Water firms face London Stock Exchange shorting from Canadian pension giant

Water companies on the London Stock Exchange are being shorted by one of the world’s largest pension schemes, according to data from the Financial Conduct Authority (FCA).

The watchdog revealed that the Canada Pension Plan Investment Board (CPPI) – worth £336bn – has accrued hefty bets against Severn Trent and United Utilities.

Short selling enables investors to generate profits from falling share prices, and is used by the Canadian fund as a hedging strategy to mitigate against potential losses on investments elsewhere in its equities portfolio.

CPPI is currently the only investor with an outstanding short against United Utilities sufficient in size to require disclosure to the City regulator, and is one of only two funds that have bets disclosed against Severn Trent.

The FCA requires investors to publicly report short bets if they reach 0.5 per cent of a company’s issued share capital.

The Toronto-based group is betting against the pair despite its prominent role in the UK’s water industry, with the group holding a 32.9 per cent stake in the privately owned Anglian Water, which it has backed since 2006.

However, the Anglian investment is run by a separate part of the pension fund, and is unrelated to its short positions on Severn Trent and United Utilities.

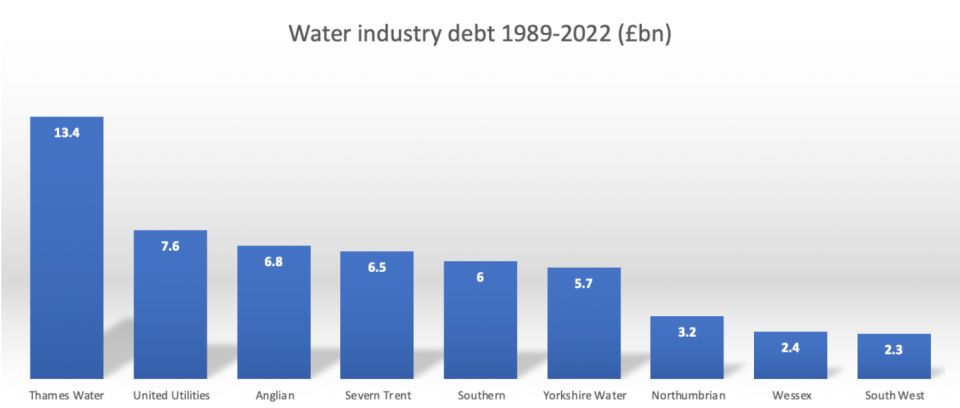

The UK’s water industry has faced severe scrutiny over its financial health after Thames Water scrambled for funds following a boardroom exodus, with the supplier buckling under the weight of £14bn of debts.

Chief executive Sarah Bentley resigned in June, a day before it emerged that the government was drawing up contingency plans in case an emergency re-nationalisation was necessary.

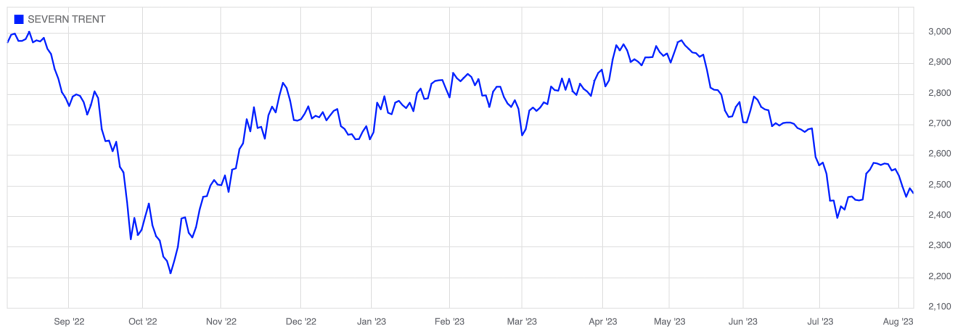

Severn Trent shares have fallen 15 per cent since the start of May following the crisis, while United Utilities’ shares are down 10 per cent over the same period.

CPPI has been approached for comment.

This story was first reported in The Times.