Was that the Dip? Crypto markets bounce back!

Crypto at a Glance

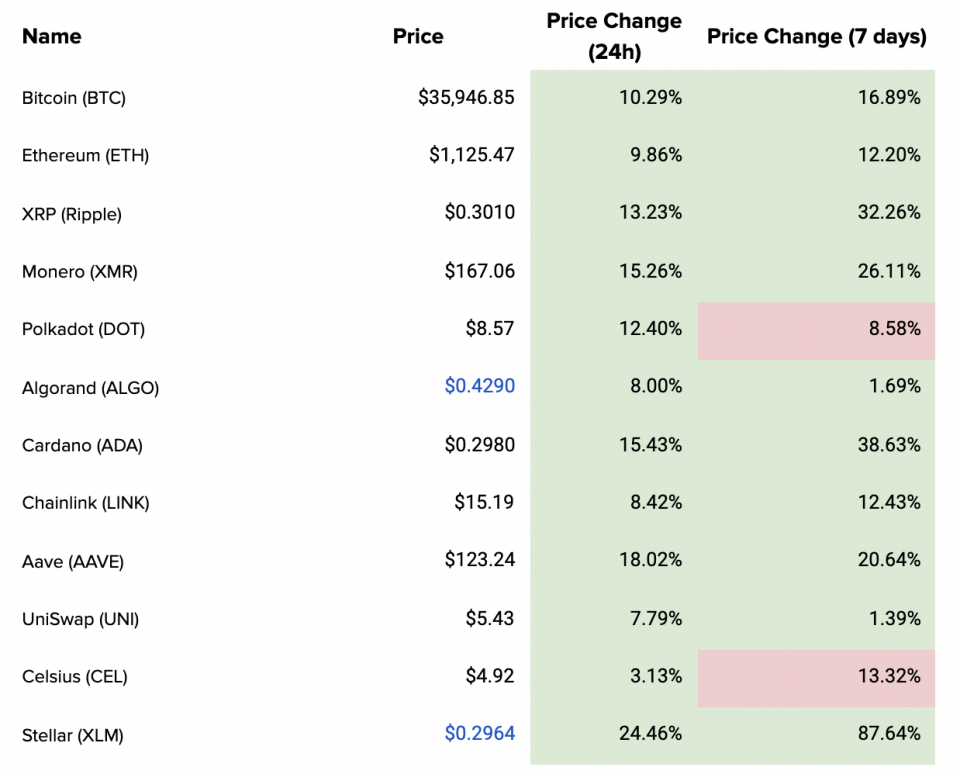

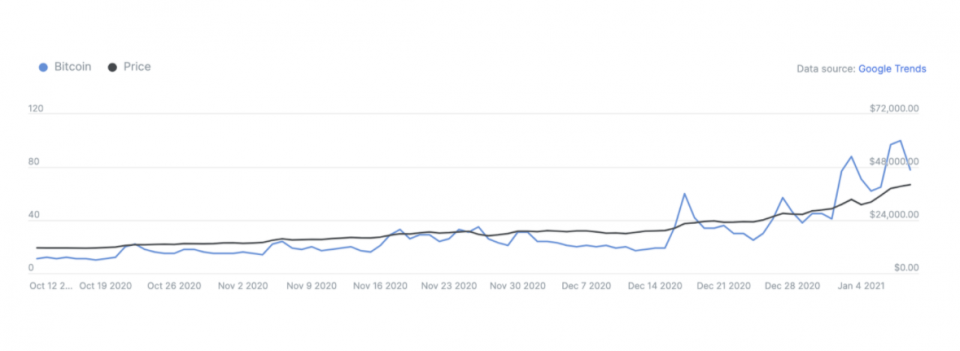

The decision by some news outlets to declare a bear market yesterday, mere seconds into what was a widely-expected retrace, was always going to leave them at risk of having egg on their face when it rebounded. But then, they’re probably used to wiping yolk off their sweaty brows when it comes to bitcoin! The almost V-shaped recovery has already pulled us back to the levels we were seeing just last Thursday, and the likes of Cardano and Stellar are still up almost 40% and 90% respectively over the past 7 days. If that was all the bears had, it certainly wasn’t enough.

Equally, it’s also possible that yesterday’s correction and subsequent rebound was the result of more isolated factors. Chris Weston, analyst at brokerage Pepperstone, for one speculated that it could simply be the work of one whale, noting: “Bitcoin and the crypto space more broadly have been slammed, but you wonder how much of this was down to someone getting out of a position – the whales will tell you when they’re getting in, but when they’re reducing then its radio silence and this makes sense. Is this the flush out that needed to play out?” In general, though, markets across the board have stabilised after a nervy start to the week, which could also have had an impact. The question now is: Where to next?

