We need to build houses for renters as well as owners

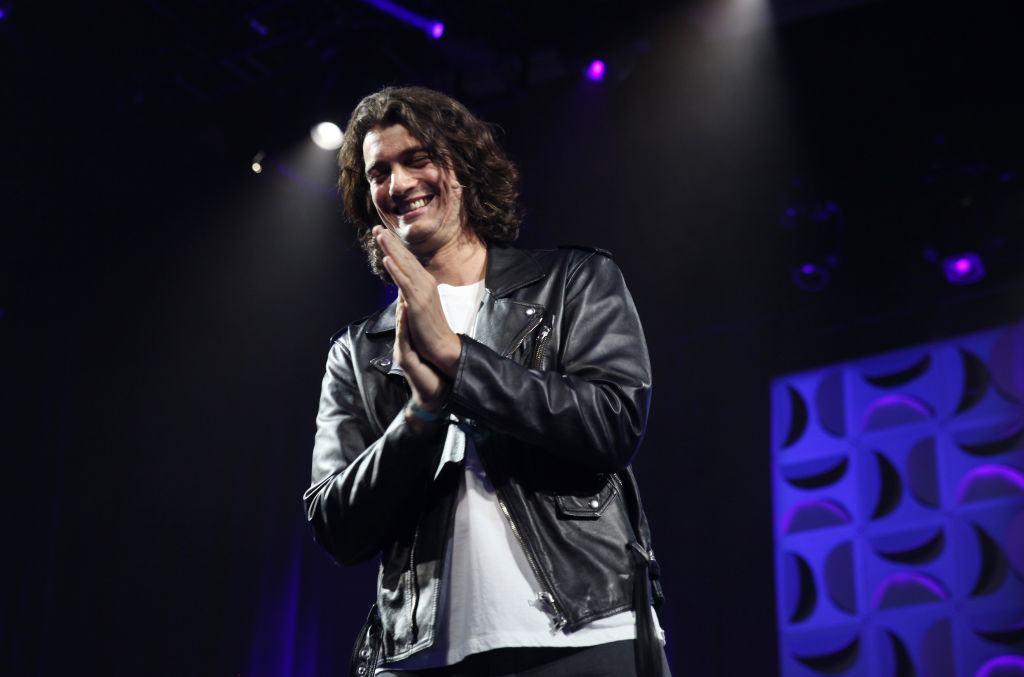

Adam Neumann, for better or worse, was at the forefront of a revolution of how people viewed the office. Now the former WeWork founder has turned his attention to a different kind of real estate, as cities around the world struggle with overheated rental markets.

Before WeWork, Neumann first wanted to start a co-living concept, but faced an uphill battle finding investors to put money into homes. How times have changed. Now he’s turned back to his original idea, backing a new venture – Flow, a residential real estate startup.

Marc Andreessen, who has invested $350m into Flow, set out in a blog post why residential property – the world’s largest asset class by value – needs disrupting. He is right.

You only have to read recent horror stories about the London rental market, with renters queuing to view properties before being forced into bidding wars, to see why.

A severe demand-supply imbalance coupled with the dominance of amateur landlords has left many paying through the nose for poor quality accommodation and bad service.The private rented sector comprises some of the oldest housing available – a package that comes with leaks and insulation problems.

Driving up standards by upgrading existing stock and modernising property management, which largely remains in the analogue era, is one way to fix the rental market. Proptech start-up IMMO has recently pledged to invest £1bn in refurbishing over 3,000 homes across the UK to bring them up to modern energy standards before renting them out via a “living-as-a-service” platform.

Clearly, we also need to be building more homes to tackle decades of undersupply and face the new reality that more people are renting and for longer. Some of these should be purely designed with renters in mind – not homeowners.

Recognising the gap in the market, and eager to find new sources of income streams, institutional investors such as pension funds and insurers are increasingly funding homes built specifically for renters.

Many of these new homes are managed by branded operators with names like Fizzy Living, Moda, or Uncle – the kind you would expect more from a consumer goods company than a real estate business. Most of these build-to-rent homes come with onsite amenities like gyms and co-working spaces. In this sense Flow, from what little we know, is not a wholly revolutionary concept. Even John Lewis is planning to build thousands of rental homes.

In the US, branded purpose-built apartment blocks have been around for decades and are a key part of institutional investors’ real estate portfolios. In the UK, these kinds of apartment complexes have only just started to take off. There are some 240,000 homes of this kind open, under construction or in planning state according to the latest data from the British Property Federation and Savills. Almost 100,000 of those are in London.

There is a false narrative that everyone renting is doing so because they can’t buy a home. Young professionals, for example, who don’t want to be tied down will rent out of choice. With many buy-to-let landlords considering selling up thanks to a raft of regulatory and tax changes, build-to-rent homes will provide much needed supply and a higher quality alternative for consumers.

Whether Flow becomes a household name or lives up to its lofty ambitions to “solve the housing crisis” remains to be seen. But these firms, at least, will be able to provide a level of consistency instead of luck-of-the-draw private landlords, and restore a sense of trust in the industry.