We’ve discovered the UK’s tech unicorns – now we must nurture their growth

After creating its first product in the 1970s, it took Apple years to become one of the world’s most valuable companies. But in today’s technology sector, a new breed of tech firm is emerging – the unicorn. The unicorn is a startup that grows exponentially to reach a billion-dollar valuation within a few years of being founded. And as a leading source of innovation and job growth, it is vital that we help firms like this achieve their potential, and stay in the UK.

Unicorns are no longer a rarity in Britain. Research by GP Bullhound discovered that 30 billion-dollar tech companies have been founded in Europe since 2000. With the UK’s digital economy growing faster than the average across the G20 countries, it should be no surprise that 11 of the 30 are based here. Firms like Asos, AO.com, and Zoopla represent the heartbeat of our booming digital economy, and are central to the UK’s future prosperity.

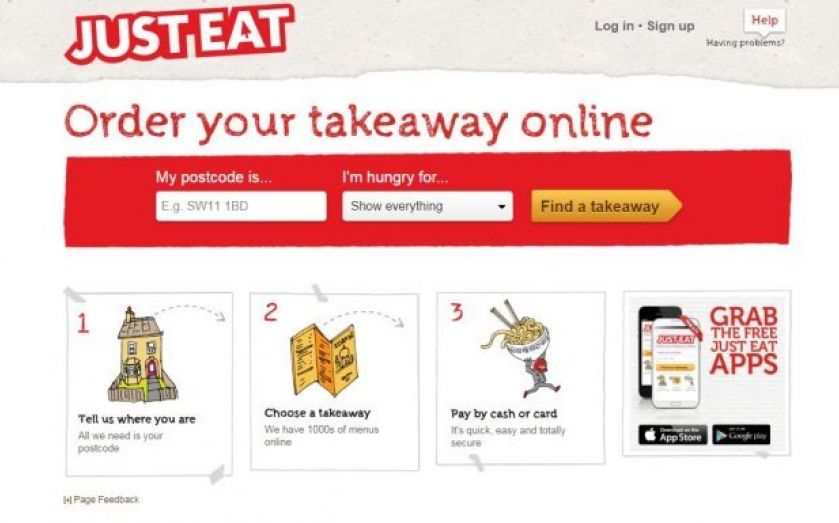

Further, the UK has built a strong international reputation as a world-class destination for companies that weren’t founded here. Over the last few years, a number of growth-stage international firms have chosen to set-up headquarters in the UK. Companies like eToro and Just-Eat, founded outside the UK, are now taking advantage of and contributing to the UK tech scene.

There are a number of reasons for this. Companies are attracted to the UK’s high calibre technical expertise and talent. Whether they require hardware experts from Cambridge or gaming developers from Aberdeen, business leaders can draw upon the best. Tech City UK’s support for the Home Office’s Tier One Exceptional Talent Visa, introduced in April, is also helping to ensure that the UK stays competitive in attracting the best overseas talent.

Growth firms can also benefit from an increasingly favourable investment climate. We have seen a sharp rise in the venture capital available to UK-based companies. Index, Accel and Balderton raised a combined £820m in the past year, dedicated to investing in the UK and Europe. Google Ventures’s recent decision to launch a £100m investment fund in London, its first outside the US, provides further evidence that the UK is an attractive pace to scale a business.

But we need to build on this. Crucial steps have been made. The London Stock Exchange has implemented initiatives to increase the attractiveness of listing in the UK: the introduction of the High Growth Segment, the establishment of the Elite management training programme, and working with the government to abolish investor stamp duty on traded Aim shares. Funding for growth businesses has also been boosted by the Enterprise Investment Scheme and Seed Enterprise Investment Scheme.

However, such schemes can be difficult for fast-growing firms to navigate. Other types of support are needed to help these businesses to scale.

To address this, Tech City UK has worked closely with the government to support the Future Fifty programme. Fifty of the UK’s most innovative and exciting growth companies are supported by a framework that matches them with publicly-funded schemes and incentives relevant to their stage of growth. Businesses also benefit from access to tailored advice, helping them to engage with investors, suppliers, customers and other growth-stage firms.

Ultimately, the UK’s ability to deliver more unicorns will depend on the availability of growth-stage funding, broader support to help UK businesses scale and globalise from many more quarters, a continued focus on attracting world leading talent to the UK, and clear accessibility to capital markets so that UK firms are incentivised to grow and IPO here. With such support playing its part to further accelerate a well-established tech ecosystem, the UK has all the necessary ingredients to continue to develop and attract high-growth tech businesses – the pasture on which to grow the unicorns of tomorrow.