In the Markets

What bitcoin did yesterday

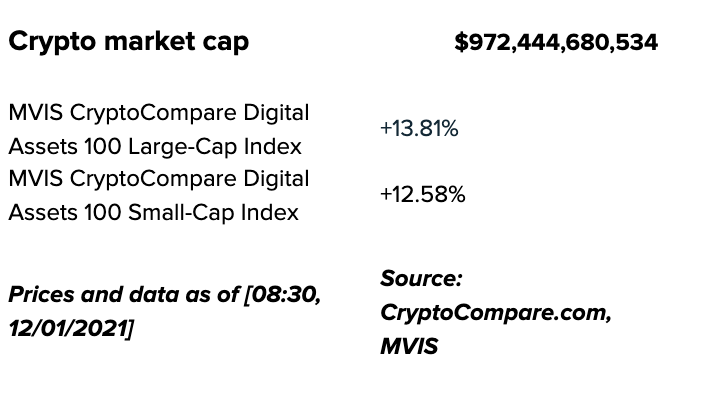

We closed yesterday, 11 January, 2020, at a price of $38,356.44 – down from $38,356.44 the day before. It’s now been ten days in a row that the price of bitcoin has closed at over $30,000.

The daily high yesterday was $38,346.53 and the daily low was $30,549.60. That’s some swing.

This time last year, the price of bitcoin closed the day at $8,037.54 and in 2019 it was $3,687.37.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $678,876,091,509, up from $656,156,776,341 yesterday. This means that despite the recovery, it remains outside the top 10 assets by market cap – for now. To put things into context though, it’s still around $200 billion higher than Visa and $300 billion higher than Mastercard, making it far and away the largest global financial network in the world.

Bitcoin volume

The volume traded over the last 24 hours was $111,582,160,990, up from $101,140,622,719 yesterday – one of the highest daily trading volumes on record. A number of exchanges also reported record high volumes. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 87.95%.

Fear and Greed Index

The Fear and Greed Index continues its streak in Extreme Greed, although it’s down to 84 today – its lowest level since 8 November, 2020. To the untrained eye, 84 might seem like a low number given that it’s been so high for so long, but it’s important to remember that this is still in Extreme Greed territory and should be considered very high. It’s also important to remember that the index doesn’t usually stay this high for very long and could mean a correction is on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.34. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 66.09. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

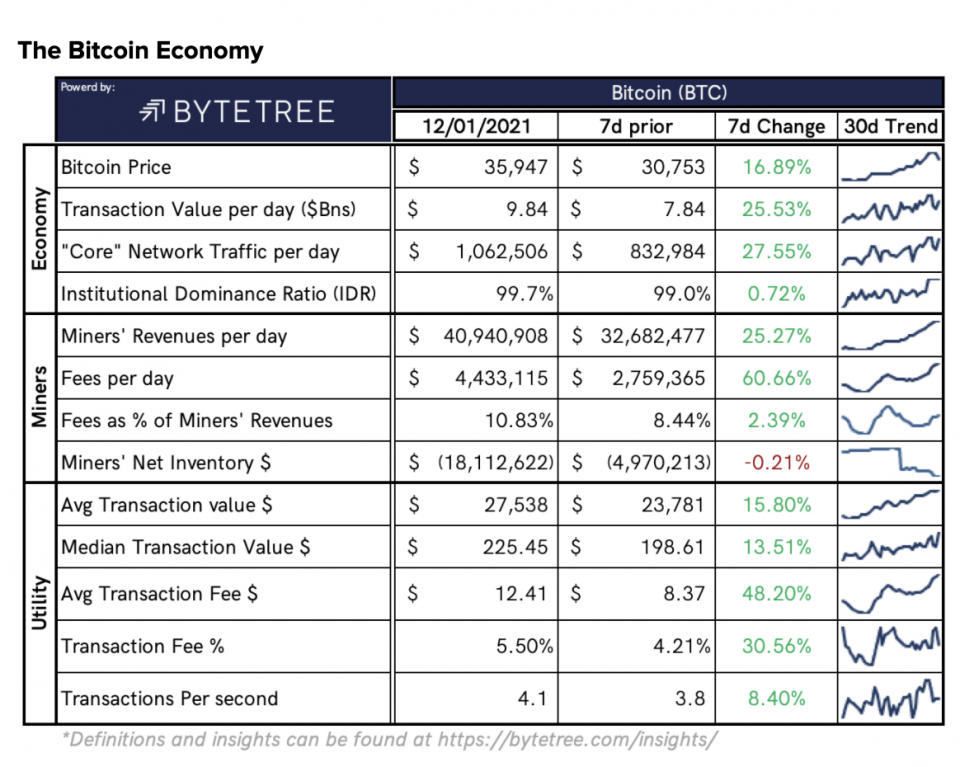

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 78 – taken from 9 January.

Convince your Nan: Soundbite of the day

“Frankly, if the gold bet works, the bitcoin bet will probably work better because it’s thinner, more illiquid, and has a lot more beta to it.”

- Stanley Druckenmiller,

What they said yesterday…

Mark Cuban doesn’t mess about with his comparisons

Tyler Winklevoss puts gold bug Peter Schiff in his place

It was definitely a big day yesterday…

But always remember to zoom out…

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.