England to rock markets with 75bps rate hike

Markets are preparing for a steep rate hike by the Bank of England on Thursday, but not as bad as first feared after former prime minister Liz Truss’s tax cutting mini-budget last month.

London’s premier FTSE 100 index posted a decent performance last week, adding 1.12 per cent to close at 7,047.67 points, while the domestically-focused mid-cap FTSE 250 index surged more than four per cent to close the week near the 18,000 mark.

Officials at the Bank on Thursday are expected to raise interest rates 75 basis points, the eighth hike in a row, to three per cent.

That would be the steepest rise since 1989 and take borrowing costs to the highest level since November 2008.

However, analysts were just a few weeks ago warning of a 125 basis point rise due to the Bank needing to restore market credibility after Truss launched £45bn of unfunded tax cuts on 23 September.

New prime minister Rishi Sunak and chancellor Jeremy Hunt are on course to raise taxes and cut public spending at 17 November’s delayed fiscal statement to find a £10bn budget surplus. Hunt already ditched nearly all of the mini-budget a couple weeks ago.

Greater focus on repairing the public finances has reversed all the market damage triggered after Truss’s budget. UK borrowing costs are lower and the pound is higher than when the mini-budget was delivered.

But analysts at Capital Economics said a majority of five members of the Bank’s rate setting will back a whole percentage rate rise.

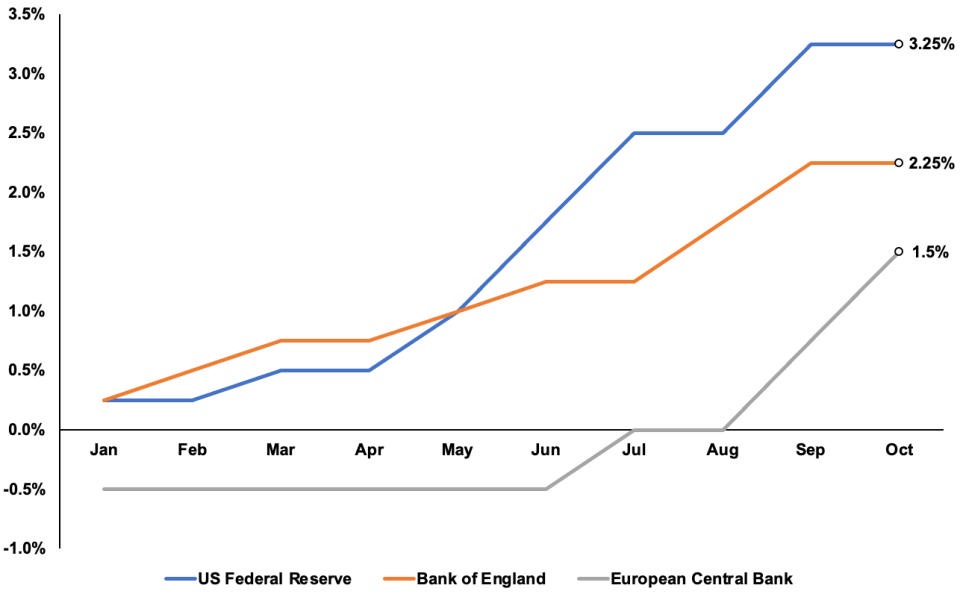

US, UK and eurozone interest rates have climbed sharply this year

“We expect Bank Rate to reach 4.5 per cent (previously 4.75 per cent), as fiscal policy retreats and fiscal consolidation grows over the coming years,” Sanjay Raja, senior economist at Deutsche Bank, said.

Governor Andrew Bailey and the rest of the monetary policy committee will also publish updated economic forecasts on Thursday which are likely to predict the UK is headed for a longer and deeper recession than the central bank projected at its August meeting.

Oil giant BP on Tuesday is forecast to announce another bumper set of profits, following in the footsteps of its rival Shell last week.

On Wednesday, the US Federal Reserve is likely to set the bar for the Bank and also lift interest rates 75 basis points for the fourth time in a row.

And, final purchasing managers’ indexes are out on Tuesday, Thursday and Friday.

Mortgage approvals data out tomorrow will be closely watched for signs of rising interest rates curbing housing demand.