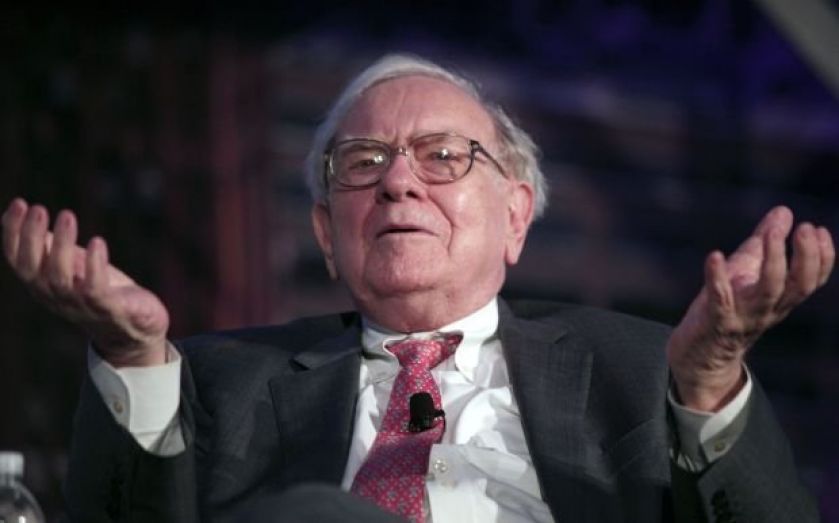

Warren Buffett’s Berkshire Hathaway buys Duracell for $4.7bn from Proctor and Gamble

Warren Buffet’s Berkshire Hathaway has bought up Procter and Gamble’s (P&G) bunny-led battery brand Duracell.

The investment firm paid $4.7bn (£3bn) in the form of P&G shares returned to the consumer goods giant- its entire stake in the business.

P&G, which had been wanting to offload a host of non-core brands to concentrate on its biggest selling products such as pampers, will invest $1.8bn (£1.1bn) in cash to recapitalise Duracell before the deal goes through.

Berkshire’s stake in P&G amounts to 52.8m shares, or around 1.9 per cent.

Buffett said of the deal, which is expected to complete in the second half of next year, “I have always been impressed by Duracell, as a consumer and as a long-term investor in P&G and Gillette. Duracell is a leading global brand with top quality products, and it will fit well within Berkshire Hathaway.”